Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Feb, 2025

By Ben Dyson

|

The insurance industry continues to face pressure to stop underwriting fossil fuels, as shown by this Extinction Rebellion protest outside Lloyd's of London in October 2024. |

The insurance industry's progress on cutting greenhouse gas emissions in underwriting portfolios appears to be slowing as it faces a series of political and practical obstacles.

Success for insurers is heavily dependent on the real-economy companies they insure reducing their greenhouse gas emissions, which is in turn influenced by governments' approaches to energy use. Some hydrocarbon producers have begun watering down their environmental commitments, and the raft of elections in 2024 has brought into power some governments that are openly hostile to environmental considerations. Notably, US President Donald Trump has withdrawn from the Paris Agreement and signed executive orders to boost domestic fossil fuel production and freeze offshore wind leasing since taking office on Jan. 20.

"There is undoubtedly a slowdown because of these headwinds. It would be naive to say that's not the case," Miqdaad Versi, partner and founder of the sustainability practice at insurance consultant Oxbow Partners, said in an interview.

Steps forward

Yet insurers continue to make progress on reducing underwriting of GHG. US insurance group Chubb Ltd. strengthened its oil and gas underwriting criteria in April 2024. It now requires insured oil and gas producers with more than $1 billion in annual revenues to achieve methane emissions intensity of 0.2% or less by 2030 globally or risk losing their cover. The policy change, contained in a proxy filing, is "a step forward," according to Rainforest Action Network, although the environmental group also said the insurer's policies are still not aligned with the goal of limiting global warming to 1.5 degrees C above preindustrial levels.

Italian insurer Assicurazioni Generali SpA extended its oil and gas underwriting restrictions in October 2024, and now no longer provides cover for midstream and downstream assets of conventional oil and gas companies it deems "transition laggards," and midstream assets in the tar sands and fracking industries.

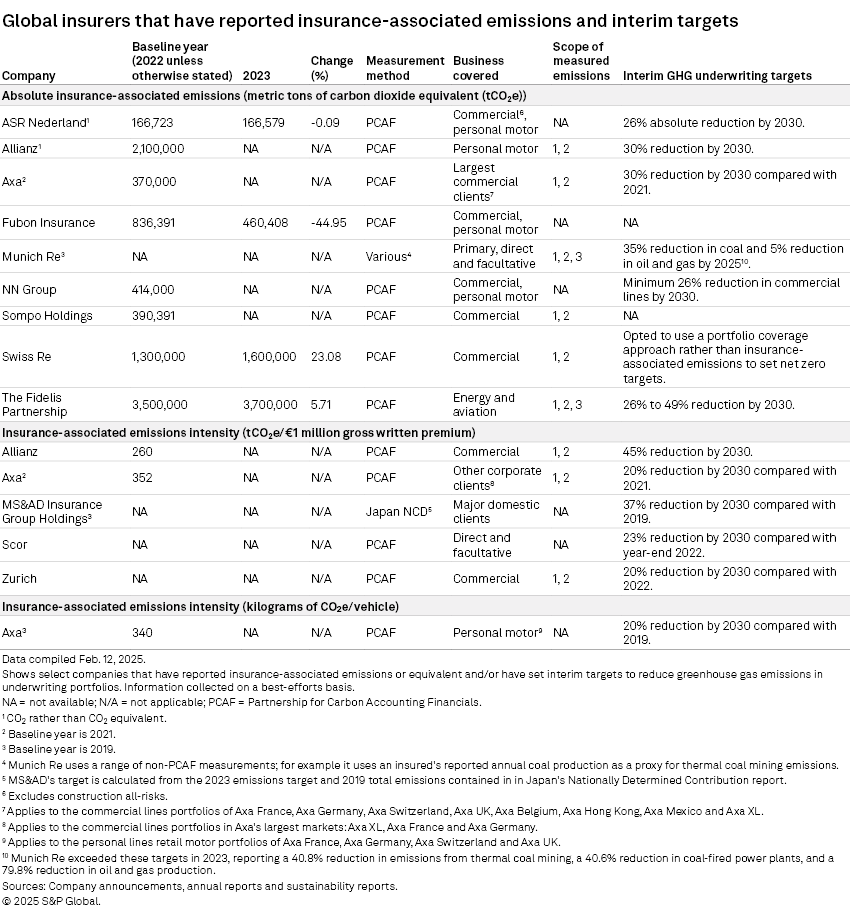

More insurers have announced interim GHG reduction targets in underwriting, typically for 2030, and more are now reporting insurance-associated emissions using the standard set by the Partnership for Carbon Accounting Financials in November 2022. Allianz SE, Axa SA, Sompo Holdings Inc. and Swiss Re AG have reported emissions data since S&P Global Market Intelligence last researched the Partnership for Carbon Accounting Financials standard’s use. Some have also now provided updates on their progress. Fubon Insurance's insurance-associated emissions fell by just under 45% in 2023 compared to its 2022 baseline, while those of Fidelis Partnership and Swiss Re increased by 5.7% and 23.1%, respectively.

