Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Aug, 2016 | 13:30

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

Verizon Communications Inc.'s Verizon Wireless has plunged into the complex world of connected vehicles with solutions such as Hum and Zubie.

In what is being dubbed the Trump effect, a shift in campaign money that may have previously been designated for the presidential race is now being targeted at Senate, House and gubernatorial races that will likely influence the Republican Party's control of congress

Spending from presidential nominees has been lopsided, with Trump's campaign operating on limited contributions and avoiding TV ad spots, instead relying on earned media.

Although nationally all eyes are on the presidential campaign, state Senate races are expected to be flooded with political ad revenue in the second half of the year

Early primaries gave broadcasters lofty expectations, and record-shattering political revenues are still likely. However, the Trump campaign's willingness to limit TV ad spots is expected to impact where Republican political ad spending is disbursed.

In what is being dubbed "the Trump effect," a shift in campaign money that may have previously been designated for the presidential race is now being targeted at Senate, House and gubernatorial races that will likely influence the Republican Party's control of congress. Local TV is expected to benefit from a record amount of political revenue as ad spots will likely come from a different source, such as super PACs who are shifting money from the presidential campaign into Senate and House races.

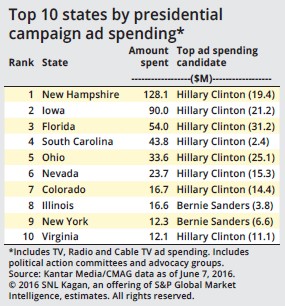

According to an analysis of data from Kantar Media's Campaign Media Analysis Group through June 7, the top three states for presidential campaigns ad spending among TV, radio and cable TV are New Hampshire, Iowa and Florida. Of the top 10 most heavily targeted states for presidential ad spots, Democratic candidate Hillary Clinton has outspent Republican candidate Donald Trump in every one. Only former Democratic presidential candidate Bernie Sanders outspent Clinton in two of the top 10 states, those being Illinois and New York.

New Hampshire was the top-ranked state with $128.1 million in presidential ad spending as of June 7. Clinton is by far the top spending candidate targeting the state with $19.4 million in ads. The state has only four electoral votes, but a poll conducted by the University of New Hampshire on July 21, showed Clinton holding only a slight edge at 39.0% to Trump's 37.0%.

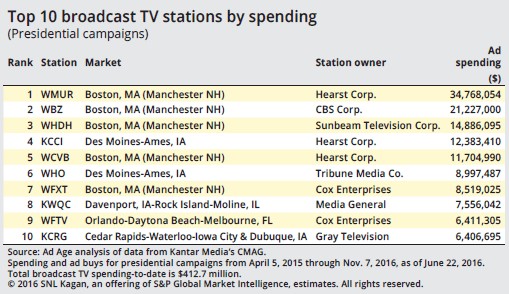

Of the top 10 broadcast TV stations by presidential spending, five stations are in Boston, Mass., (Manchester N.H.) markets. Hearst Corp. owns two of those stations, WMUR-TV and WCVB-TV, which together have brought in $46.5 million in presidential ad dollars. CBS Corp.'s WBZ-TV ranked second on the list bringing in over $21.2 million as of June 22.

Iowa was second in presidential ad spending through June 7 with $90.0 million, $21.2 million coming from the Clinton campaign. The swing-state attracted a hefty amount of ad spots leading up to the February caucuses with Des Moines-Ames, Iowa, and Cedar Rapids-Waterloo-Iowa City & Dubuque, Iowa, ranked in the top three media markets for total political ad airings, according to Kantar Media/CMAG data from a Wesleyan report released in May.

Florida rounds out the top three with $54.0 million in presidential campaign spending. Clinton spent more in Florida than any other state with $31.2 million in ad spending in the Sunshine State.

