Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 23 Aug, 2023

By Jim O'Reilly

The Federal Energy Regulatory Commission advanced a key policy priority when the commission adopted a major shift in its generator interconnection policies July 28. FERC's action launches an expansive effort to accelerate the processing of over 10,000 interconnection requests in transmission provider queues representing approximately 2,000 GW of new generation and storage capacity.

Among other things, the commission's final rule adopted a new multi-phase first-ready, first-served cluster study process for interconnection requests to replace the current first-come, first-served process in which each interconnection request is studied separately and serially.

➤ The adoption of a major generator interconnection rule marks a significant milestone for FERC and industry stakeholders, but pressure is mounting on the commission to advance two other key pending matters — proposed rules governing transmission planning and cost allocation and draft policy statements addressing greenhouse gas emissions and the permitting of natural gas projects — with significant implications for new electric and gas infrastructure projects, reliability and the energy transition.

➤ In addition, FERC continues to consider other high-profile issues, including the commission's unsettled base return on equity (ROE) policy for electric utilities and the appropriate scope and level of ROE incentives for new transmission projects.

➤ While a final policy for determining electric utility base ROEs is pending, parties in utility rate cases at the commission have continued to spar over the appropriate financial methodologies to apply in their respective proceedings. The parties in two pending rate cases featuring contested ROEs recently reached settlements, avoiding further litigation and a resolution by the commission.

➤ FERC ponders these issues with one vacancy on the commission and the term of one of the four sitting commissioners recently expired. It is uncertain when the White House will advance nominations for the two available seats on the commission.

Among other noteworthy developments at FERC during the past month, a complaint brought by state regulators against Entergy Corp. entered the formal litigation process with the Louisiana Public Service Commission filing a motion asking the commission "for confirmation of commission determination that the Louisiana [PSC] complaint and attachments raised 'serious doubt' on prudence" of Entergy's operation of the Grand Gulf nuclear plant.

In addition, the parties in a pair of electric rate cases featuring contested ROEs — one involving transmission rates charged by Consolidated Edison Inc. subsidiary Rockland Electric Co. and the other involving wholesale sales from Southern Co. subsidiary Mississippi Power Co. — reached proposed settlements, avoiding further litigation that could have tested the application of the commission's ROE policy for electric utilities.

Finally, the commission granted a transmission rate incentive for a $594 million transmission project in Iowa planned by Fortis Inc. subsidiary ITC Midwest LLC, despite opposition from large transmission customers and uncertainty generated by a state law in Iowa that provides existing transmission owners a right of first refusal to develop and own certain new transmission facilities.

A more detailed discussion of these developments that Regulatory Research Associates is following is provided below.

The commission

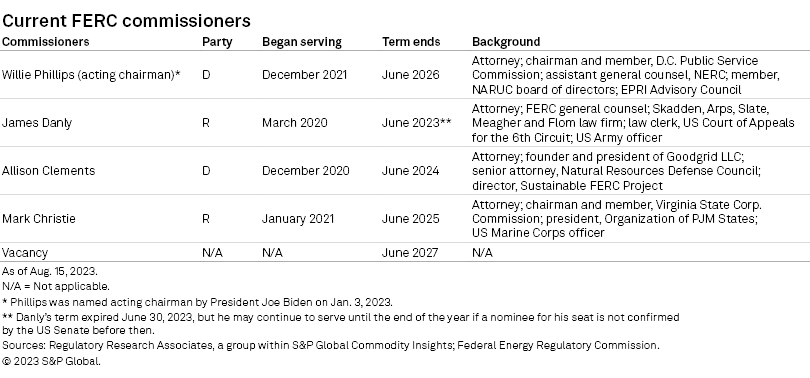

FERC continues to operate with only four commissioners, evenly split 2-2 between Democrats and Republicans, and Republican Commissioner James Danly's term expired June 30, 2023. It is unclear whether the White House will renominate Danly to another term or whether a nomination to the vacant seat is forthcoming.

Danly can remain at FERC until the end of the year if a nominee for his seat is not confirmed by the US Senate by then. Acting Chairman Willie Phillips, a Democrat, is serving a term that expires in June 2026. Mark Christie, a Republican, is serving a term that expires in June 2025. The fourth member of the commission, Allison Clements, is a Democrat whose term expires in June 2024.

|

In the electric power sector, a key US Senate committee urged FERC to finalize the pending rulemakings on transmission planning and cost allocation while Congress continues to seek bipartisan agreement on energy infrastructure permitting reform: "Schumer asks FERC to strengthen final grid planning, backstop siting rules" and "US senators target judicial review, transmission for next take on permitting."

In the natural gas sector, disagreements among the commissioners about the appropriate approach for evaluating the impacts of greenhouse gas emissions from new natural gas projects prompted FERC to remove six proceedings related to new gas projects from the commission's July 27 open meeting agenda: "Disagreement over FERC climate analysis spells trouble for gas projects" and "FERC stance on gas projects ignores changes in law – Commissioner Danly."