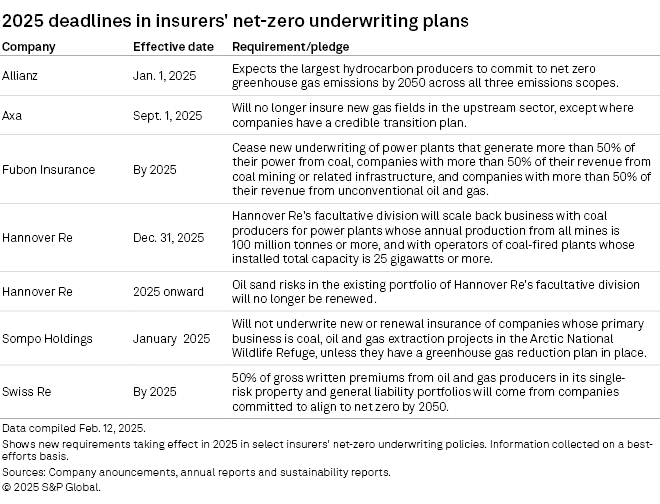

Several insurers' fossil fuel underwriting restrictions get tougher from 2025, insurance broker Miller Insurance Services LLP said in December 2024. Allianz, for example, expects the largest oil and gas companies it insures to commit to achieving net-zero GHG emissions across all three scopes by 2050.

Changing priorities

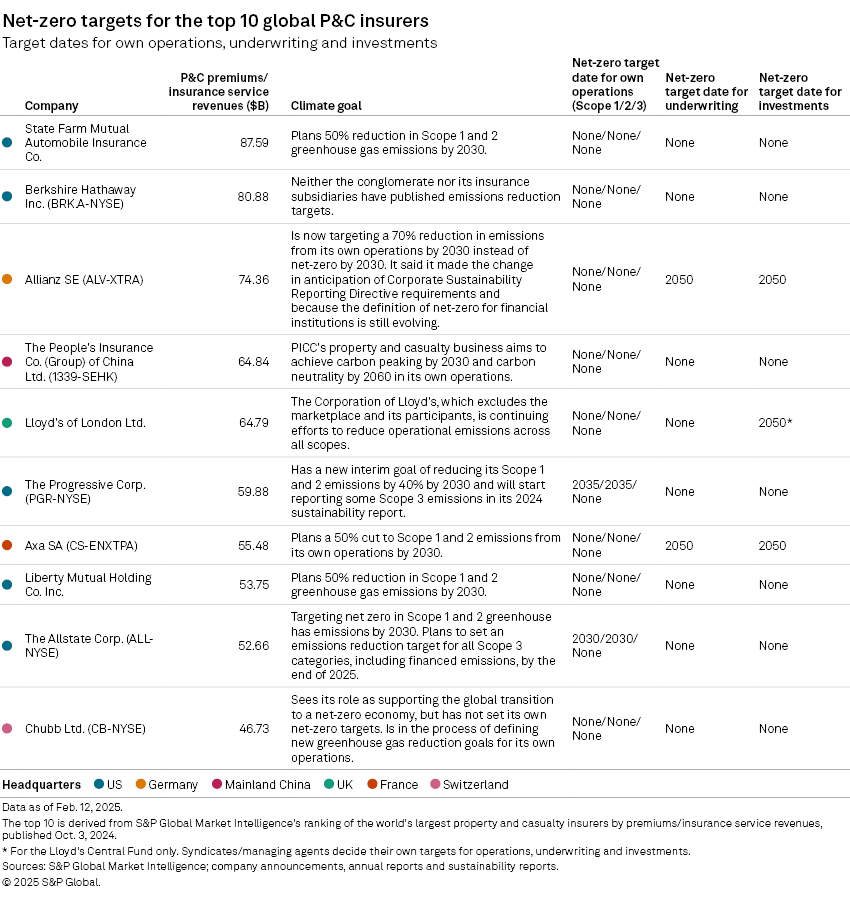

Despite this progress, there has not been a flurry of new net-zero policies and updates seen in previous years. The demise of the UN-convened Net-Zero Insurance Alliance, which aimed to coordinate the net-zero underwriting target setting of its members, though not the content of those targets, has resulted in a staggered and piecemeal release of interim goals by large global insurers.

