Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 May, 2018

Insurance

By Ben Dyson and Husain Rupawala

Insurers that write business through Lloyd's of London are struggling to charge the right price to take on risks, contributing to the marketplace's deteriorating underlying underwriting performance in 2017, according to the CEO of one insurer. Other observers say Lloyd's must continue its efforts to drive down the cost of doing business to help improve underlying performance.

Stephen Redmond, managing director of Lloyd's insurer Antares, said there was a "pent-up level of frustration" because of low prices, also known in the market as rating levels. He added: "I am frustrated by the real opportunity to put the market in a position of appropriate levels of rating across portfolios and being prevented from doing so because there remains too much capacity chasing too little business."

Big losses

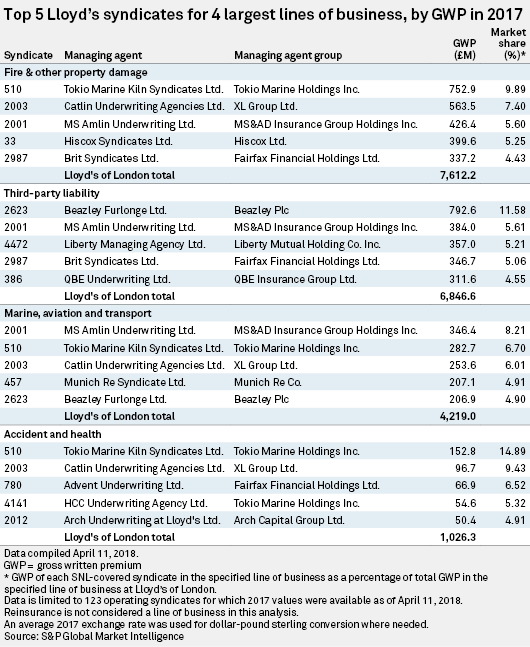

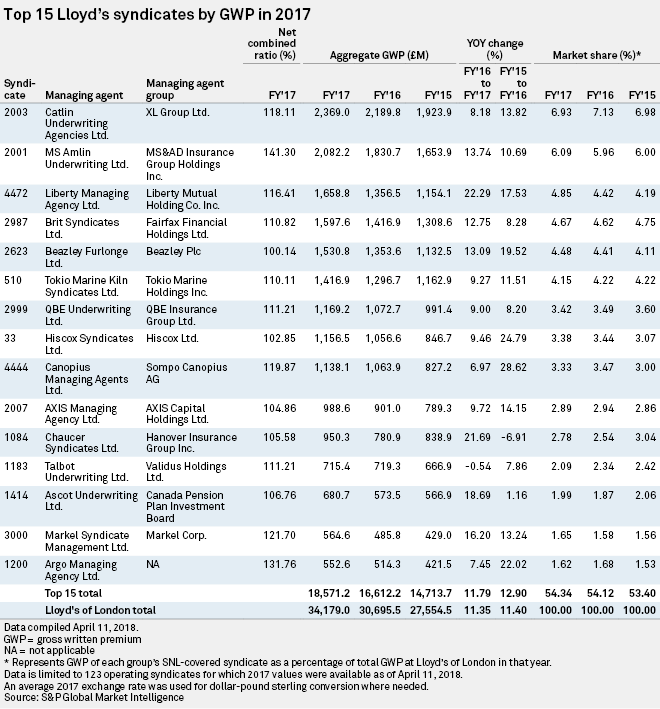

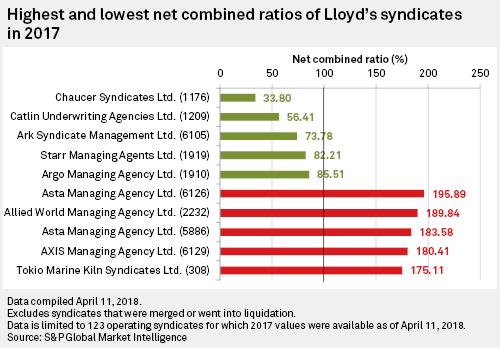

Lloyd's made a £2 billion loss for 2017 and reported a combined ratio of 114%, indicating that for every £1 Lloyd's underwriters collected in premium in 2017, they paid out £1.14 in claims and expenses. Although there was a wide variation in underwriting performance at individual syndicates, with the worst combined ratio at 195.89% and the best at 33.80%, none of the 15 biggest syndicates by gross written premium came in below the breakeven point of 100%.

