Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 23, 2024

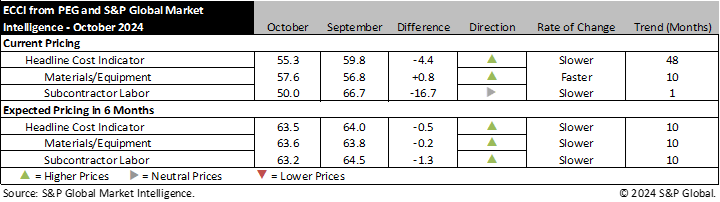

Engineering and construction costs increased again in October, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector declined 4.4 points to 55.3 this month. The sub-indicator for materials and equipment costs edged up 0.8 points to 57.6 while the sub-indicator for subcontractor labor costs fell to 50.0 in October from 66.7 in September.

The materials and equipment indicator saw a minor increase in October and continues to show rising prices. Only five of the 12 components increased compared to last month, but the magnitude of the increases was larger than the declines. The primary drivers of the increase were the 19.4-point jump for electrical equipment, the 12.7-point increase for alloy steel pipe and the 10.0-point increase for shell and tube heat exchangers. On the other hand, only transformers saw a double-digit decline, down 11.1-points to 66.7 this month. Carbon pipe and fabricated structural steel remain in contractionary territory this month with readings of 42.9 and 35.7 respectively. Ready-mix concrete declined 7.1-points this month to a neutral reading, the first time in since late 2020 that the category did not register a value above 50.0.

“Ready-mix concrete price movements in the U.S. have quieted in late 2024 while the market waits to see how the start of the 2025 construction season deals with opposing demand pressures,” said Luke Lillehaugen, Senior Economist, S&P Global Market Intelligence. “Construction spending—especially in the infrastructure sector, a key market for concrete—has softened as funding from government stimulus like the Infrastructure Investment and Jobs Act starts to wind down. Private sector spending should provide some offset to this decline as the Federal Reserve has begun to cut interest rates, stimulating growth. But, still early in the monetary easing cycle, concrete prices are little changed as the market seeks to find where demand will go in 2025 between unwinding government stimulus and strengthening private sector investment.”

The sub-indicator for current subcontractor labor costs saw a significant decline, falling 16.7-points compared to last month. Every region and labor category had neutral readings of 50.0 this month after significant declines in all regions of the U.S. as well as instrumentation and electrical subcontractors in Eastern Canada.

The six-month headline expectations for future construction costs indicator saw a minor decrease to 63.5 in October. The six-month expectations indicator for materials and equipment came in at 63.6, just 0.2-points lower than last month’s figure. The largest declines were in the ocean freight categories, which each saw double digit declines compared to last month and ended at neutral readings of 50.0. Additionally, carbon steel pipe saw a 7.1-point decline to a reading of 42.9, solidly in contractionary territory for the second time in just three months. Meanwhile, copper-based wire and cable saw a very large 15.9-point increase, rebounding after being the only category to decline last month. Ready-mix concrete also recorded a strong increase, rising 11.4-points to settle at a very high reading of 90.0.

The six-month expectations indicator for sub-contractor labor saw a modest decline down 1.3-points this month to a reading of 63.2. The declines were focused in all labor categories in the U.S. South and West regions, while the partially offsetting increases came in the U.S. Midwest and Western Canada.

Respondents continue to report some shortages for electrical equipment and noted worries about the impacts of the since (temporarily) resolved ILA labor strike.