Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 May, 2022

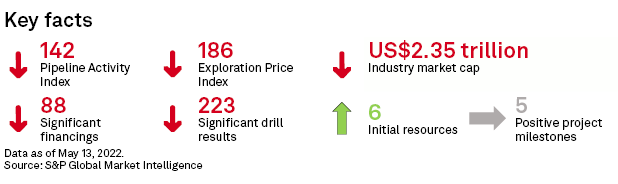

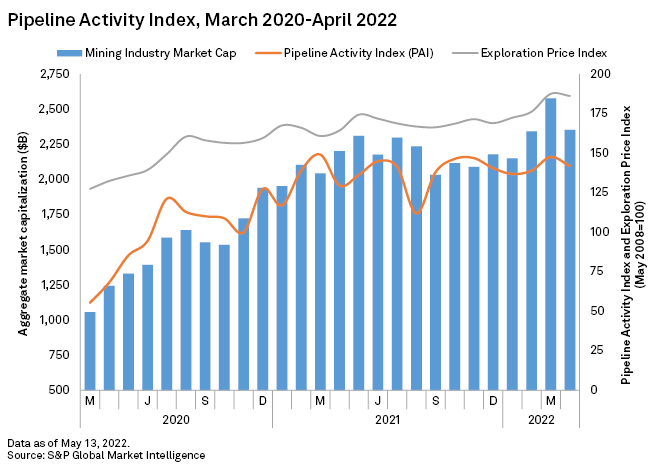

S&P Global Market Intelligence's Pipeline Activity Index, or PAI, retreated from a 10-year high in April, falling to 142 from 148 in March, as decreases in significant financings and drill results were offset by an increase in initial resources; positive project milestones were unchanged. The gold PAI fell to 181 from 204, while the base/other metals PAI rose to 108 from 103.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Total raisings down 57%; number of financings off slightly

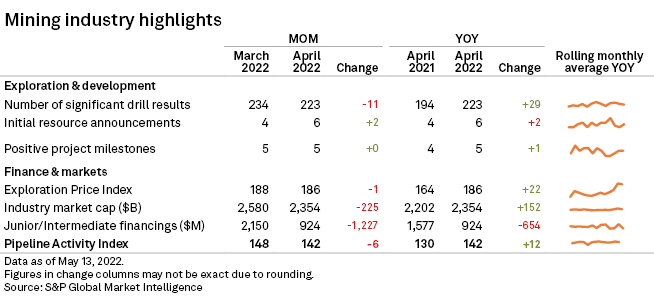

After rebounding for two consecutive months, the number of financings by junior and intermediate companies decreased in April, falling to 209 from 216 in March, and the US$923.6 million raised was less than half the US$2.15 billion garnered in the previous month.

In line with the overall decrease in financings, the number of significant gold and base metals financings, used in the PAI calculation, also decreased in April, falling to 88 from 100 in March. Significant gold financings were down by 14, to 53 from 67, while base/other metals financings rose by two, to 35 from 33.

New York Stock Exchange-listed Contango Ore Inc. had April's largest gold financing with a US$20 million unsecured 8% convertible debenture. Contango will use the proceeds to fund commitments at its 30%-owned Manh Choh joint venture with Kinross Gold Corp. (70%) in Alaska, for exploration drilling and underground development at its Lucky Shot properties in Alaska and for general corporate purposes. Contango plans to complete a feasibility study at Manh Choh in the second half.

In the month's largest base/other metals financing, London Stock Exchange-listed First Tin PLC completed a £20 million (US$26 million) IPO, the proceeds of which the company will use to advance its Taronga tin-copper project in New South Wales acquired from Aus Tin Mining Ltd. for A$34 million in November 2021.

Australian Securities Exchange-listed Syrah Resources Ltd. had April's largest specialty commodities financing and the largest raising overall, a US$107 million loan from the U.S. Energy Department. Syrah will use the proceeds for the initial expansion of its Vidalia natural graphite Active Anode Material facility in Louisiana. The U.S. government considers graphite to be a critical mineral due to its use in electric vehicle batteries.

Drilling activity off from all-time high despite record number of drillholes

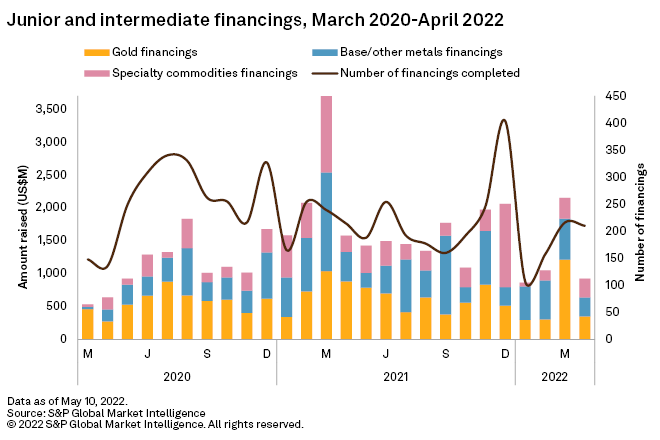

After increasing for three consecutive months, global drilling activity decreased in April with the total number of distinct projects reporting drill results falling to 375, from a record 414 projects in March.

