Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Oct, 2022

By Sean DeCoff

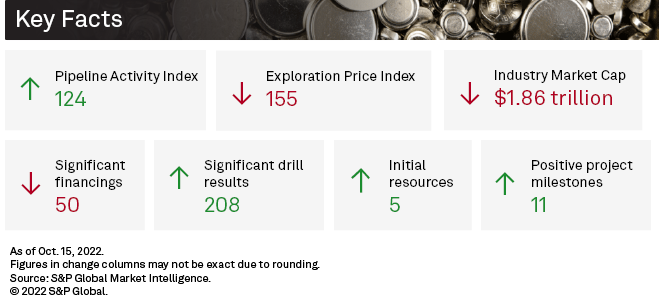

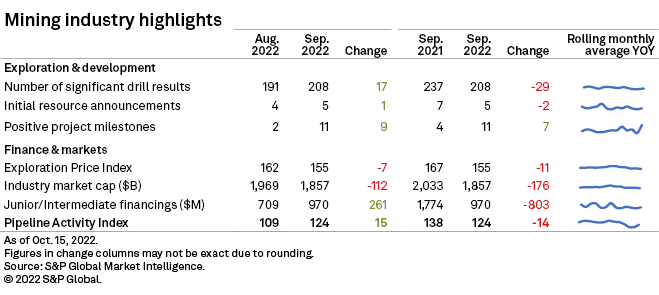

S&P Global Market Intelligence's Pipeline Activity Index, or PAI, increased in September to 124, coming off the 21-month low of 109 registered in August. The gold PAI increased from 143 to 167, while the base/other metals PAI increased from 81 to 88.

Most of our tracked metrics, such as significant drill results, initial resources and positive milestones, increased in September. Significant financings, however, fell due to an overall drop in metals prices. Following the price drop and a deterioration of overall market conditions, the mining industry market cap slipped as well.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

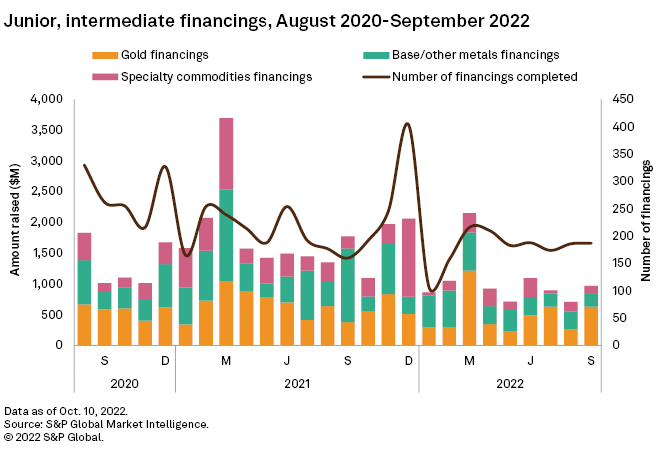

Financings rebound to 3-month high as gold fundraisings double

Funds raised in September increased 37% month over month, rebounding from the 28-month low recorded in August. Unlike in August, when no transaction was valued more than US$100 million, three companies raised more than US$100 million for gold and base/other metals in September, lifting the month's total to US$970 million. The number of financings increased by one, to 187.

Significant financings — those valued at US$2 million or more — dipped to 63 from 66 in August and accounted for 92% of the funds raised. The average offering amount in September increased to US$5.2 million from US$3.8 million in August.

Gold financings jumped 138% month over month to US$631 million after falling to US$265 million in August. Despite the rebound in total funds raised, the number of financings fell to 103 from 112. Equity offerings accounted for 54% of September's gold fundraisings with the remainder coming mostly from debt for a 45% share.

Funds raised for the base/other metals group fell 23% to US$223 million, slightly above the 27-month low of US$216 million in July. The number of transactions remained flat at 53.

Fundraising for specialty commodities fell 25% month over month to US$116 million following a rebound in August from the recent low of US$47 million recorded in July. Despite the decrease in the amount of funds raised, the number of financings increased to 31 from 21 in the previous month.

September's largest gold financing, and the second largest overall, was the first of the three senior debt offerings made by Indonesia-based PT Merdeka Copper Gold Tbk. The company's largest debt transaction in September was valued at 1.73 trillion rupiah (US$116.3 million), and the aggregate of the three transactions was valued at nearly 4 trillion rupiah (US$269 million). The largest bond was offered to domestic lenders with a fixed quarterly paid interest rate of 8.25%, from December 2022 until September 2025. PT Merdeka owns gold, copper and nickel mines and facilities in Indonesia.

