Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Oct, 2017 | 14:00

Despite changes in the market and in the borrower’s risk profile, it’s common for many banks to simply roll over existing pricing when it comes to loan renewals. Our Performance Optimization Program delivers the data-driven pricing guidance you need to optimize pricing and fee incidence in the context of the current market. This case study examines the steps that one of our clients took to successfully re-price the majority of their renewals last year with the help of our Performance Optimization Program.

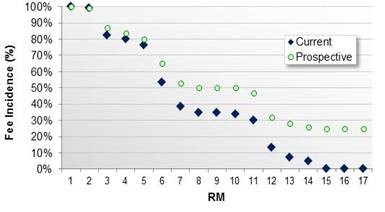

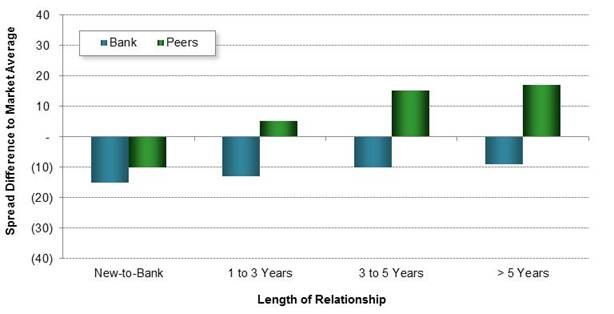

During our analysis of the bank’s portfolio, we found that new originations carried significantly higher spreads and fee incidence than their renewal book of business. Since a high percentage of the bank’s loan volume each year comes from renewals, we worked with the bank to implement a new data-driven process for renewing credits.

After taking into account the bank’s volume and non-credit revenue objectives, the Performance Optimization Program found that the bank had missed out on a 32 basis point revenue opportunity. The bank could have captured this opportunity if they had repriced the prior year’s renewals according to our local market spread and fee levels.

Our client bank, like many banks, handled renewals very differently from new loan originations, not only from a credit review and approval perspective, but also in terms of pricing approvals. We noticed two principle impacts:

The Performance Optimization Program team worked with the bank to design a renewal repricing process. This contained several key aspects and deliverables:

So what were the key takeaways? In the first year of this initiative alone, the bank was able to capitalize on roughly one-fourth of the opportunity identified – Just over eight basis points of their renewal loan volume for the deal. The primary drivers of this improvement were:

With reinforcement of these new procedures, the bank is positioned to capture even more of the opportunity over time.

The Performance Optimization Program is a data-driven solution that helps banks maximize risk-adjusted revenue, while also taking into account their broader total relationship profitability, volume, market share, and customer satisfaction objectives. Learn more.