Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Apr, 2025

By Audrey Elsberry and Zuhaib Gull

Bank stocks fell, then jumped, in response to President Donald Trump's implementation and pause of tariffs on most US trading partners.

Although stocks have regained some value, investment bankers say dramatic market movements still inhibit pending bank deals from moving forward. Bank deal advisers are reassuring clients that exchange ratios remain the same despite the price fluctuation, but most deals have still been put on ice until market conditions are more certain.

Buyers and sellers are being told to focus on their long-term priorities instead of trying to time the market, say investment bankers and bank executives alike.

"Stability will be more important than valuation," Morgan Stanley Chairman and CEO Edward Pick said during the company's first-quarter earnings call April 11. "Waiting for stocks to hit all-time highs again, that probably is not the right strategy."

The long game

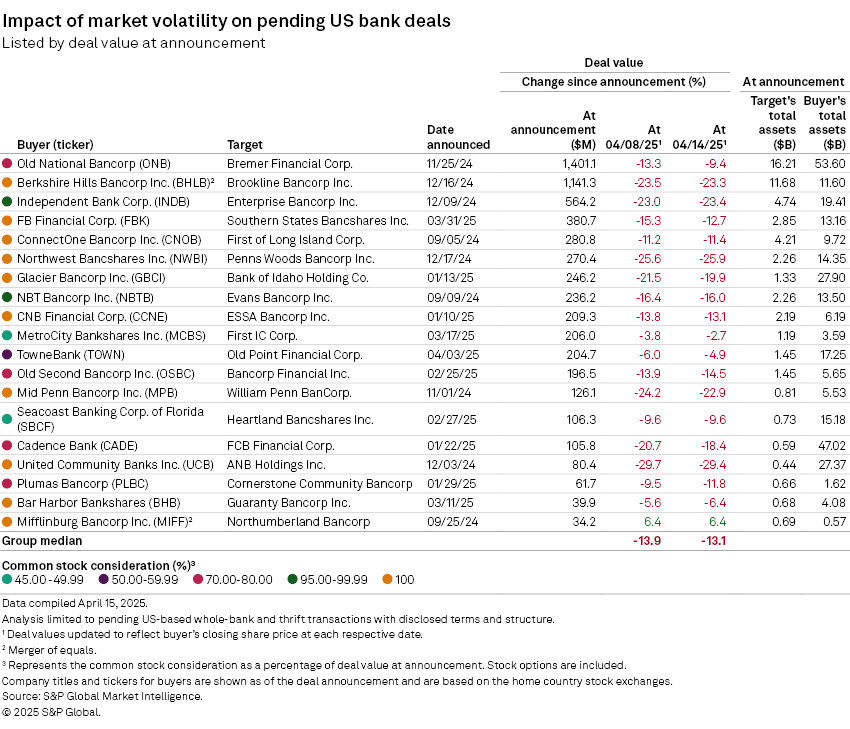

Across the board, prices on pending bank deals have changed dramatically since their dates of announcement. Valuations of pending bank deals dropped a median rate of 13.9% between their dates of announcement and the close of trading April 8.

Though announced deals already have contractual agreements on their terms, it takes a sophisticated management team to digest price variation, Matthew Veneri, Janney Montgomery Scott LLC head of investment banking, said in an interview.

Sellers always need to be prepared for the deal price to change because deals can take up to a year to be approved, Veneri said. A seller's decision to be acquired should have more to do with confidence in the success of the acquiring institution and should not deteriorate depending on day-to-day conditions, he said, adding that his team is telling sellers to trust the value of the combination, especially now.

"That's really what we try to focus them on, is the relative value, not necessarily the current price in today's market," Veneri said.

Within contractual agreements, some deals include collar arrangements that give a seller the option to exit the transaction if the buyer's stock falls by an agreed-upon amount, Raymond James Financial Inc. managing director William Wagner said in an interview. However, announced deals will most likely remain on course for approval, advisers said. While markets like these do tend to trigger collar arrangements, many transactions are protected because the buyer's stock is falling in line with the rest of the market.

Still, volatile markets can sometimes expose financial weaknesses that buyers did not find in the diligence process before announcement, Wagner said. If an institution has substantial losses, credit deterioration could trigger a collar arrangement as well, he said.

"If we do go into a recession and credit quality of the bank starts to deteriorate, then I think no matter what, most of your discussions are going to be sidelined," Wagner said. "When you see this volatility followed by increasing nonperforming assets, you start seeing banks go into their own corner, so to speak."

Playing therapist

No bank will want to announce a deal in a chaotic environment, so negotiations on unannounced deals will likely slow until the market has leveled out, Veneri said.

The volatility makes calculating a bank's valuation difficult because it stems mostly from the macroeconomic environment. Wagner calculated a fair value range for a client in February, and when he reran the same calculation to find the company's value range after the recent market movement, the bank's values were 20% lower with no fundamental change in its financial performance, he said.

When deal advisers calculate a bank's valuation, they create a graph that tracks a bank's relative value over time, including analyst estimates, to get directional stability, Veneri said. Balance sheet makeup, capital levels and earnings performance are among data points used by deal advisers to determine what a bank's relative value is, which is then calculated at absolute value based on the exchange ratio, he added.

Advisers are telling clients to be patient until the market settles in order to get a better view of where valuations will be, Dan Flaherty, a managing director in Janney's financial institutions group, said in an interview. Easing the nerves of bankers looking to transact is a part of the job, Flaherty said, adding, "We play therapists like 70% of the time anyway for all matters, not just market volatility."

No one knows how long it will take for the market to calm down, however. If the market volatility only lasts a couple of more weeks, it could amount to a "speed bump" in the bank M&A rebound that was expected for 2025, Flaherty said. But if trade policy keeps shifting, keeping the market unpredictable, 2025 could be another slow year for M&A.

The market sell-off in early April felt to some like the bank failures of March 2023 in the way that it was expected to affect the bank M&A market. But the two events differ in that the bank failures triggered a regulatory reaction in the bank space that hampered M&A through the rest of the year and into 2024, Veneri said.

The market's tariff reaction was not solely related to the banking sector, and there are simultaneous regulatory tailwinds that could help bank M&A rebound from the current uncertainty.

"The wave that people have been talking about, consolidation, I think everyone has agreed that's coming," Flaherty said. "We're all trying to figure out at what pace, right? And I think [market volatility] is going to certainly impact the pace at which it comes. I don't think it's going to impact whether or not it comes."