September's largest base/other metals financing, and the largest overall, was the US$126 million nonconvertible debt offering by Peru-based Cia. Minera Raura SA. The company owns a producing base metals mine in Peru that was put temporarily on hold in June 2020 to begin feasibility studies and arrange for necessary investments to make the mine economical again.

Detailed information on junior and intermediate financings completed in September is available in the Financings article in this series.

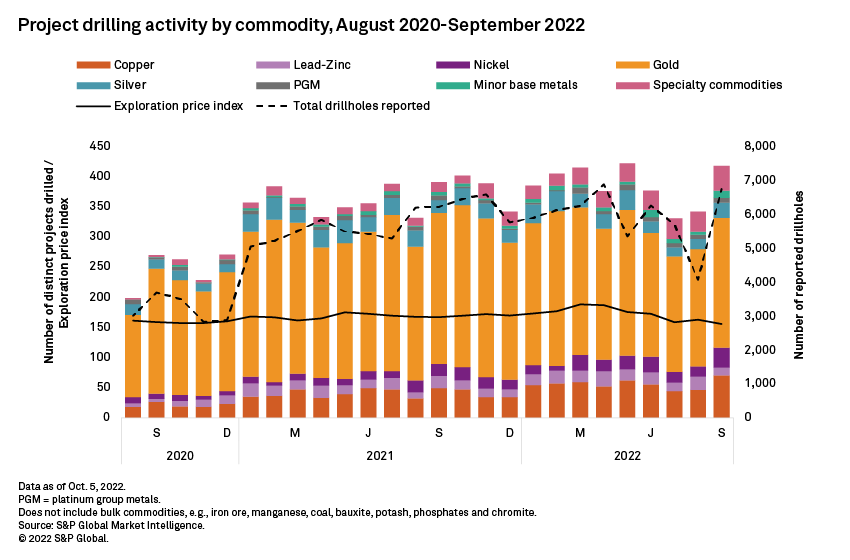

Drilling activity recovers

Monthly drilling activity posted increases across nearly all metrics in September, with a monthly total of 417 projects drilled, 22% more than in August. The number of distinct drillholes surged 66% to 6,729, putting September almost on par with the year-to-date high in April.

Gold projects drilled were up 11% month over month to 215 and comprised more than half the total projects drilled in September. Nickel and copper led the increase among major base metals as both posted record-high counts of projects drilled. Nickel projects almost doubled to 33, while copper projects grew by half to 70, values not seen since the start of our records in 2012. Projects drilled for specialty commodities reached their highest level since March 2015 with a 24% jump to 41, mostly driven by increased drilling activities at lithium and uranium projects.

By country, Australia remained on top with the most projects drilled, despite a 9% decline month over month to 122 projects. Canada closed in with a 30% increase to 82 projects, recovering from a 20-month record low in July. The U.S. surged 43% month over month to 33 projects.

The top result for September came from Frontier Lithium Inc.'s late-stage Pakeagama Lake lithium project in Ontario with a 330.7-meter intersection grading 1.79% lithium and including 67 parts per million of tantalum. The result comes from analysis of some of the 34-hole, 11,150 meters of drilling completed by the company as of September. Ongoing phase 12 delineation and infill drilling on the project aims to convert inferred resources to the indicated category.

The second-best result came from Baroyeca Gold & Silver Inc.'s early-stage Santa Barbara gold project in Colombia with a 21-meter intersect grading 59 grams of gold per tonne. As of early October, the company is preparing for a 1,500-meter drill program on the project

Detailed information on all drilling activity in September is available in the Drill Results article in this series.

