Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Apr, 2025

By Allison Good

Utility stocks traditionally benefit at the onset of a recession, as was the case during the financial crisis of 2007 to 2009 and the height of the COVID-19 pandemic in 2020, with investors preferring steady dividend payments over plummeting bond yields. But utility stock prices can suffer later in a recession cycle, as increasing customer bills push state regulators to authorize lower rates of return on companies' investments.

"It comes down to an affordability game and which companies have the most constructive relationships with their state commissions," Barclays analyst Nicholas Campanella said during an interview.

Analysts at Guggenheim agreed, saying in an April 17 report that "deterioration in regulatory environments becomes a case-by-case basis."

For now, the sector's traditional defensiveness "helps set a floor" for stock prices in the immediate term, according to Guggenheim. Looking further ahead, utilities are poised to benefit from an eventual moderation of inflation and interest rate cuts by the US Federal Reserve.

"Utilities have broadly implemented higher for longer interest rates into financial plans, and the near-term treasury yield move lower and potential for moderating Fed policy can create headroom on financing for utilities in the continued growth cycle of electrification, core infrastructure and resource adequacy related spending," Guggenheim analysts wrote.

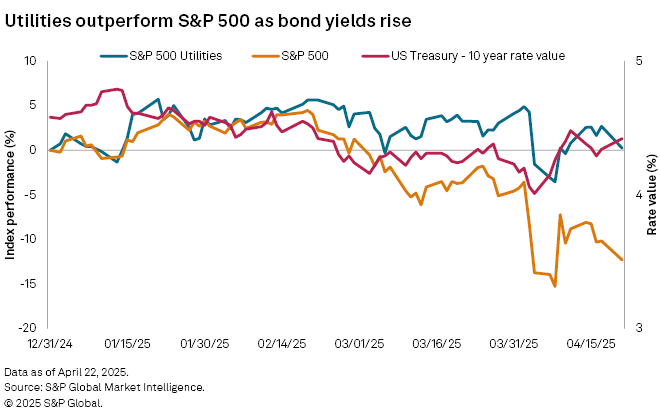

So far in 2025, the S&P 500 index has dropped nearly 9% while the S&P Utilities index has gained 3%. The S&P 500 and S&P Utilities indexes have fallen 4.6% and just under 1%, respectively, since the Trump administration announced sweeping new tariffs April 2.

Utility analysts are issuing commentary responding to investor inquiries about the impacts of a potential recession, but some economists see stagflation, a rare mix of stagnant economic growth, rising unemployment and higher inflation, as a more likely outcome given the tariffs.

Since April 2, the US 10-year Treasury yield has gone from 4.16% to 4.39% as of April 23 — including dropping as low as 3.86% on April 4 and rising as high as 4.59% on April 11 — reflecting tariff-driven market volatility that could erode utilities' advantage over bonds. Utility stocks, and the dividend yields they offer, compare favorably as 10-year Treasury yields decline, which typically occurs during economic downturns.

"I think there's greater fears of stagflation," Neil Kalton, Wells Fargo Securities' managing director of utility equity research, said during an interview.

Since central banks tend to raise interest rates during periods of stagflation to combat inflation, "it makes it a little bit more questionable how utilities would actually perform," Kalton added.

"My gut is that ... it's going to be a tough environment for utilities," Kalton said.

Barclays' Campanella agreed that stagflation would be more difficult for utilities due to the challenge of passing through costs to customers in regions where booming commercial and industrial activity from manufacturing and datacenters could reverse.

"The industry hasn't been through this in the current regulatory construct," Campanella said. "We're in unknown territory."

"It shouldn't be ignored that the sector's increase in long-term load is an offset to rising bills," Campanella added. "The problem is that also comes with an acceleration of rate base growth ... and to me that almost entirely offsets the bill headroom created by this higher power demand environment."

Guggenheim, on the other hand, wrote that regulated utilities are "unlikely to see a significant earnings downturn in a tariff-fueled recessionary scenario in 2025" because "cost of service models allow for recovery of prudently incurred costs."

The bank listed FirstEnergy Corp., Duke Energy Corp., Sempra and Constellation Energy Corp. as the industry stocks with the biggest upside.

Jefferies analysts, however, told clients April 15 that in 2009, when the financial crisis peaked, commercial power demand was down 9%, "which is the most relevant for Constellation who focuses much more on that customer class compared with [NRG Energy Inc. and Vistra Corp.] that are oriented residential."

"Residential has to contend with higher bad debts; however, these were relatively small during COVID as a reference," the analysts said.

Independent power producer stocks fared just as poorly as the broader market on April 3 as investors assessed the impact of the Trump administration's expanding tariff plans.

Shares in independent power producers have already faced several sell-offs so far in 2025. This includes a sell-off after China's Hangzhou DeepSeek Artificial Intelligence Co. Ltd. launched an open-source reasoning foundation AI model that uses significantly less electricity than US alternatives, and when TD Cowen analysts reported Microsoft Corp. datacenter lease cancellations in the US and Europe.