Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Jan, 2022

By Nimayi Dixit

Many banks are adjusting to customers' quick shift to digital channels with a hybrid approach of increasing the specialization of branch operations while enhancing the capabilities of their mobile apps.

The pandemic shifted many banking transactions to digital channels and cemented mobile apps as the go-to offering for basic banking transactions. Banks have responded to the shift by increasing the parity between capabilities of mobile apps and offerings within the branch. Institutions have introduced more features in mobile apps that leverage their unique characteristics but recognize that the branch still offers value for customers, including those of the youngest generations, who are looking for more complex banking services.

Augmenting the mobile app

Having a suite of services in mobile apps that closely mirror those available in the branch has become a key priority for several financial institutions.

The pandemic forced consumers to overcome any inertia they may have had in terms of using digital channels for banking. Roughly half of those surveyed in S&P Global Market Intelligence's annual consumer mobile banking survey said they are using their mobile apps more frequently because of the pandemic and about the same amount are visiting branches less often. The vast majority expects those shifts to stick.

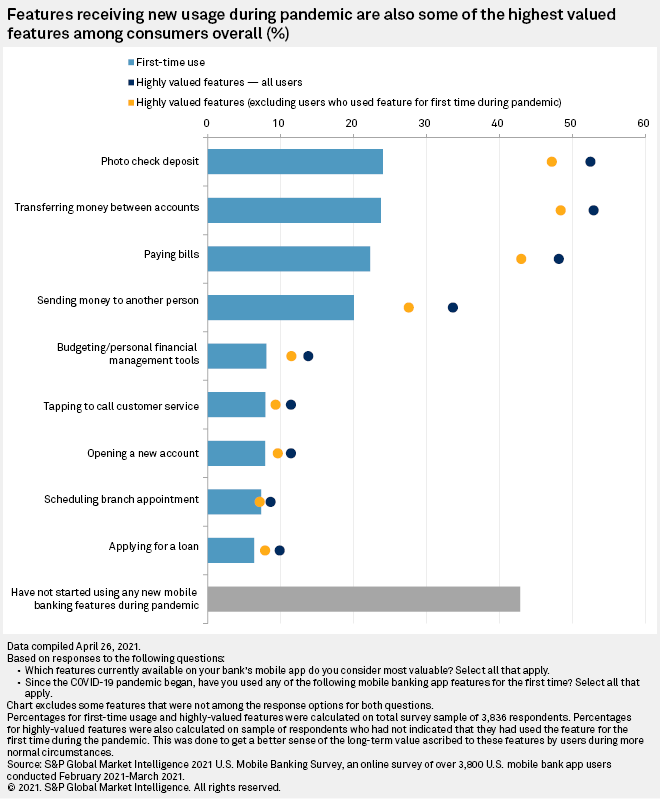

In the process, many consumers discovered new features for the first time and have, by now, become comfortable with them. For example, photo check deposit was used for the first time by nearly a quarter of mobile banking users after the pandemic began. Another feature, peer-to-peer money transfer, was used by nearly one-fifth of consumers for the first time.

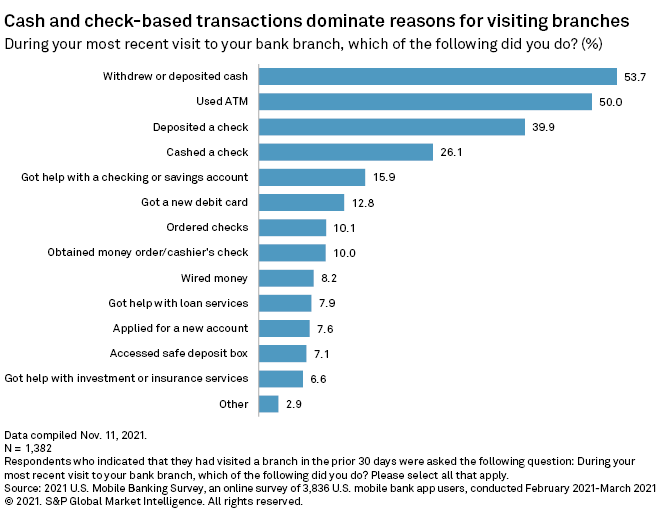

These basic mobile features could serve as substitutes for common activities performed at branches. Check depositing was used by nearly 40% of mobile banking users who had visited a branch in the 30 days prior to responding to the survey. Cash or check-based transactions represented some of the most popular branch use cases.

Some basic banking features have reached near-ubiquitous status. Among the 80 national and regional banks surveyed for our annual mobile banking report, all banks with a checking account product had features such as photo check deposit and bill pay available in their app. Over 90% of these banks had a peer-to-peer payment feature available in-app.

Other capabilities are growing in availability. Sixty of the 80 banks surveyed offered or planned to offer a feature to turn a card on or off or to report it stolen from within the app, up from 56 last year. Fifty-one banks offered or planned to offer the ability to open a deposit account from within the app, and 32 did the same for loan applications; this is up from 47 and 30, respectively, in 2020.

