Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Mar, 2025

By Brian Scheid

A looming trade war, fears of another substantial rise in inflation, and extensive cuts within the federal workforce have caused a sharp decline in US spending and overall consumer confidence while threatening to upend the more than two-year rally in consumer discretionary stocks.

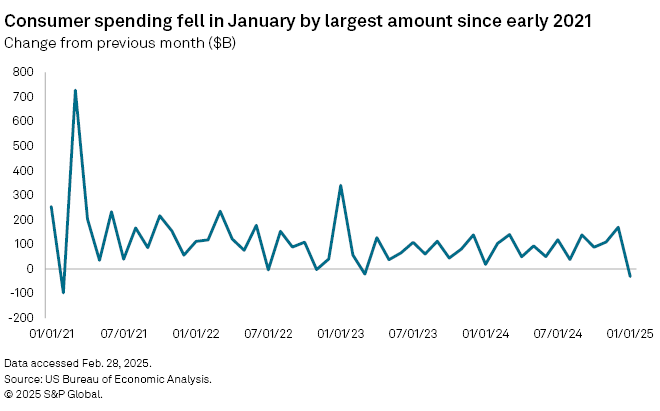

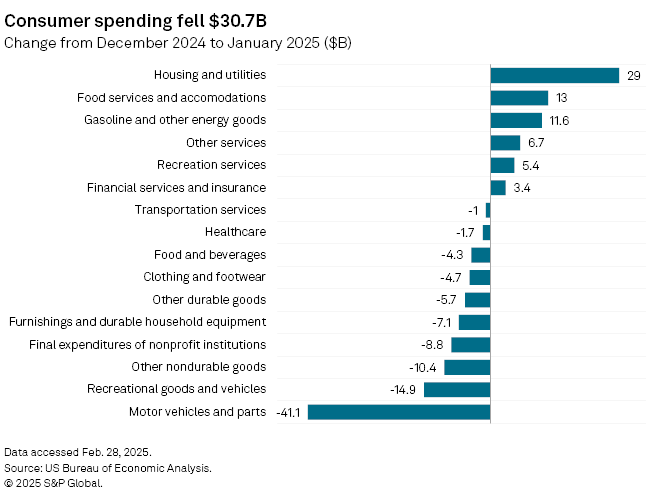

Consumer spending fell by $30.7 billion from December 2024 to January 2025, the first monthly decline in spending since March 2023, according to the latest US Bureau of Economic Analysis data, released Feb. 28. The core personal consumption expenditures price index, which excludes volatile energy and food prices and is the key inflation gauge for the US Federal Reserve, increased 2.6% year over year in January 2025, its lowest level of annual growth since June 2024.

Just over a month into the second Donald Trump presidency, inflation is moving away from the Fed's 2% target, consumers have shifted to saving from spending and dormant recession fears have been revived.

"Stocks, sentiment and consumer confidence have all been under pressure, while economic policy uncertainty has been hitting its highest levels since [COVID-19] and the financial crisis," said Bret Kenwell, a US investment and options analyst at eToro.

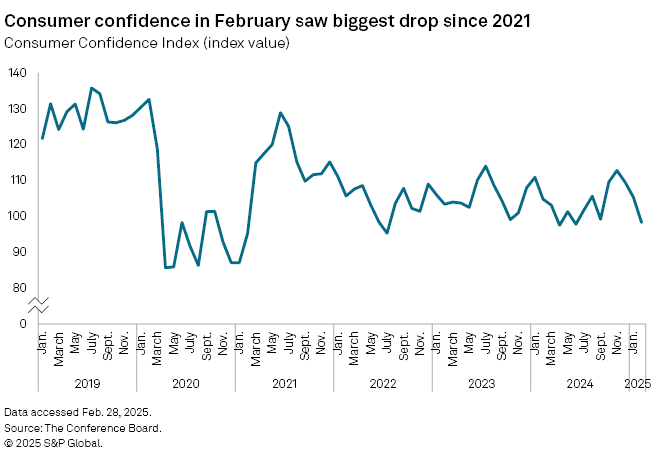

The Conference Board's Consumer Confidence Index fell 7 points from January to February, its steepest monthly drop since August 2021. At the same time, the Conference Board's Expectations Index, a measure of consumers' short-term income, business and labor market outlooks, fell more than 9 points in February, also its steepest drop since August 2021 and below the threshold that typically signals a recession ahead.

"There's been a lot of optimism that things would improve under the new administration," said David Russell, global head of market strategy at TradeStation. "Business and consumer confidence could take a hit if those hopes don't pan out."