This was little surprise in one of the worst years on record for natural catastrophe claims, with estimated insured losses across the whole industry of $144 billion, according to Swiss Re. Lloyd's itself picked up a catastrophe claims bill of £4.5 billion.

Of more concern is that the Lloyd's accident year combined ratio excluding catastrophes jumped to 98.4% in 2017 from 93.9% in 2016, which, according to CFO John Parry, implied that the figure would have been above 100% had there been even a normal level of catastrophe claims in 2017. Speaking to journalists in March, Parry blamed the underlying deterioration on "the pricing challenge the market has had for a number of years," and he urged "remedial action."

Catastrophe claims have been well below the average in recent years, putting insurance and reinsurance buyers in the pricing driver's seat, and investors' desperate search for reasonable yields in an era of depressed interest rates has added to the pressure on the market. Prices did rise in response to the heavy natural catastrophe burden in 2017, but not by as much as the market was expecting.

Redmond said that in the absence of adequate pricing, the market has "relied on the lack of catastrophes to produce decent results. It has been the lack of catastrophes that has propped up the market over a number of years, coupled with the ability of many organizations to tap into reserve releases."

Such releases are carried out when claims costs fall short of expectations, and they typically flatter underwriting results. Yet they are beginning to dry up, lowering the overall Lloyd's combined ratio by 2.9 percentage points in 2017, compared with 5.1 points in 2016.

Fitch Ratings director Graham Coutts said reserve release benefits of between 2 percentage points and 3 percentage points, rather than the 5 percentage points to 6 percentage points seen in previous years, are "probably going to be the level going forward."

Persistently high costs

Also contributing to the lackluster underwriting result was the fact that despite Lloyd's efforts to lower costs, for example through its modernization program, the expense ratio remained almost flat at 39.5% in 2017, compared with 40.6% in 2016. That compares unfavorably to the roughly 32% to 33% achieved across the London companies market, the London-based international insurance market outside Lloyd's, said Mike van Slooten, head of market analysis at broker Aon Benfield.

"In a competitive environment, that is quite a big difference," he said. "The danger is that you have got a lot of large corporate players in the market now who have alternatives. If they don't feel the situation is improving, they may start to make decisions that are to the detriment of Lloyd's."

Van Slooten described the expense ratio as "the most important thing" for Lloyd's to tackle and said "it has got to the point where the effort needs to be redoubled." But he also acknowledged that tackling the cost differential would be tricky because Lloyd's is made up of around 55 independent businesses with their own individual corporate structures.

"That structure has a lot of embedded costs associated with it. There is no easy way of solving that," he said.

Vote of confidence

Although Lloyd's has its challenges, many strengths remain. Costs will be difficult to cut, but some believe the modernization efforts are going well.

"You might say they should have done this 10 years ago, but now they have started [the modernization program], I am quite impressed with the progress that is being made," said Michael Tripp, head of financial services in the U.K. at accounting firm Mazars.

Lloyd's was also able to raise £3 billion in fresh funds to restore capital levels directly after the 2017 catastrophes in the so-called coming-into-line process, whereby Lloyd's underwriters need to ensure their capital levels match their risks.

"There has seemingly been a vote of confidence by capital providers in the market through the coming-into-line process and there does seem to be, anecdotally at least, a continued interest in placing capital and business on the Lloyd's platform despite all the questions over expenses and efficiency," said Mark Nicholson, an insurance ratings director at S&P Global Ratings.

Aon Benfield's van Slooten added: "If you see a queue of people continuing to want to get into the market and you see a market that is prepared to reload to that extent that quickly, I think that tells you something about its relative strength."