Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Nov, 2017 | 12:15

Highlights

Various mining costs impact the profit margins of iron ore producers.

What is different in this latest fall is that cost inflation is again stalking the industry

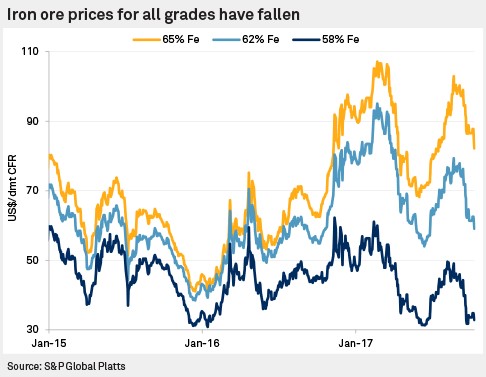

Iron ore prices fell sharply at the tail end of the third quarter, with 62% of iron prices falling 23% between September 13 and October 11, as assessed by S&P Global Platts. Although the price fell 14% below the average for the September quarter, they do not represent a year-to-date low, with a price of just US$54/t being recorded June 13. What is different in this latest fall is that cost inflation is again stalking the industry; market freight rates have held at year-high levels, while energy costs have increased and the Australian dollar has strengthened. These conditions have clear consequences for profit margins among iron ore producers.

What has caused these price falls?

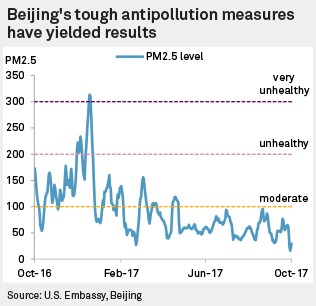

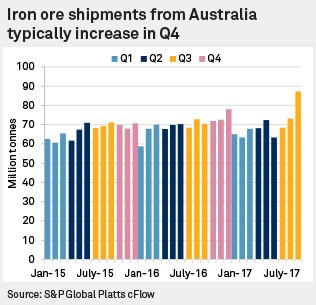

Prices have come under pressure recently as fears of winter cuts to crude steel production are expected to coincide with a seasonally strong period of seaborne iron ore supply. To control emissions, China's Ministry of Environmental Protection has mandated suspensions of up to 50% of some iron and steel capacity across 28 cities in northern China for November 2017 through February 2018. Northern China's pollution levels rise in the winter months as heating demand from the household sector increases. The market is pricing in an increasing surplus of landed iron ore in China at a time when environmental restrictions for mills in China might mean reduced national crude steel production. According to S&P Global Platts, the directives could affect 33 million tonnes of crude steel production.

The market also took guidance from weaker economic data releases in August, including disappointing levels of industrial production, the growth of which fell to 6.0% year-over-year, compared with 6.4% and 7.6% in the two months prior, and from fixed-asset investment, which recorded its slowest growth in almost 18 years, at 7.8% year-over-year for January to August. Fears were slightly allayed by September's numbers, which showed stronger-than-expected industrial production growth at 6.6% year-over-year, and broad money growth back to July's encouraging 9.2% year-over-year; prices came back from the recent US$58/t lows to stabilize around US$60/t.

What does this mean for miners' margins?

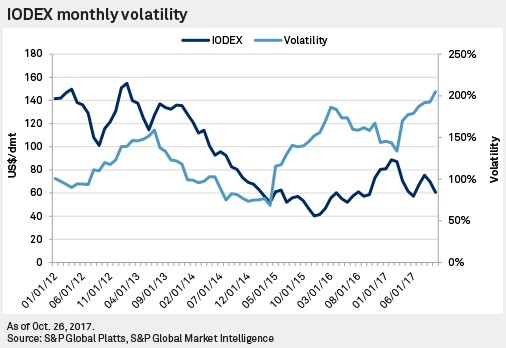

The dominant portion of the majors' sales are priced on a quarterly, monthly, or weekly basis. These prices are increasingly volatile when examined as the standard deviation in the logarithmic returns of the monthly average IODEX over a period of 12 months. This annual volatility has reached and maintained levels not seen since the fallout of the global financial crisis. Pronounced volatility introduces substantial cash flow risk to the miners and has a serious impact on unit margins.