Declining consumer confidence and the bulk of economic uncertainty may be stemming from the wild fluctuations in tariff policy coming out of the White House and its potentially deep impact on global trade, Kenwell with eToro said.

Trump said in the last week of February that 25% tariffs on imports from Canada and Mexico would go into effect March 4. And products from China, already subject to a 10% tariff, will face an additional 10% tariff, Trump said.

But the White House's timeline on tariffs has remained murky, and their potential impacts are unclear.

"At this point, it's hard to say whether the potential for tariffs has sustainably altered business or consumer spending," Kenwell said. "However, if more tariffs were to go into effect, that observation is likely to change as consumers may not have the wiggle room that some policymakers assume."

Tariffs, if imposed on Mexico and Canada, will boost inflation by 1.1% to 1.4%, and the additional tariffs on Chinese imports will increase inflation by an additional 0.7%, Nigel Green, CEO of deVere Group, wrote in a Feb. 28 note.

"The economic implications are vast," Green wrote. "The price of everyday goods will rise, corporate profits will feel the squeeze, and consumers will ultimately foot the bill."

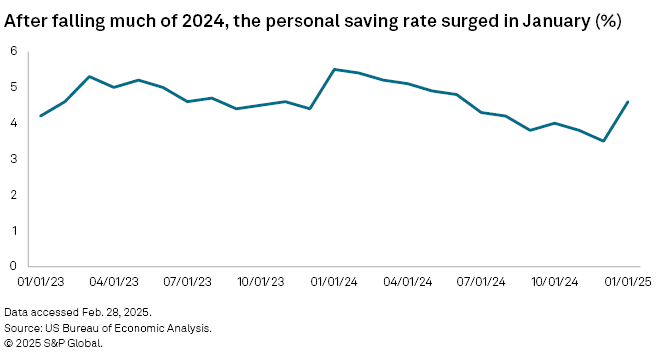

As spending slowed and concerns of tariff impacts escalated, the US personal saving rate jumped 110 basis points to 4.6% in January from 3.5% in December 2024, its highest level since June 2024.

This rise in saving could signal the start of precautionary savings by households preparing for the effects of tariffs, federal government layoffs and tax uncertainty, said Gregory Daco, EY's chief economist.

Market impacts

The slowdown in spending, uncertainty around tariffs and rise in savings are all fueling a downturn in consumer discretionary stocks — companies that sell goods and services that people may want but do not need.

The S&P 500's consumer discretionary sector fell 5.4% through the first two months of 2025, while the overall S&P 500 increased 1.2%.

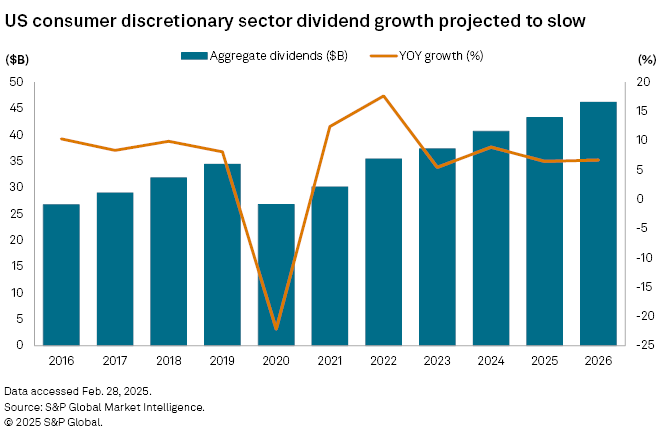

US consumer discretionary sector dividends are projected to increase less than 6.5% in 2025, well below the 8.9% growth in 2024 and the recent peak dividend growth of 17.6% in 2022, according to the latest S&P Global Market Intelligence forecast.

Tariffs on imports will increase costs to consumers, but the overall impact on stocks and dividends depends on how broadly they are imposed, according to Gopendra Yadav, senior specialist in equity research/fixed income with Market Intelligence.

"A limited number of tariffs could help the consumer discretionary sector perform better and sustain higher dividend growth because the negative impact on costs and profitability would be more contained," Yadav said. "However, the overall effect would also depend on other factors like consumer confidence, interest rates, inflation and other macroeconomic conditions."

Policy uncertainty around tariffs, as well as the potential for higher inflation, ongoing efforts to crack down on illegal immigration and other economic factors are complicating efforts by consumer discretionary companies to determine dividends this year, according to Yadav.

"These issues create unpredictability in costs, consumer demand and labor markets, which could lead companies to adopt a cautious approach, potentially freezing or reducing dividends to manage risks and preserve capital," Yadav said.