Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jan, 2016 | 13:30

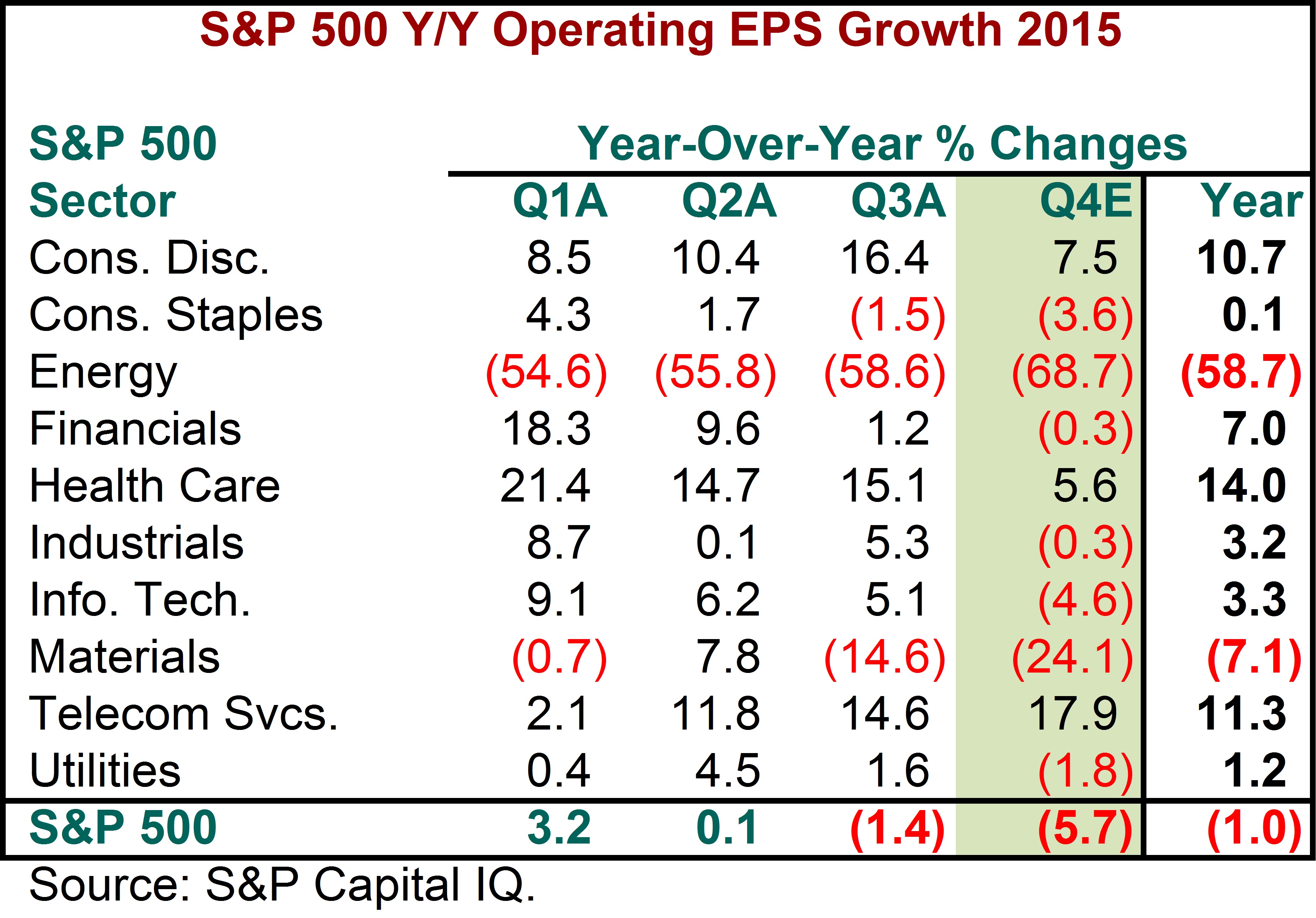

The fourth-quarter earnings reporting season is at hand. As of January 8, 2016, Capital IQ aggregate Q4 2015 S&P 500 earnings are estimated to be $28.82, representing a decline of 5.7% on a year-over-year basis, versus the 1.4% shortfall in Q3, and representing the first time since 2009 that the S&P 500 recorded y/y EPS declines in two successive quarters.

Only four of 10 S&P sectors are expected to post positive earnings growth for Q4, with telecommunications (17.9%), consumer discretionary (7.5%) and health care (5.6%) once again leading. The energy sector (-68.7%) continues to heavily weigh on the Index. Other sectors projected to show earnings declines include materials (-24.1%), info technology (-4.6%), consumer staples (-3.6%), utilities (-1.8%) and industrials (-0.3%). Excluding the energy drag, S&P 500 EPS growth would be +0.4% in Q4. From a valuation perspective, the S&P 500 is trading at 15.9x on a forward 12 month price-to-earnings ratio, just below the 16.0x fifteen year average.

For the full year 2015, the S&P 500 is still expected to record a dip in EPS of 1.0%, which would also be the first full-year decline since 2009. Energy (-58.7%) is expected to be the overwhelming drag on calendar-year growth, along with materials (-7.1%). However, health care (+14.0%), telecom services (+11.3%), and consumer discretionary (+10.7%) should post double-digit gains.

What will be the driving forces behind Q4’s results? Please visit S&P’s MarketScope Advisor to see the comments by S&P Capital IQ equity analysts as to the factors that likely affected Q4 EPS growth, including an 11% rise in the U.S. Dollar Index (Q4 2015 average vs. Q4 2014 average) and a more than 40% year-over-year drop in average quarterly WTI oil prices.