Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Mar, 2017 | 09:30

Highlights

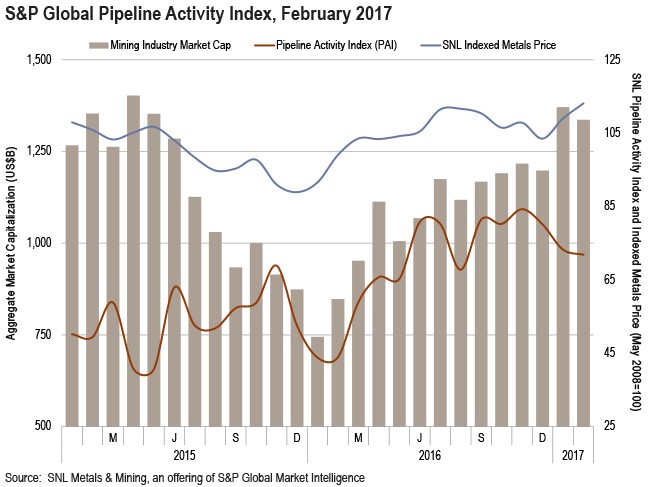

With most analysts bullish on the long-term outlook for the mining sector, the industry's optimism was on display at the recent PDAC Convention in Toronto. Despite the positive outlook, S&P Global Market Intelligence's Pipeline Activity Index PAI slipped to 72 in February.

The mood at the recent Prospectors and Developers Association of Canada's annual convention in Toronto was decidedly upbeat, with most analysts bullish on the long-term outlook for both base and precious metals, as looming supply gaps and increasing demand push prices higher. The short-term outlook is also largely positive, thanks to a stronger U.S. economy and a recovery in commodities.

S&P Global Market Intelligence's Indexed Metals Price rose to 113 in February from 109 in January, its highest value since September 2014. The indexed price rose for gold, silver, cobalt, zinc, nickel and copper, decreased for platinum, and, for a third consecutive month, was unchanged for molybdenum.

Mining equities took a breather last month, as S&P Global Market Intelligence's aggregate market value of the industry's listed companies, which is based on 2,472 firms, retreated 3% to US$1.34 trillion; it was nonetheless still at a level unmatched since May 2015. Similarly, the aggregate market cap of the industry's top-100 companies also eased slightly in February but was still above US$1 trillion for the second time since June 2015.

Despite the sanguine outlook, the Pipeline Activity Index, or PAI, retrenched for a third consecutive month, to 72 from a 44-month high of 84 in November, as a modest decrease in drilling activity, from more than a four-year high, and an anomalous drop in project milestones were only partially offset by increases in initial resources and financings. By target, the PAI for base/other metals was down for a fifth consecutive month, while the gold PAI was up slightly.

After hitting a four-year high in January, global drilling activity eased off in February, with the total number of distinct projects reporting drilling dropping to 205, from 232 in the previous month. S&P Global Market Intelligence's milestone activity plummeted in February. The number of positive milestones fell from six to one, and at US$7.78 billion, the value of that milestone represented less than one-third of the US$24.07 billion recorded in January.

After retreating for two consecutive months, the number of initial resource announcements rebounded slightly in February, from four to five, and the US$2.61 billion total value was up 3% from US$2.54 billion recorded in the previous month. After a drop in January that may have been largely cyclical in nature, the number of financings by junior and intermediate companies bounced back to 169 in February from 137 in the previous month. If the pattern shown in the first half of 2016 repeats itself, we may see a gradual increase in financings as the year progresses.

Our mining industry research and analysis is powered by our in-depth global mining data and analytics.