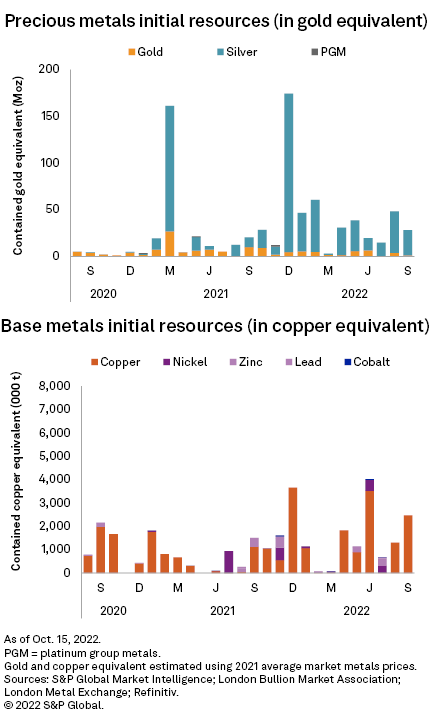

New resources up slightly

There were five initial resource announcements in September, one more than in August; three resources were for gold projects and two were for copper projects.

September's largest new resource was announced by Victoria Gold Corp. for the Raven deposit at its Dublin Gulch gold mine in Canada's Yukon territory. The inferred resource announcement totaled 20.0 million tonnes grading 1.67g/t Au, containing 1.07 million ounces of gold.

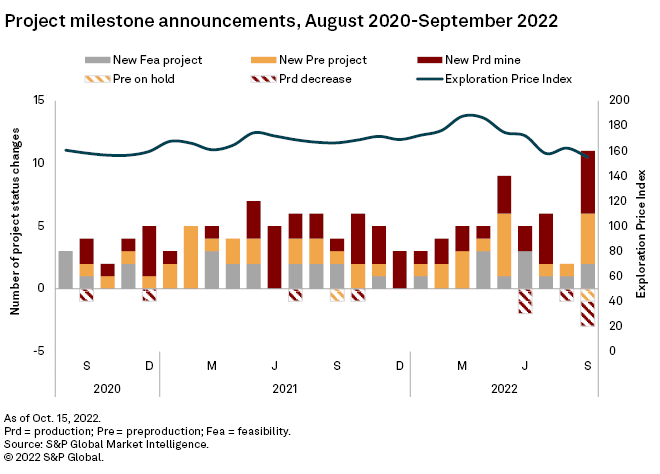

Project milestones jump

September marked a significant turnaround in project milestone activity. We registered 11 positive project announcements, the most since mid-2016. However, there was also an uptick in negative announcements with three announcements compared with only one in August.

September's positive milestones included two projects entering feasibility, four entering preproduction and five production startups. Six milestones were for gold projects and five were for base/other metals.

In the month's largest milestone, U.K. based Anglo American PLC announced that its 60%-owned flagship copper project, Quellaveco (Mitsubishi Corp. 40%), located in Moquegua, Peru, has begun commercial operations. Quellaveco is expected to ramp up fully over the next nine to 12 months following a commissioning and testing period and final regulatory clearance. The mine is forecast to produce 80,000-100,000 tonnes of copper for calendar year 2022 but will ramp up to produce more than 300,000 t/y for the first 10 years.

The second-largest positive milestone announcement was from OZ Minerals Ltd. for its West Musgrave nickel-copper project in Western Australia. The board's final investment approval to develop the company's fourth operating asset includes a direct capital investment of about A$1.7 billion. Average annual production is forecast at 28,000 t/y of nickel and 35,000 t/y of copper over a 24-year operating life.

Among the negative milestones, the most notable was from Vancouver, British Columbia-based Trevali Mining Corp., which announced the closure of its Perkoa zinc mine in Burkina Faso after a flood that killed eight workers. Trevali said it does not have the funds required to rehabilite the mine. Trevali also had August's only negative milestone, announcing that its Caribou Zinc mine in New Brunswick was being placed on care and maintenance due to "operational and financial challenges."

Exploration Price Index at 27-month low

Metals prices declined in September, lowering S&P Global Market Intelligence's Exploration Price Index from 162 in August to 155, its lowest level since July 2020. Of the eight metals included in the index calculation, prices dropped for gold, silver, platinum, copper and zinc and increased for nickel, cobalt and molybdenum.

The EPI measures the relative change in precious and base metals prices, weighted by the percentage of overall exploration spending for each metal as a proxy of its relative importance to the industry at a given time.

Equities resume decline

After appearing to stabilize in August, mining equities resumed their downward trajectory in September. S&P Global Market Intelligence's aggregate market value of the industry's listed companies, based on 2,421 firms, slipped to US$1.86 trillion, more than US$100 billion lower than in August. Most of the decline came from the aggregate market cap of the industry's top 100 companies, which dropped to US$1.54 trillion from US$1.62 trillion.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings