Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 14, 2024

By Nathan Stovall and Ronamil Portes

Lower interest rates have supported stronger values in banks' deeply underwater bond portfolios and could spur more repositioning activity in the next few quarters.

The Federal Reserve's pivot to decrease interest rates could lead to more structuring of bank bond portfolios as the capital hit associated with those transactions will not be as large. Those actions might still require a bank to raise capital and there have been a number of institutions in the last month that have repositioned their bond portfolios, while attracting outside capital. Even with declines in rates, many institutions likely will opt to wait for their portfolios to season and avoid taking the capital hit associated with a loss trade, but others will see the opportunity to improve their future streams through incremental restructuring.

Lower rates could drive more repositioning activity

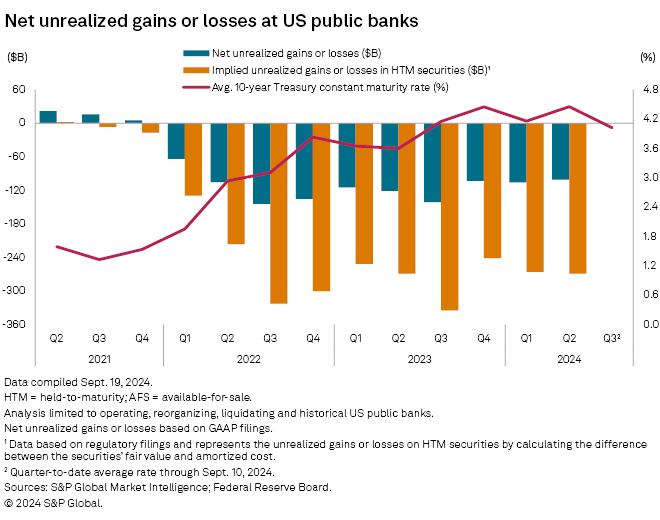

Bond portfolio restructurings were relatively muted in the second quarter as the positions remained deeply underwater in the period, but transaction activity could pick up in the third quarter due to sharp declines in rates.

As the yields on 2-year and 5-year Treasurys each rose 34 basis points in the second quarter, the values of bonds held by banks declined. With those increases, the regulatory capital hit associated with loss trades rose in the period. The tide turned in the third quarter and the intermediate rate plunged as the market saw the Fed's eventual pivot to lower rates on the horizon. The yield on 2-year Treasury fell 79 basis points in the third quarter, while the yield on the 5-year Treasury declined 66 basis points in the period.

Lower rates bolstered values in banks' bond portfolios and some institutions took advantage of the move to reposition their investment portfolios. For instance, Rhinebeck Bancorp Inc., MidWestOne Financial Group Inc. and Amerant Bancorp Inc. announced restructurings on their bond portfolios or unveiled plans to pursue such a transaction. In those cases, the banks are selling low-yielding securities and reinvesting the proceeds into higher-yielding bonds or loans available in the marketplace today. MidwestOne and Amerant also announced common stock offerings to alleviate the capital hit associated with the loss trades.

Absent sales of securities, changes in values of banks' available-for-sale (AFS) portfolios do not impact banks' regulatory capital, save for large banks classified as US global systemically important banks (G-SIBs). Banks have to mark their AFS portfolios on a quarterly basis and those marks are captured in accumulated other comprehensive income (AOCI) and impact tangible common equity.

Since portfolios remain underwater, that mark has negatively impacted tangible book value since the the first quarter of 2022. The hit to tangible book value rose at the end of the second quarter, with institutions including US commercial banks, savings banks, and savings and loan associations that file GAAP financials reporting $101.1 billion in unrealized losses in their AFS portfolios, compared to $106.2 billion in unrealized losses in the prior quarter.