Florida has the same electoral power as New York with 29 electoral votes and is an important swing state for the presidential election. President Barack Obama won the state in 2008 with 51% of the vote. In 2012, he took 50% of the votes to Mitt Romney's 49%. Trump has business ties to Florida, and the Clinton campaign and pro-Clinton PACs are concentrating on the state to potentially swing those electoral votes in their favor

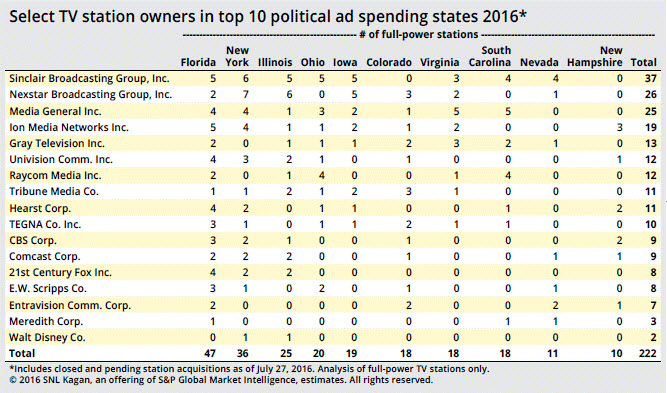

Using our TV station database of full-power TV stations as of July 27, Sinclair Broadcast Group Inc. has the largest presence in the top 10 states for presidential ad spending with 37 total. Sinclair has six full-power stations in New York; five in Florida, Illinois, Ohio and Iowa; and four in South Carolina and Nevada.

Nexstar Broadcasting Group Inc. is the runner-up with 26 full-power stations in top 10 presidential ad spending states. Nexstar has a heavy presence in New York with seven full-power stations, Illinois with six full-power stations and Iowa with five full-power stations.

Just behind Nexstar, Media General Inc. ranks third with 25 full-power TV stations in the top 10 states for presidential ad spending. Media General has five stations in both Virginia and South Carolina and four in both Florida and New York.

Following the early primaries, spending from presidential nominees has been lopsided, with Trump's campaign operating on limited contributions and avoiding TV ad spots, instead relying on earned media.

According to the Federal Election Commission, or FEC, data as of June 30, the Clinton campaign along with joint fundraising committees, the Democratic National Committee and pro-Clinton PACs have raised just under $600.0 million in campaign funding, with $287.4 million coming from Clinton's own campaign. That is almost twice as much as the Trump total of $312.6 million in campaign funding, with just $89.4 million raised by Trump's own campaign. The largest contribution for Trump has come from the Republican National Committee with $168.5 million, outraising the Democratic National Committee by $66.6 million.

A July 20 FEC report indicated that Trump raised $3.2 million in campaign money in May, versus $26.0 million Clinton brought in. Trump started June with $1.29 million in cash on hand, compared to $42.0 million for Clinton.

The Clinton campaign reported that it raised $68.0 million in June and had $44.0 million of cash on hand heading in to July. Trump raised over $26.7 million in June and has over $20.2 million in cash on hand as of July 1, according to an FEC filing. The news may spark donors who might feel more comfortable giving money to a campaign with some fundraising momentum.

Pro-Trump PACs stepped up efforts during the Democratic National Convention, with reports from Kantar Media's CMAG that Rebuilding America Now spent $2.2 million during the convention week on TV ads in battleground states. The pro-Trump PAC had only spent $1.7 million since the end of primary season, evidence that pro-Trump supporters will air TV spots at opportune times.

Fundraising by presidential candidates can change at any moment as large donations could arrive any time, leading to a surge in ad buys from the Republican side. According to RealClearPolitics.com, which collects all general election polling data and calculates an average, Trump was ahead of Clinton by 0.9 percentage points as of polling July 18 through July 27.

Although nationally all eyes are on the presidential campaign, state Senate races are expected to be flooded with political ad revenue in the second half of the year. Senate Republicans have been cashing in on donors who are not giving to the Trump campaign. The control of the Senate is at stake, and there has already been significant advertising during the primaries aimed at states with tight Senate races.

Political advertising for broadcasters in the first quarter came in better than expected as hotly contested presidential primaries, along with Senate, House and gubernatorial campaigns, contributed to a surge in political ads. Broadcasters have been optimistic political will be strong despite some meager spending by the Republican side of the presidential race. An estimated 80% of political revenues were generated in the second half of each of the last five election years, with roughly 60% of the total coming in during the fourth quarter.