Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 13, 2025

Energy utility initial rate increase requests in January were over $3.0 billion across a case volume of 12, while there was one rate decrease of $34.7 million associated with a limited-issue rider annual true-up in Virginia. Over half of the $3.0 billion in rate increase requests flowed from a single $1.6 billion electric distribution case filed in New York.

January decisions included 10 cases, compared with 22 in December 2024. Total authorized rate increases in January were $1.55 billion compared with $1.85 billion in December.

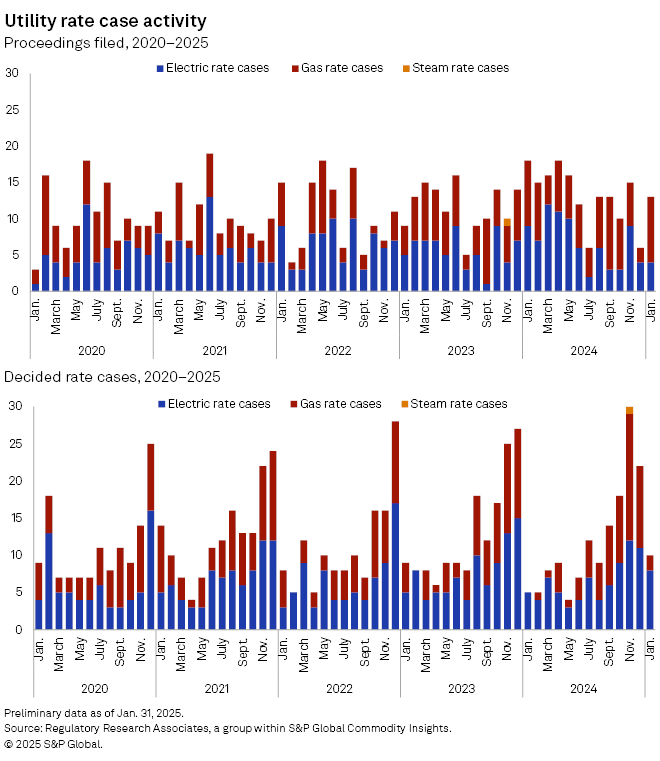

➤ Four electric and nine gas rate cases were initiated in January compared with four electric and two gas rate case filings submitted in December 2024. December volume was considerably below the combined five-year average of 10.8 electric and gas cases calculated for the month in 2019–2023. January's 10 case filings were on par with the five-year average of nine over 2020–2024 for the month.

➤ Ten cases concluded in January compared with 22 cases closed in December 2024. January decision volume was one case above the 2020–2024 average of nine decisions for the month.

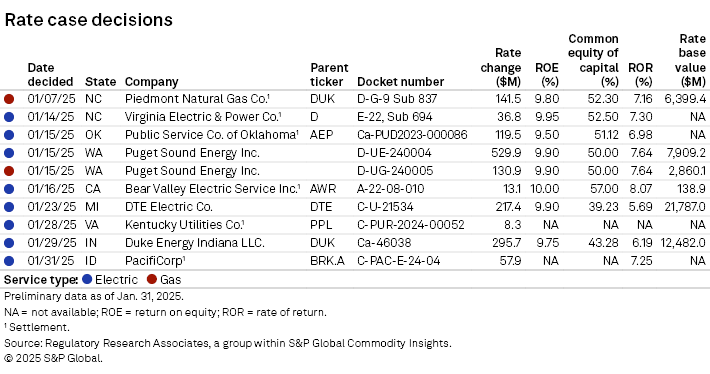

➤ State regulators authorized eight new returns on equity (ROEs) in January, ranging between 9.50% and 10.00%. The remaining two cases did not disclose ROEs. This may be because the ROE was determined in a previous proceeding, the details were not part of the settlement or the final ruling in the case was silent regarding the ROE.

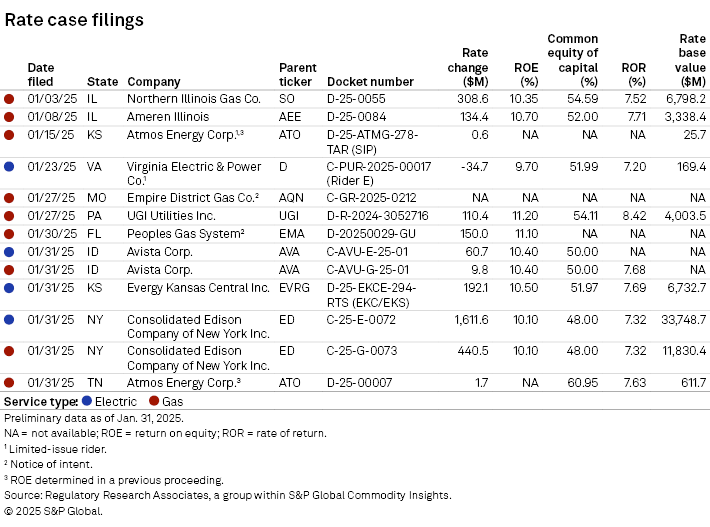

➤ In the 10 of 13 cases filed in January with disclosed ROEs, the requested ROEs ranged between 9.70% and 11.20%.

