Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 05, 2020

The cessation of LIBOR is a significant development for financial markets. Two of the main remaining uncertainties around the transition away from LIBOR to risk-free rates (RFR) are the exact timings and, closely connected with them, the actual fixings of the LIBOR fallback spreads. Despite COVID-19 disrupting many market participants' preparation efforts, it is quite possible that the original timeline will largely remain intact: relevant authorities have urged market participants to be ready as soon as possible [1] and a firm commitment of LIBOR panel banks to support LIBOR will last only until the end of 2021. Whatever the case may be, the clock is ticking. October saw another set of transition milestones reached: the switch to SOFR discounting and SOFR price alignment interest at clearing houses and ISDA's launch of the IBOR Fallbacks Supplement and the IBOR Fallbacks Protocol, which will be effective from 25 January 2021.

Arguably, the most anticipated event (or possibly events) of the transition schedule is the LIBOR cessation trigger event which precedes or concurs with the actual LIBOR cessation. The LIBOR cessation trigger event is the announcement that a LIBOR has ceased or will cease as of a particular date and has several implications. For one, it could clarify whether there is a cliff edge transition involving all LIBOR-tenor pairs simultaneously or a staggered approach with different LIBOR-tenor pairs ceasing at different times. A second and perhaps more pressing ramification is that the LIBOR cessation trigger event also carries the weight of fixing the LIBOR fallback spreads. This could cement any value transfer associated with legacy contracts. A LIBOR cessation could potentially be triggered as early as the end of 2020.

What LIBOR fallback spreads can be expected?

The LIBOR fallback methodology defines the LIBOR fallback spread as the median spread of a set of historical LIBOR-RFR basis spreads recorded over a five-year lookback period. Start and end of this lookback period are determined by the LIBOR cessation trigger event (which sets the so-called spread adjustment fixing date) [2].

Assuming that the LIBOR cessation trigger event is not in the too distant future, many or most of the basis spreads contributing to the median calculation have already been observed. The range within which the fallback spread must lie is thus already known to a fair degree and tightens with each additional basis spread observation. IHS Markit's Risk Bureau offers a simple tool to investigate the fallback spread ranges for a selected set of LIBORs and spread adjustment fixing dates, giving a historical view on the expected fallback spreads. The tool also provides market-implied basis spreads, which could be interpreted as the market's view on the LIBOR fallback spreads and are derived from the valuation of forward-starting ten-year LIBOR-RFR basis swaps. The tool is part of a broader RFR impact analysis dashboard [3].

These spread estimates represent complementary views on the final LIBOR fallback spreads and sooner or later both may be expected to converge. Discrepancies, however, do exist and can be read in different ways.

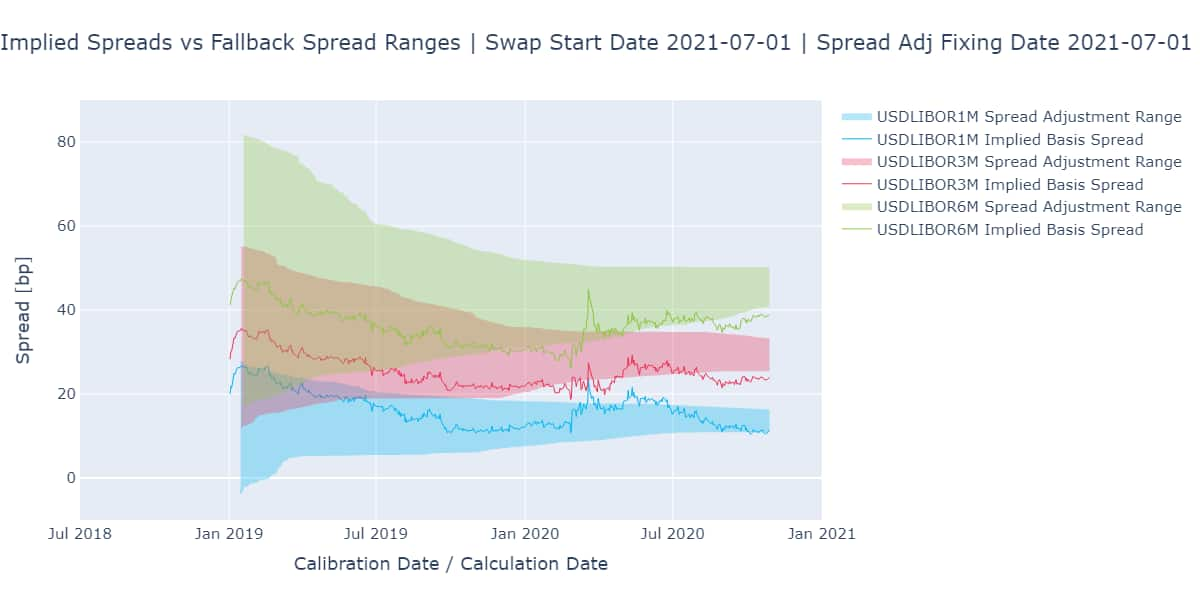

For example, Fig. 1 shows selected USD LIBOR fallback spread ranges (shaded bands) associated with a relatively early cessation trigger event. Overlaid are the market-implied basis spreads (solid lines) for a similarly early swap start date. The historical fallback spread bands narrow with time, as expected, and the market-implied basis spreads appear to be roughly consistent with the fallback spread bands. More recently, though, some of the market-implied spread curves fall slightly outside the lower fallback spread bounds. They also appear to be more strongly impacted by this year's market turmoil than the fallback spread bands, which is expected, too (for other currencies see [3]).

