Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Aug, 2016 | 09:00

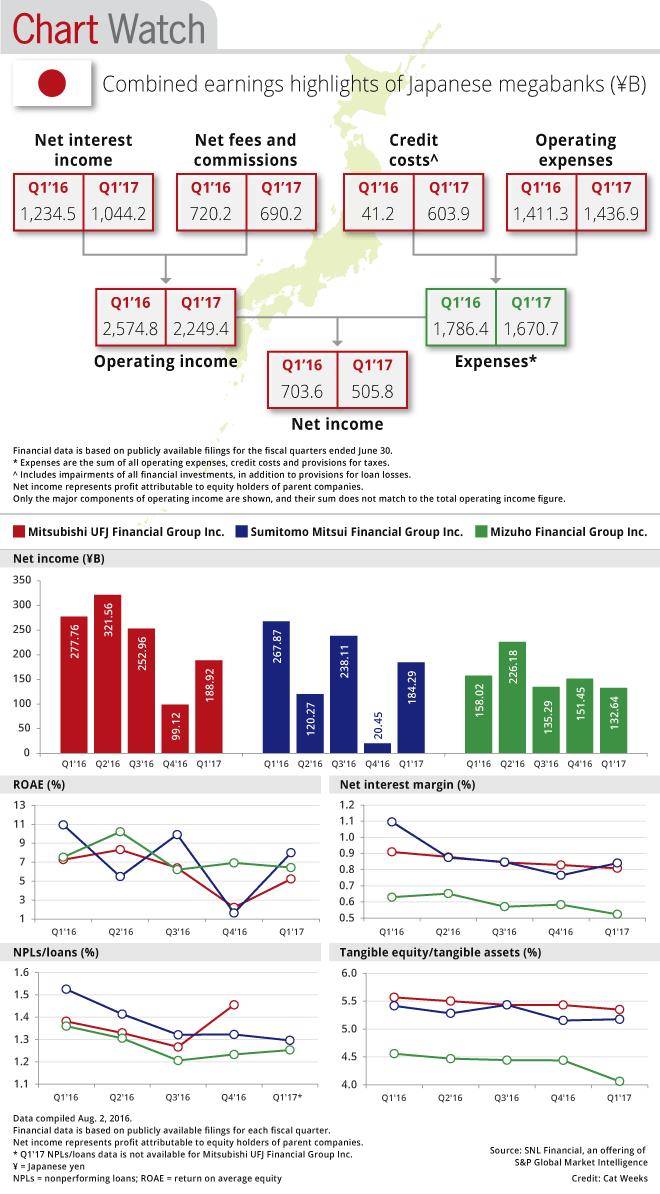

Profits at Japan's three megabanks slid in the first quarter of the fiscal year as negative interest rates cut into interest margins.

Aggregate net income at Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. fell to ¥505.8 billion in the first quarter ended June 30 from ¥703.6 billion in the prior-year period. Aggregate net interest income fell to ¥1.044 trillion from ¥1.235 trillion, while net fees and commissions dropped to ¥690.2 billion from ¥720.2 billion.

The three banks' aggregate operating income amounted to ¥2.249 trillion, down from ¥2.575 trillion. Operating expenses increased to ¥1.437 trillion for the first quarter from ¥1.411 trillion in the prior-year period.

Mitsubishi UFJ, the largest commercial bank in Japan by assets, saw net profit fall 31.98% year over year to ¥188.92 billion, or ¥13.72 per share, from ¥277.76 billion, or ¥19.74 per share. The weaker earnings results were echoed at Sumitomo Mitsui and Mizuho Financial, which reported year-over-year declines of 31.2% and 16.06%, respectively, in net profit for the quarter.

As of Aug. 2, US$1 was equivalent to ¥100.96.