US energy utilities filed for $3.0 billion of rate increases in 11 proceedings in January; one Missouri case was a notice of intent and did not include a target rate increase amount. A single notice of intent from a New York electric distribution utility accounted for $1.6 billion of the $3.0 billion aggregate. The thirteenth case was a rate decrease of $34.7 million associated with a limited-issue rider annual true-up.

January rate increase requests of $3.0 billion were in accord with the $2.9 billion in December 2024.

Authorized rate increases for January totaled $1.55 billion across 10 cases, with no rate decreases observed.

Rate case ruling activity in January, with 10 cases, was on par for the month by volume compared with the five-year average of nine cases for the month over the years 2020 through 2024.

Rate case initial filings

The accompanying table details the four electric and nine gas rate proceedings initiated in January. The requested rate changes aggregated to an increase of just over $3.0 billion, with $1.86 billion sought by electric utilities and $1.16 billion by gas utilities. One large electric distribution request in New York by Consolidated Edison of $1.6 billion accounted for the majority of aggregate rate increase requests fielded by three different electric utilities in three different states. The fourth electric case represented a rate decrease request of $34.7 million and was the result of a limited-issue rider annual true-up proceeding in Virginia.

Resolved rate cases

The accompanying table details the eight electric and two gas rate proceedings concluded in January. The requested rate changes aggregated to an increase of just over $1.55 billion, with $1.28 billion sought by electric utilities and $272 million by gas utilities.

Significant rate case activity

EV infrastructure investment proposal rejected in commission final rate case decision

Illinois — The Indiana Utility Regulatory Commission (URC) rejected Duke Energy Corp. subsidiary Duke Energy Indiana LLC.'s proposal to include about $3.5 million in rate base for its investment in fast-charging electric vehicle facilities. Among several comments, the URC said, "[I]t is one thing to supply electricity to a business which delivers fast charging services to retail customers, [but] it is quite another for a regulated utility to make investment secured by ratepayers to become both the supplier and retailer of fast charging services, expanding the scope of the traditional regulatory compact." The commission had rejected a similar EV proposal put forth by American Electric Power Co. Inc. subsidiary Indiana Michigan Power Co. in Cause 45933.

Wildfire mitigation measures featured in several Western states' recent rate requests, approvals

California — The California Public Utilities Commission voted Jan. 16 to adopt a settlement authorizing Bear Valley Electric Service Inc. a multiyear increase in base rates totaling $13.1 million, primarily to fund wildfire mitigation. In its first rate case tracked by RRA, Bear Valley Electric Services (BVES) was authorized an increase in electric base rates totaling $13.1 million over four years to fund investments to prevent wildfires sparked by the utility's equipment. BVES operates in the San Bernardino Mountains, an area considered high risk for wildfires, which have been widespread in the state in recent years. The approved rate increase is about three-quarters of the amount initially requested by BVES.

Montana — Intervenors in NorthWestern Corp.'s electric and gas rate cases pending before the Montana Public Service Commission believe regulators should reject the company's proposal for new cost trackers for wildfire management and other costs and authorize a lower return on equity than that requested by the utility. In seeking approval for the trackers, NorthWestern said the accounts will reduce regulatory lag related to investments in wildfire mitigation and wildfire insurance costs. The Montana Consumer Counsel said NorthWestern has not demonstrated that the proposed trackers are "a necessary departure from traditional ratemaking and would benefit ratepayers."

Washington — As part of an electric and gas multiyear rate plan authorization, the Washington Utilities and Transportation Commission also adopted Puget Sound Energy Inc.'s (PSE's) proposal for, and the staff's recommendation to adopt, a wildfire prevention tracker to recover applicable costs outside of base rates. However, regulators rejected PSE's proposal for three new rate trackers to recover costs associated with new wind project spending and electric and gas decarbonization efforts.

Decoupling mechanism requested to be extended to include certain nonresidential customers

Illinois — In addition to lodging a proposed $308.6 million base rate hike, Northern Illinois Gas requested that general service and general transportation service customers be subject to the volume balancing adjustment (VBA) rider that currently applies strictly to residential customers. The VBA rider is a decoupling mechanism that adjusts the company's revenues annually to reflect variations in the total volume of gas sold relative to the amount established in its most recent rate case.

Interim rate increase authorized after commission reverses prior decision

Montana — In a 4-1 vote, the Montana Public Service Commission authorized MDU Resources Group Inc. subsidiary Montana-Dakota Utilities Co. an approximately $7.7 million (10.25%) interim gas rate increase, effective Feb. 1. The commission found that a revenue hike is necessary to allow the company to recover its prudently incurred costs and earn a fair rate of return. The PSC's Jan. 14 order adopting a staff-recommended interim rate hike reverses its previous position. On Oct. 15, 2024, the PSC issued a decision denying the utility's request for an approximately $8 million interim rate increase.

Settlement adopted without change while company's prior case settlement ended in rejection

Oklahoma — The commission recently adopted a settlement without alterations for American Electric Power Co. Inc. electric utility Public Service Co. of Oklahoma. The proceeding arrived on the heels of a restrictive ruling in the company's previous case, where the commission rejected several provisions of a settlement.

Equity returns under pressure at Federal Energy Regulatory Commission

FERC — In a series of 15 pending cases across multiple segments of the electric utility sector,

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Theme

Location

Products & Offerings

Segment