Shipping rates have contributed to the squeeze

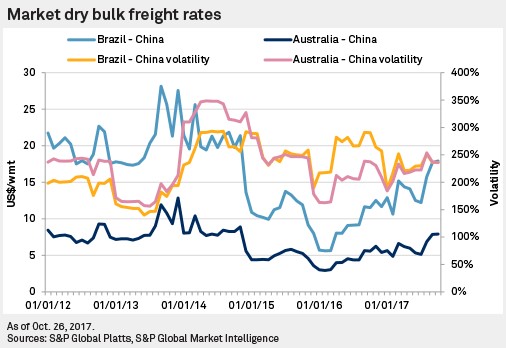

Iron ore prices represent the dominant risk to miner’s cash flow, but as they sell with reference to a price that is landed in China, freight rates also govern net margins. Market freight rates have shown consistently high monthly volatility from 2012 to 2017 year-to-date. Declining freight rates during 2015 provided a boon to miners as these reduced costs effectively protected the profit margins in a climate of falling prices. Due to high vessel-scrapping and a low number of new builds, oversupply in dry-bulk vessels has eased and freight rates have increased from the early 2016 low. Miners' margins now face the double squeeze of lower iron ore prices and higher freight costs.

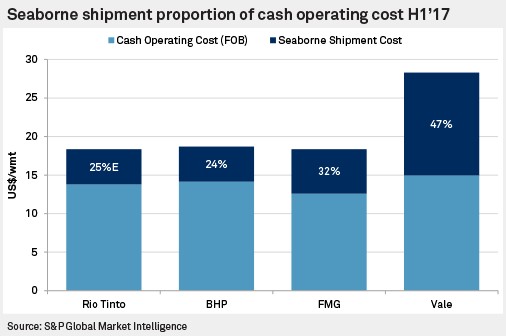

Australia's proximity to China provides Rio Tinto, BHP Billiton Group, and Fortescue Metals Group Ltd. with a competitive advantage over Vale SA. As freight rates continue to recover, Vale’s greater comparative sensitivity means the company's margins will be most impacted by increasing prices.

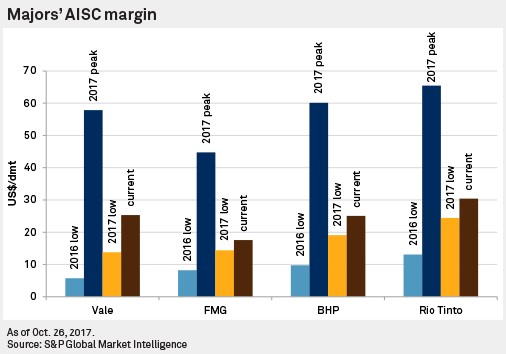

These turbulent market conditions have significantly impacted miners' margins in 2017; from the peak in February to the low in June, miners have seen margins fall 70%, on average, although margins have recovered somewhat with the recent price uptick.

In the extended price retreat of 2015, miners' margins were protected by some macro tailwinds. For example, diesel prices fell 30% in 2015, while the Australian and Brazilian currencies devalued 13% and 49%, respectively, against the U.S. dollar. Against this backdrop, miners also achieved aggressive cost-cutting predominantly due to operational efficiencies and substantial ramp-ups reducing unit costs of production. With the low-hanging fruit already picked and ramp-up volumes mostly realized, the miners have less capacity to reduce cost and are therefore more exposed to a protracted price decline over the near term. This year, miners' diesel prices are up 8% since January.

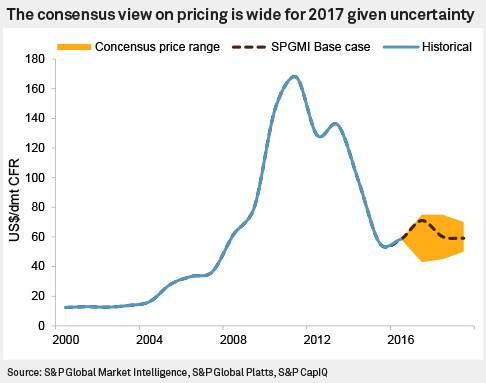

We see this recent iron ore price drop as an exaggerated reaction to the steel production cuts announced for the Chinese winter months. The range of consensus prices is wide for the fourth quarter, and we feel that S&P Global Market Intelligence is well weighted within the range. This price drop is symptomatic of volatility and not fully due to market fundamentals. Seaborne prices near US$58/t are below our fourth quarter expectation of US$64.1/t as the market has rushed to prices that it experienced in October 2016. This kind of amplified volatility will likely drive prices for the rest of the year as fundamentals are more sensitive to Chinese policy, and fund managers see the end of the year as significant timing for their positions.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

We bring transparency to the commodities market. Request a demo to find out how we can help you make well-informed decisions with reliable information.