Banks hesitant to invest further out on the yield curve

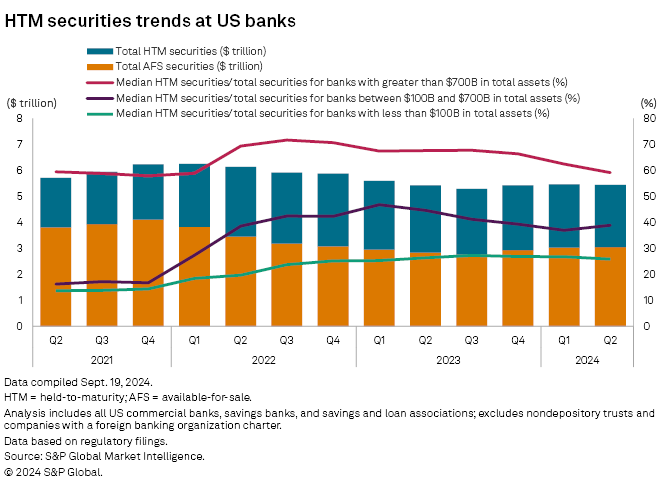

Bank regulators have focused on the negative impact from AOCI on bank capital and the impact that underwater bond portfolios have on banks' access to liquidity. Against that backdrop, banks kept their powder dry for the last few quarters and have put less cash to work in the bond market. Banks have also been hesitant to reach further out on the yield curve and extend duration in their portfolios even though the industry has expected rates to decline for some time.

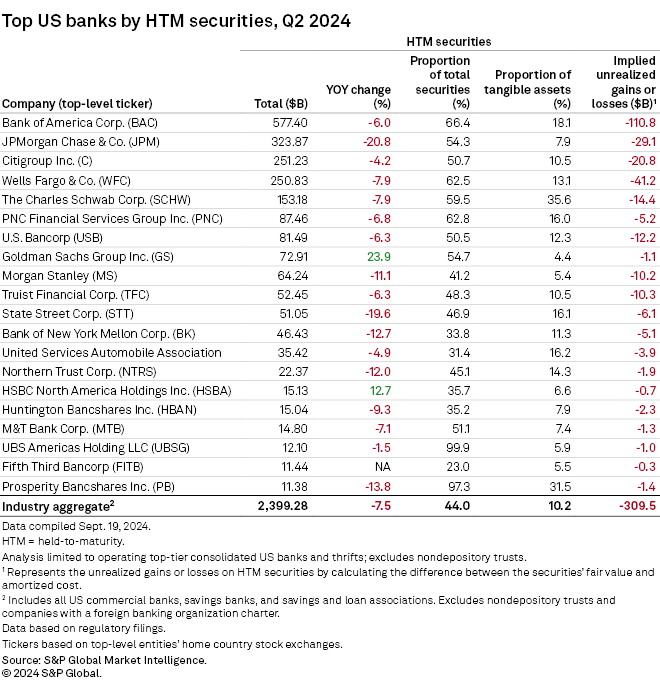

Banks have been reticent to grow their held-to-maturity (HTM) securities portfolios, which some institutions had used to mitigate the impact from AOCI by parking larger portions of longer-term bonds, often seen as loan surrogates, in those portfolios. Those positions remained significantly underwater in the second quarter. Some banks, particularly the nation's largest institutions, relied heavily on the HTM designation since changes in AOCI impact tangible book value.

For large banks classified as globally systemically important banks (G-SIBs) changes in AOCI also impact regulatory capital. Held-to-maturity securities represented a median of 59.1% of total securities among those institutions at the end of the second quarter, down notably from 62.5% in the first quarter and 67.6% a year earlier. Under the proposed capital rules, dubbed the Basel III endgame, changes in AOCI will also impact regulatory capital at banks with more than $100 billion in assets.

Unrealized losses in HTM portfolios at institutions that file GAAP financials totaled $269.2 billion in the second quarter of 2024, up slightly from $265.8 billion in the prior quarter.

Since the Fed began its tightening cycle early in 2022, the investment community has examined the ratio of loans plus HTM securities-to-deposits at a given bank to see how many deposits are tied up in less liquid assets. The ratio is also effectively a measure of duration risk on bank balance sheets given that HTM portfolios were built when rates were low and have served as a drag on bank earnings streams.

Given the negative view from the investment and regulatory community, banks likely will continue to look at HTM designations with greater skepticism. Some banks have taken advantage of lower rates to reposition their investment portfolios and more likely will follow, but few institutions have actively sought to extend duration before rates move lower. More bank managers continue to look at their bond portfolios as sources of liquidity rather than drivers of earnings.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.