Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jun 23, 2021

Research Signals - June 2021

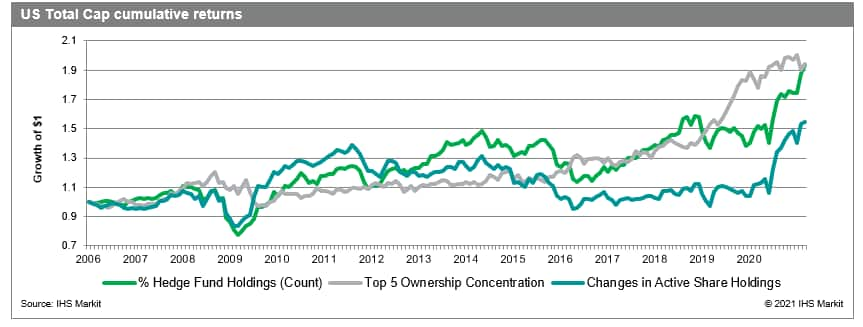

IHS Markit's Equity Point-in-Time Ownership data provides daily insights into global institutional and fund owned security positions, flow of funds and activity globally across developed and emerging markets. Ownership is sourced from 13Fs, global mutual funds, daily ETF holdings, annual reports, and major stakeholder exchange announcements for equity securities. We combine our Research Signals team's quantitative research capability with key elements of this proprietary data, specifically looking for factors that are drivers of stock price performance. In total, we introduce 17 factors capturing ownership concentration, changes in holdings, institutional and hedge fund holdings and liquidity flow ratios.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.