To understand this discrepancy, note that a meaningful interpretation of the market-implied basis spreads in the context of the LIBOR-RFR transition relies on the swap start date lying past the LIBOR cessation date. This way the swap is sensitive only to the longer-dated part of the LIBOR yield curve that is affected by the LIBOR fallback. As the LIBOR cessation date falls on or after the LIBOR cessation trigger date (spread adjustment fixing date), which in turn sets the lookback period used in the fallback spread range calculation, the discrepancy could be down to three things:

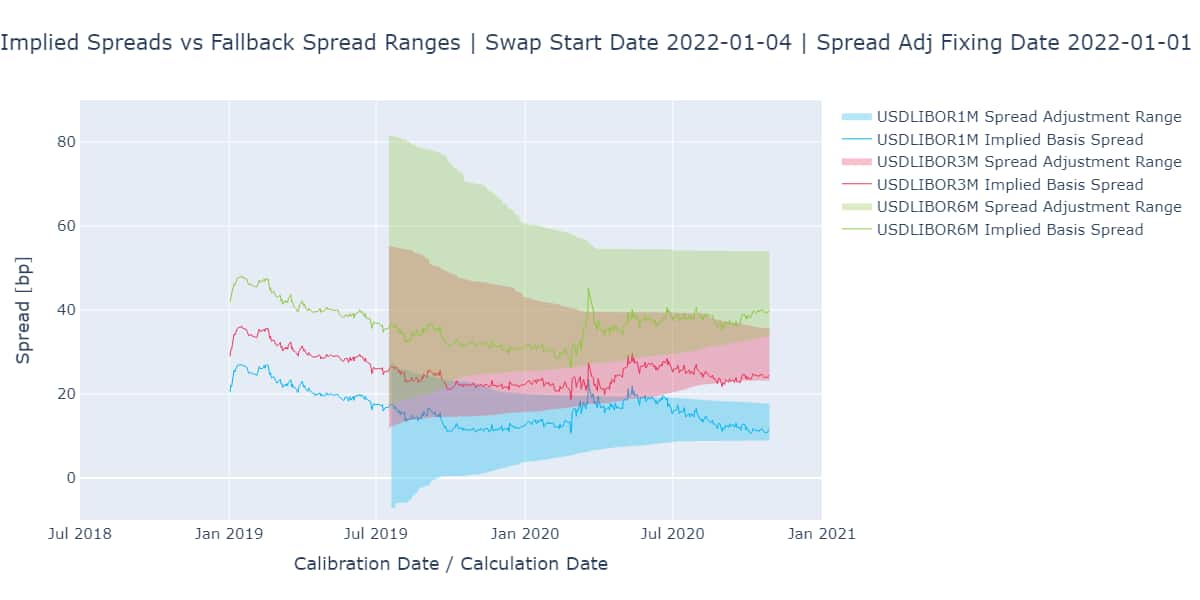

It is not too surprising that assuming an overall later LIBOR transition timeline, both fallback spread bounds and basis spreads become more consistent with each other again, see Fig. 2. Note that varying the swap start date has only a moderate impact on the market-implied basis spreads (typically, of a few basis points at most).

Interesting times are ahead!

Figure 1 Market-implied fallback spreads and historically derived LIBOR fallback spread ranges assuming an earlier LIBOR transition timeline with coinciding LIBOR cessation trigger and LIBOR cessation events.

Figure 2 Market-implied fallback spreads and historically derived LIBOR fallback spread ranges for a later LIBOR transition timeline with coinciding LIBOR cessation trigger and LIBOR cessation events.

[1] See LIBOR webinar hosted by Risk in June 2020: https://www.risk.net/investing/markets/7567721/libor-webinar-playback-schooling-latter-on-timing-of-death-notice

[2] See IBOR Fallback Rate Adjustments Rule Book and IBOR Fallbacks Fact Sheet, available from Bloomberg: https://www.bloomberg.com/professional/solution/libor-transition/

[3] Found under IHS Markit's Financial Analytics Risk Bureau: https://financialriskanalytics.net/

[4] See LIBOR webinar hosted by Risk in September 2020: https://www.risk.net/derivatives/7687006/libor-webinar-playback-spotlig

Article posted by Christoph Puetter, Data Analytics Principal, Financial Risk Analytics, IHS Markit.

For more details, please visit https://ihsmarkit.com/rfr-bp

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.