Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Aug, 2016 | 11:00

The decision on Brexit has been made, but the economic uncertainty remains, especially for the M&A market in the UK. There have been lots of mutterings about how everything will slow down, that investors into the UK will be more cautious and that it will be a lot more difficult for UK sellers to attract buyers. But what has happened so far this year and in the immediate aftermath of Brexit? We decided to look at the activity for both acquisitions of UK companies and UK acquisitions of foreign companies by month from January 2011 to the end of July 2016 to see if there were any trends. Key findings are:

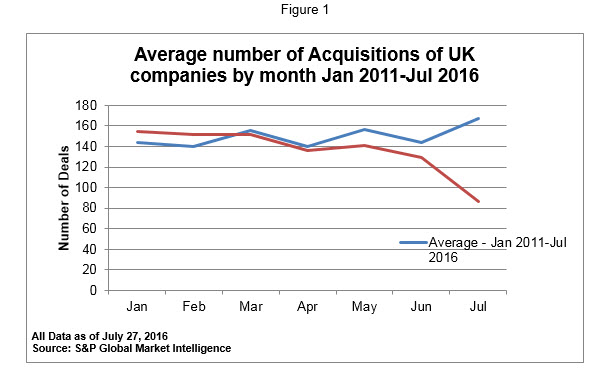

The chart above shows the average number of acquisitions of UK companies by month. We can see that at the beginning of the year, 2016 was looking to be in line with the averages over the past five years. However, as we approach the date of the vote in June we can see the numbers fall below the average. In June we would expect around 143 acquisitions whereas we saw 129 this year and in July, typically a high month of activity with 167 acquisitions on average, we see this number fall by nearly 50% to 87.

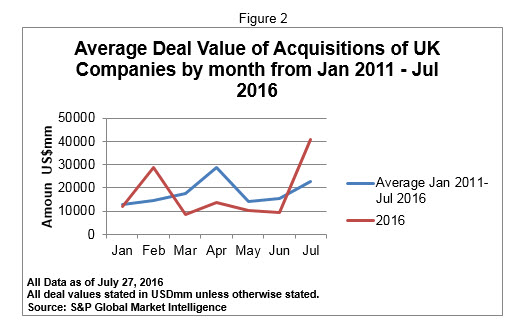

However, as the Figure 2 demonstrates, the deal values have been predominantly below average, with March 2016 being 50% of the average ($8.7B vs $17.5B), April being only 47% of the average ($13.59B vs $28.9B). July however shows a massive 177% gain ($40.6B vs $23B) although this was helped by Softbank’s acquisition of ARM holdings for $23.6 billion.

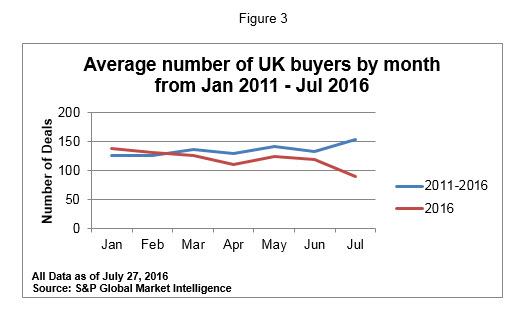

Now, let’s take a look at UK companies making acquisitions. Figure 3 below has a similar shape to what we saw in the very first chart. We see that up until June things were pretty much following the average but in July those numbers dropped significantly to 90 deals from an average of 153.

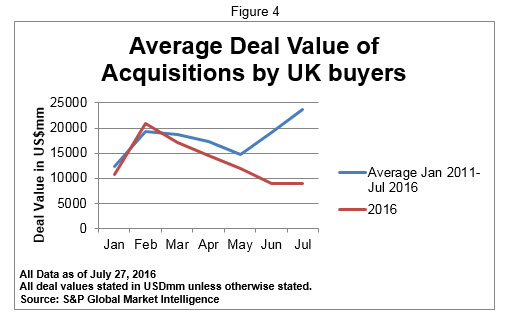

When we look at the deal value size, in Figure 4 we can see that 2016 has been trending down since February and now sits below the average. In June and July we saw total deal activity of $18.9B against an average of $31B.

It is clear from this analysis that we are definitely seeing the slowdown everyone was talking about both in terms of volume and number of deals but perhaps to a lesser extent than originally expected. It could be argued that 2015 was such a record year it was always going to be difficult to match or beat it, without any of the added complications we’ve seen this year. Given the foreign exchange risk due to the pound’s fall against the dollar after Brexit, the regulatory environment and the uncertainty surrounding the US elections these complications aren’t going away for the foreseeable future.

Although this is still early days after such a major event there’s no reason to wait until the next event that shocks us all to start thinking about strategy and how to manage the fall out. Things will continue to be a little volatile but despite this, what is also clear is that the UK is still open for M&A business and with a weaker currency this could prove to be a great opportunity for overseas buyers.

For more information on the tools and products used for this analysis, click here.

To find additional blogs on mergers and acquisitions, see below:

1. Focus On EMEA M&A: Buyers From The East by James West

2. North American Mergers & Acquisitions: Crossborder Versus Domestic Deals by Robert Collins

3. How Will M&A Activity Be Influenced By The Changing World Economy? By Pavle Sabic