Reported drilling decreased for gold, copper, nickel, platinum group metals and specialty commodities projects. Drilling increased for silver, zinc-lead and minor base metals projects.

In contrast with the decrease in projects, the number of reported drillholes rose sharply in April to 6,866 from 6,231 in March, eclipsing the previous high of 6,572 in November 2021.

ASX-listed Tesoro Gold Ltd. reported the most drill results with 725 assays from its El Zorro gold project in Chile. Vancouver, British Columbia-based Equinox Gold Corp. was second with 372 drillholes at its Fazenda Brasileiro and Santa Luz gold mines in Brazil.

By country, Australia led with 112 projects reporting drilling, down from 129 in March, followed by Canada with 101, down from 122 in March. The U.S. was a distant third with 37 projects, down from 45 in March.

In line with the decrease in the number of projects, the number of significant drill intersections, used in the PAI calculation, fell in April to 223 from 234 in the previous month, with the decrease spread equally between gold and base/other metals projects.

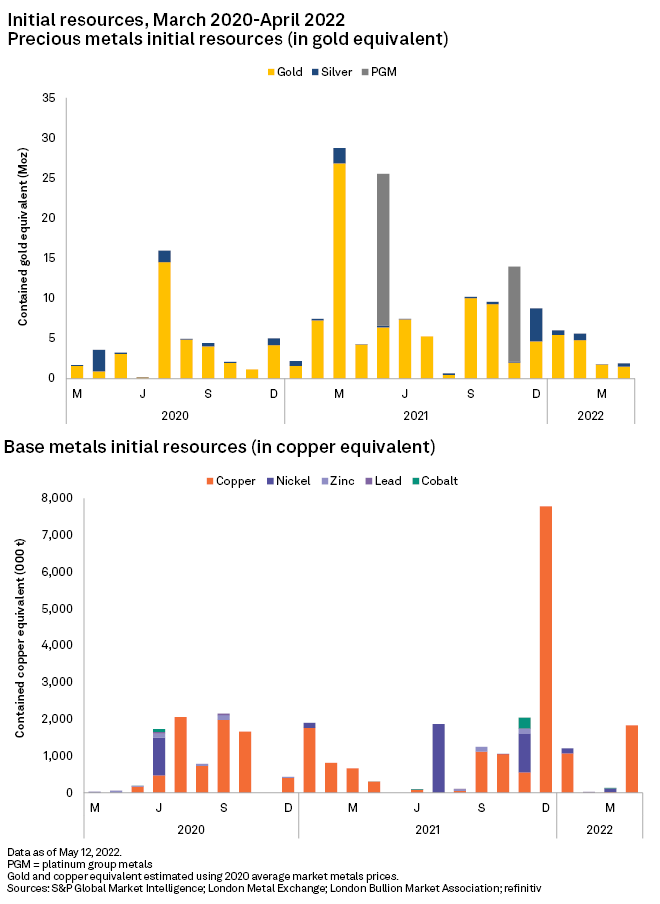

New resources up

The number of initial resource announcements increased to six in April from four in March; four resources were for base/other metals projects and two were for gold.

April's largest new resource by far was announced by Montreal-based Osisko Metals Inc. at its Gaspe copper project in Quebec, where inferred resources surrounding the past-producing Mount Copper open pit mine totaled 456 million metric tonnes grading 0.31% copper (containing 1.4 million tonnes of copper). An ongoing 30,000-meter drill program aims to refine the deposit's sulfide/oxide ratios and upgrade the resource to the measured and indicated categories by year-end.

The month's second-largest new resource was at Vancouver, British Columbia-based Metallic Minerals Corp.'s La Plata project in Colorado, where inferred resources at the Allard copper-silver porphyry deposit totaled 115.7 Mt grading 0.35% Cu and 4.02 grams of silver per tonne (containing 403,243 tonnes of copper and 15 million ounces of silver). The deposit remains open to significant expansion within the resource area. In addition, the greater La Plata silver-gold-copper project remains underexplored and open to new discoveries of both additional copper porphyry centers as well as high-grade epithermal silver and gold systems. A campaign of follow-up drilling and geophysical surveys is planned for 2022.