Some banks are also creating marketplaces within the digital environment where customers can browse through the bank's product offerings from a digital device. U.S. Bancorp has made its marketplace available to customers and noncustomers. Pittsburgh-based F.N.B. Corp. has made its eStore available in the mobile app, where customers can browse products and apply for deposit accounts or loans from directly within the mobile environment.

These marketplaces represent a way for banks to increase parity between their digital and branch capabilities but can also benefit from the unique strengths of digital channels. U.S. Bank has combined its marketplace feature with its data analytics technology to deliver personalized product recommendations to customers based on their specific life stages and important events, creating a powerful cross-selling strategy. U.S. Bank has invested heavily in building out its technology infrastructure to be able to deliver individualized financial insights to customers. The bank has delivered over 2 billion personalized insights to customers since the program began.

Other banks are also looking for ways to deliver financial insights to customers via the app. Fifty-six banks of the 80 surveyed either offered or planned to offer a budgeting or personal financial management tool in their mobile app in 2021, up from 39 last year. Jefferson City, Mo.-based Central Banco. Inc. launched a round-up program this year that allows customers to opt in to rounding up their transactions to the closest dollar and having those funds put into a savings account. The bank, along with several competitors, is looking at ways of using digital channels to help customers save and manage finances more efficiently.

Rethinking branches

As branch and digital capabilities increasingly overlap, there will be a push to increasingly integrate the systems that support both channels, allowing for a seamless exchange of data between the digital and branch environment. This would allow customers to start product applications online and complete them in-branch with the help of a banker, or vice versa. It would also enable bankers to have access to a richer set of data and insights on a customer's financial profile, allowing bankers to better assist customers with specific queries.

The recent consumer shift toward greater use of digital channels has created profound changes in banks' approaches to their branch operations. It has accelerated the long-term trend of banks shrinking their branch operations; 2020 and 2021 have seen record levels of branch closures.

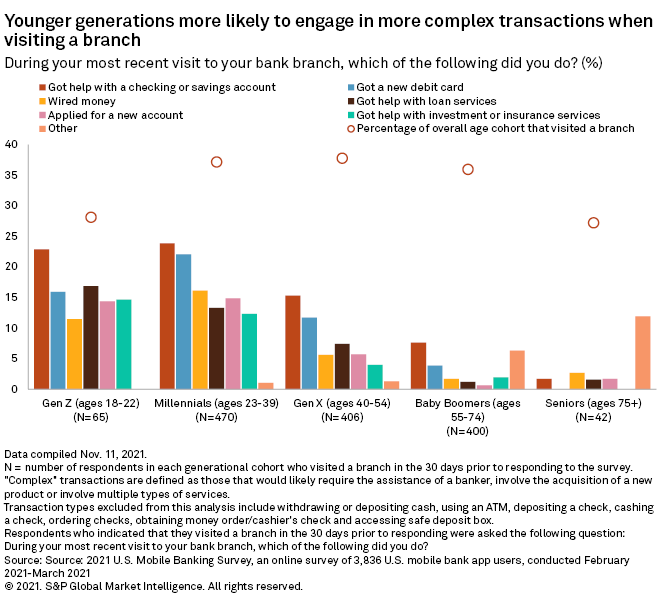

While banks continue to shrink branch networks and closed locations at a record pace during the pandemic, institutions are increasingly optimizing branches for more complex banking transactions, such as applying for loans or managing investments. This appears especially true for younger age groups.

Survey data shows that millennial customers, those between 23 and 39 years old, still used branches for more intricate services. Millennials who visited a branch in the 30 days prior to responding to the survey were more likely to seek general help with their accounts, loans services or investment services and were more likely to apply for a new account than were older customers. They were also more likely to engage with simpler banking transactions such as depositing or cashing checks.

This survey data suggests that younger customers specifically seek out branches for in-person help with various accounts and that younger customers may be more likely to perform multiple transactions during each branch visit.

Some banks have sought to optimize branch operations to facilitate these more complex transactions. Rockland, Mass.-based Rockland Trust Co., a subsidiary of Independent Bank Corp., is experimenting with "transformation branches" where customers have access to banking technology such as ATMs with live video tellers who can assist with different types of transactions from simple check deposits to loan payments and where in-branch relationship bankers who can handle a wider range of transactions are staffed and trained. Though the operational efficiencies of such a model are clear for some of Rockland Trust's branches, Debra Smith, director of digital operations at the bank, noted that evaluating the unique needs within each market is important.

Bank of America Corp. has tried something similar, at a much larger scale, over the past few years. At a recent conference, Aron Levine, president of preferred banking, noted that the company had 10,000 to 11,000 client service representatives four years ago. Technology and the ability to conduct many transactions outside the bank has allowed the company to reduce those positions substantially and to redefine the role of relationship bankers who are able to be more mobile within the branch and engage more freely with customers. "So the CSR role has gone from, I think, 11,000 down to 4,000," Levine said.

The bank has also pushed its relationship managers to specialize in a particular vertical of financial services, such as small business banking, mortgage lending or financial management, moving away from the predominantly generalist approach it had taken before. Levine recognized these changes as a key source of efficiency for the bank that it would continue to tap into.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.