Grand Gulf litigation — Entergy

On Aug. 9, 2023, the Louisiana PSC filed a motion asking FERC to determine that earlier commission orders on a pending complaint filed by the Louisiana PSC, the Arkansas Public Service Commission and the City Council of New Orleans were sufficient to raise "serious doubt" as to the prudence of an extended power uprate project and the continuing management of the Grand Gulf nuclear plant by System Energy Resources Inc. (SERI), Entergy Services LLC and Entergy Operations Inc.

The Louisiana PSC said the commission's earlier orders determined that "the allegations and evidentiary submissions of the [complainants], and SERI's responsive evidence, left material issues of fact to be decided. In other words, the [complainants'] case could not be summarily dismissed." The Louisiana PSC said the commission "dismissed SERI's contention that the 'complainants failed to provide adequate evidence to warrant a hearing.'"

Finally, the Louisiana PSC said, "[T]hose findings necessarily mean that the [complainants'] allegations and evidence established a prima facie case, including serious doubt. Even if discovery were to produce no new evidence, the evidence filed in support of the complaint is sufficient for the [complainants] to prevail, shifting the burden of proof to SERI."

The Louisiana PSC said the motion was filed "to resolve prehearing scheduling and discovery disputes" between the parties, including which party would present testimony first and whether SERI should be required to file first "to rebut the presumption of imprudence."

On August 11, FERC's presiding law judge in the proceeding scheduled oral argument on the Louisiana PSC's motion for Sept. 6.

The proceeding was initiated in 2021 when the Louisiana PSC, Arkansas PSC and the New Orleans Council filed the complaint against SERI and the other Entergy companies. The complaint said SERI has acted imprudently in operating the Grand Gulf plant in Mississippi, resulting in large overcharges under a wholesale rate in a unit power sales agreement. The unit power sales agreement is a cost-based formula rate for the sale of electric energy and capacity from SERI to Entergy Arkansas LLC, Entergy Louisiana LLC, Entergy New Orleans LLC and Entergy Mississippi LLC.

The complaint also asserted that Grand Gulf's performance since 2012 "has been below industry standards and since 2016 has been far below industry levels and has forced the operating companies to acquire replacement energy at much higher cost than the Grand Gulf energy cost." In addition, the complaint asserted that Entergy "performed an $800 million uprate of the unit in 2012 without adequate economic justification and without actually achieving an increase in overall realized output of electricity from the plant from 2012–20."

Finally, the complaint asserted that Grand Gulf's safety performance "has also been far below national averages, causing significant mitigation costs to be imposed on ratepayers as a result of [SERI's] imprudent operation of the plant."

On July 12, FERC's chief law judge issued an order terminating settlement talks in the proceeding following a report from the presiding settlement judge that "despite their efforts and discussions of possible resolutions, the parties have reached an impasse in their current negotiations. The parties expressed a desire to conclude settlement negotiations and to commence hearing proceedings."

Transmission rate case — Rockland Electric

On July 19, Rockland Electric (RECO) filed a proposed settlement intended to resolve all issues set for hearing in the company's transmission rate case. The settlement would increase RECO's annual transmission revenue requirement to $20.7 million effective Jan. 1, 2024, an increase of 13.7% that reflects a 47.31% equity layer in the company's capital structure, a 7.28% rate of return and a 10.40% ROE. The 10.4% ROE consists of a 9.90% base ROE and a 50-basis-point ROE adder to reflect the company's participation in the PJM Interconnection LLC.

The parties to the case had engaged in six settlement conferences between June 2022 and March 30, 2023, but FERC's chief law judge terminated settlement judge procedures April 3 after a status report issued by the presiding judge stated in part that "given that a year has passed since this settlement process commenced, the undersigned considers the matter to be at an impasse."

The proceeding was initiated Jan. 28, 2022, when RECO proposed increasing the company's stated annual transmission revenue requirement and a total ROE of 11.04%, reflecting a base ROE of 10.54% plus the 50-basis-point ROE adder for the company's participation in PJM. Pursuant to a settlement of the company's previous rate case in 2017, RECO's ROE was 10.00%, inclusive of the 50-basis-point ROE adder.

RECO said its proposed 10.54% base ROE was calculated in accordance with FERC Opinion No. 569-A, the May 21, 2020, order that established the commission's three-model financial methodology for determining electric utility ROEs. RECO noted that it applied the three models adopted in Opinion No. 569-A, the two-step discounted cash flow (DCF) model, the capital asset pricing model (CAPM) and the risk premium method, to support its proposed ROE.

RECO supplemented its three-model analysis with a fourth financial model, the expected earnings approach, and submitted two additional analyses, a constant growth DCF analysis and an empirical CAPM analysis, "as alternative benchmark analyses to provide additional reference points in evaluating a just and reasonable base ROE" for the company.

New Jersey's Division of Rate Counsel filed a protest of RECO's proposed rates and ROE, arguing among other things that the company's ROE analysis was based in part on application of the expected earnings methodology, which FERC explicitly rejected in Opinion No. 569-A and the commission's earlier order in the same proceeding, Opinion No. 569. The Division of Rate Counsel argued that "nothing in [RECO's] lengthy testimony provides the commission with new facts or data. Rather, [RECO] rehashes arguments the commission considered and rejected in Opinion Nos. 569 and 569-A."

