Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Sep, 2016 | 16:45

Highlights

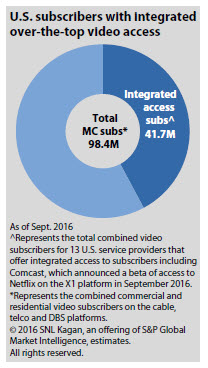

The direct integration of online video services into traditional cable and DBS platforms is still limited to a minority of multichannel subscribers, but is poised to take a big step with Comcast Corp.'s integration of Netflix Inc. into its X1 platform.

The direct integration of online video services into traditional cable and DBS platforms is still limited to a minority of multichannel subscribers, but the number is poised to take a big step forward with Comcast’s integration of Netflix into its X1 platform.

S&P Global Market Intelligence has identified 13 tier 1 and 2 service providers in the U.S. offering access to OTT content through their leased set-top boxes, including Comcast, Dish Network and Cablevision as well more than half a dozen smaller cable providers partnering with TiVo.

Comcast, with its September Beta launch of Netflix on the X1 platform, would not only be the largest operator to participate but also arguably offers the deepest integration of Netflix content into its user interface.

Comcast is featuring access to the traditional Netflix App on its X1 set-top boxes without changing inputs. But it also includes Netflix titles alongside Comcast’s own live linear and on-demand selections in the program guide and search results, including using voice search for either specific titles or broader genres.

Comcast is phasing in access to a Beta version in October, but it expects full deployment before the end of 2016. The inclusion of Comcast’s 22.4 million video subs will more than double the number of OTT-integrated multichannel subs to 41.7 million and account for 42% of the combined cable, telco and DBS subs in the U.S, according to SNL Kagan estimates.

It’s important to note that the actual integration will be limited to customers on the X1 platform, which reached 40% of Comcast subs at the end of the second quarter, but as with the rest of the operators we employed the full video subscriber count as the benchmark for availability.

Removing Comcast, the number of integrated subscribers slips to 19.3 million or less than 20% of the U.S. multichannel subscribers. Comcast’s all-in approach sets a precedent for the larger operators as well as providing a technical framework for the X1 licensees such as Cox and Shaw in Canada.