April's third-largest new resource was at Toronto-based G2 Goldfields Inc.'s Oku-Aremu gold project in Guyana, where indicated resources at the Oko main zone totaled 3.3 Mt grading 9.25 g/t Au (containing 974,000 ounces of gold). Additional inferred resources totaled 793,000 tonnes grading 8.63 g/t Au (containing 220,000 ounces of gold). The company has mobilized three diamond drill rigs to rapidly build upon the high-grade foundational resource.

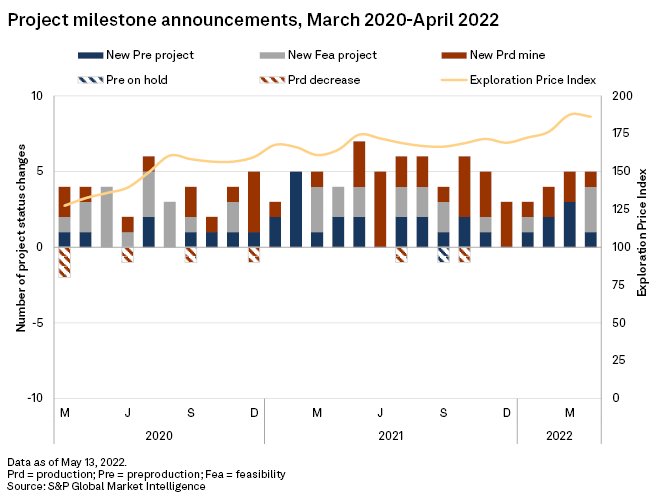

Milestone activity down

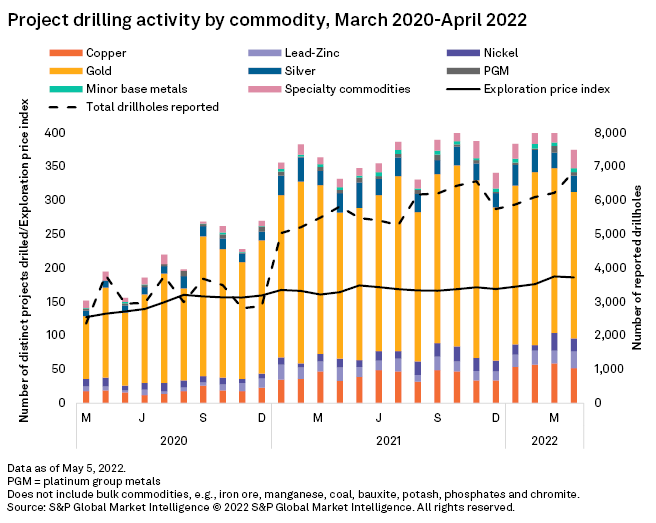

As the graph below indicates, positive project milestone activity was down in April to three announcements from five in March. There were no negative milestones.

April's positive milestones included three projects entering feasibility, one project entering preproduction and one new mine production startup. Three milestones were for base/other metals projects and two were for gold.

In the month's largest milestone by far, Toronto-based Barrick Gold Corp. is updating the feasibility study for the Reko Diq copper-gold project in Pakistan's Balochistan province. While not a complete ground-up rework of the 2010 feasibility study, the refresh of the historical study will focus on both de-risking key technical areas of concern today, such as power and water management, and performing trade-off studies on key subjects to better understand available project options. Barrick owns 50% of the project, and the remaining 50% interest is divided between three Pakistani stakeholders. If the project is reconstituted, previous joint venture partner Antofagasta PLC has separately agreed in principle to exit the project in return for a US$900 million payment from the Pakistani parties.

April's second-largest milestone was the groundbreaking of construction for a phase three expansion at Toronto-based Alamos Gold Inc.'s Island gold mine in Ontario. According to a study published in July 2020, the expansion will increase output by about 70% to 236,000 ounces per year, at significantly lower costs, over a 16-year mine life.

In the month's third-largest milestone, ASX-listed Red 5 Ltd. is on track for its first gold production in the June quarter at its King of the Hills gold project in Western Australia. Open pit mining teams are operating around the clock, and underground mining is ramping up on schedule as commissioning of the processing plant advances.

Exploration Price Index eases off record high

After increasing for three consecutive months, metals prices decreased slightly in April, lowering Market Intelligence's Exploration Price Index, or EPI, to 186 from a record high of 188 in March. The indexed price fell for six — gold, silver, platinum, copper, nickel and molybdenum — of the eight constituents of the index and increased for zinc and cobalt.

The EPI measures the relative change in precious and base metals prices, weighted by the percentage of overall exploration spending for each metal as a proxy of its relative importance to the industry at a given time.

Equities retreat from record high

After reaching an all-time high in March, mining equities pulled back in April as Market Intelligence's aggregate market value of the industry's listed companies, based on 2,348 firms, decreased 9% month over month to US$2.35 trillion. The aggregate market cap of the industry's top 100 companies was also down 9% in April at US$1.93 trillion.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.