The US Court of Appeals for the DC Circuit subsequently vacated and remanded the commission's ROE opinions Aug. 9, 2022, finding that FERC failed to adequately explain why it resurrected the risk premium model in Opinion No. 569-A that the commission explicitly rejected in Opinion No. 569: "DC Circuit ruling gives FERC new chance to establish durable transmission ROEs." Further FERC action on the court's remand is pending.

Wholesale power rate case — Mississippi Power

On July 31, 2023, Mississippi Power (MPC) submitted a proposed black-box settlement that would increase the company's annual revenue requirement by $16 million in a wholesale tariff under which MPC provides wholesale requirements service to various electric power associations, including Cooperative Energy, a generation and transmission cooperative.

The proposed settlement is silent with respect to ROE and other ratemaking parameters but would establish a rate moratorium providing that MPC may not file to increase the rates under the tariff before March 25, 2024.

The proposed settlement also requires MPC to provide Cooperative Energy with information that allows the cooperative to verify a proposed increase to MPC's annual revenue requirement, including a cost-of-service study and certain other information, prior to the utility submitting its next rate proceeding.

MPC initially requested an increase in the company's annual revenue requirement of $23 million and said the rate increase was necessitated by "increases in the cost of doing business since its last approved rate change in 2021, combined with the full amortization of certain specific deferred income tax regulatory liabilities associated with the Tax Cuts and Jobs Act."

MPC also requested that FERC approve a 9.875% ROE based upon the ROE approved by the Mississippi Public Service Commission in the utility's performance evaluation plan, a formula-based alternative regulation plan that provides for annual rate adjustments and reflects timely recognition of new investments and fluctuations in operating costs. See the Mississippi state regulatory review for additional details.

MPC said the ROE of 9.875% was calculated by an independent consultant for use in MPC's retail rate case in Mississippi for 2022. MPC also said FERC has stated that it has discretion to consider ROE methodologies on a case-by-case basis and has never foreclosed the proposed use of a state-approved ROE.

MPC explained that the ROE was determined by averaging two financial methods, the DCF model, indicating a 9.779% ROE, and a regression analysis indicating a 9.721% ROE. MPC said the average of these two methods, plus a 0.125% issuance cost adjustment, resulted in a 9.875% total ROE.

On Aug. 5, 2023, Cooperative Energy filed a protest of MPC's proposed tariff revisions. With respect to MPC's requested ROE, Cooperative Energy's protest argued that FERC "has made clear that it finds 'state-authorized and commission-authorized ROEs are conceptually distinct and do not necessarily need to be aligned' and that 'it is not legally required to base its jurisdictional transmission ROE determinations on the ROEs determined by state utility commissions.'"

Cooperative Energy added that MPC "inappropriately utilizes a two-model approach to calculate ROE (the DCF model and a regression analysis) relied on by the [Mississippi Public Service Commission] rather than the three-model approach that [FERC] relies on (DCF model, the CAPM and the Risk Premium method)."

As mentioned above, FERC adopted the three-model approach in Opinion No. 569-A that was subsequently vacated and remanded by the DC Circuit, and further FERC action on the court's remand is pending.

Transmission incentive — ITC Midwest

On Aug. 8, FERC granted ITC Midwest's request to recover 100% of the company's prudently incurred costs associated with the Iowa portion of the $594 million, 125-mile Skunk River-Ipava transmission project if the project is canceled or abandoned for reasons beyond the company's control.

FERC granted ITC Midwest's request despite a protest filed June 20 by an alliance of large transmission customers, including the Industrial Energy Consumers of America, the Coalition of MISO Transmission Customers, the Resale Power Group of Iowa and the Wisconsin Industrial Energy Group.

The protesters argued that ITC Midwest's request "is premature and should be rejected outright," saying ITC Midwest's right to construct and own the project derives solely from Iowa's right of first refusal (ROFR) law. The protesters noted that the effectiveness of the Iowa law has been enjoined by the Iowa Supreme Court while its constitutionality is litigated: "Iowa high court revives challenge to right-of-first-refusal law for transmission."

The protesters said the Midcontinent ISO, acting pursuant to Iowa's ROFR statute, did not begin a competitive transmission process for the project and allowed ITC Midwest, as the incumbent utility, to undertake the Iowa portion of the project. The protesters said that "if the ROFR statute had not been in effect, MISO would have begun a competitive developer section process" for the project.

The protesters also argued that "ITC Midwest attempts to shift the project's total development risk to consumers who already bear the ponderous burden of paying the utility's already incentive-heavy transmission rates." ITC Midwest is currently authorized a base ROE of 10.02%, a 50-basis-point ROE adder as a member of MISO and a 25-basis-point ROE adder approved by FERC to reflect the company's independent transmission company status.

The project is a 345-kV transmission line between an ITC Midwest substation in southeastern Iowa and a substation in west-central Illinois. The section of the line in Illinois will be built and owned by a third party selected through MISO's competitive selection process. ITC Midwest said it plans to work with the third party to determine cost and construction responsibility for the line's crossing of the Mississippi River.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.