"Fresh announcements on net-zero underwriting have been thin on the ground during 2024," Miller's article said, while acknowledging Chubb and Generali's new commitments. "An expected rush of target-setting from [Net-Zero Insurance Alliance] members did not materialize."

Sustainability generally has slipped down companies' list of priorities, according to Versi of Oxbow Partners. "A few years ago, it was top of agenda," he said. "It was part of [executive] discussions. There were big strategic questions being thought through. Now that's not the case."

Versi said work is now being focused on three main areas: mandatory or near-mandatory reporting of emissions, opportunities arising from the transition away from carbon, and the development of transition plans.

Insurers' progress has not been fast enough for Insure Our Future, a collective of environmental groups pushing insurers to stop covering fossil fuels. While praising Generali's new policy and placing the insurer in the top spot in the 2024 edition of its annual scorecard, the collective said the industry overall continues to insure fossil fuel expansion, and that 2024 was a "year of stalled underwriting progress."

The apparent stalling of progress is particularly concerning, according to the group, because it is happening amid an increase in the frequency and severity of natural catastrophes. This is increasing the industry's claims bills, prompting insurers and reinsurers to restrict coverage to affected areas.

"That's what we feel is a really worrying disconnect, where insurers do have economic incentive to limit these losses, but how they're going about it is mostly cutting off communities and reducing exposure rather than actually looking at what are the root drivers of these causes, which happens to be greenhouse gas emissions," Risalat Khan, senior strategist at Insure Our Future US and author of the group's 2024 scorecard report, said in an interview.

The climate-attributed share of insured weather losses increased to 38% from 31% over the last decade, according to the report, citing an analysis by economic research company SEO Amsterdam Economics, commissioned by Insure Our Future. Estimated climate-attributed losses for the top 28 property and casualty insurers was $10.6 billion, compared with $11.3 billion in premiums from insuring fossil fuels in 2023. For 15 of the 28 companies, estimated climate-attributed losses exceeded fossil fuel premiums.

The more hostile political climate for environmental initiatives can influence the insurance industry's actions, Khan acknowledged, as shown by the Net-Zero Insurance Alliance's closure amid attacks from Republican attorneys general in the US.

Early days

The insurance industry overall is still at the early stages of its journey toward net-zero underwriting. "Most insurance companies, with some exceptions, haven't really laid out targets when it comes to their Scope 3 emissions in terms of their underwriting portfolio," Versi said.

While the current environment might make it challenging for the insurers that have set targets, Versi said, for the industry more broadly, "I don't think it's about hitting targets. We're a step before that."

Even those insurers that have set targets are facing some practical hurdles. Some are openly having difficulty measuring insurance-associated emissions.

"Based on the currently available external data, steering commercial insurance portfolios toward net zero based on [insurance-associated emissions] is not feasible, in Swiss Re's view," the reinsurer said in its 2023 sustainability report. The company has instead opted for a portfolio coverage approach to determine its net-zero underwriting target.

Beazley PLC said in its net-zero transition plan, published December 2024, that having tried to insurance-associated emissions using the Partnership for Carbon Accounting Financials methodology, data limitations meant that it has decided against setting GHG reduction targets for now.

Chubb, meanwhile, eschews insurance-associated emissions altogether. The insurer said in its 2024 proxy report that its strategy of using the industry's importance to the economy to effect change "is far more effective at influencing the actions of our insureds than attempting to measure our insured clients' emissions."

Making headway

There is a recognition that, to some extent, insurers' net zero progress is out of their hands. Axa said in its net-zero underwriting and investment strategy that achieving its targets "will depend on the overall transition of the world economy and society to net zero in the coming decades which itself will depend on a variety of political, economic, regulatory, civil society and scientific developments beyond Axa's control."

"Fundamentally, an insurance company's transition plan is dependent on the real economy," Oxbow Partners' Versi said. He added: "For the vast majority of energy needs, insurance companies aren't the people that say no to coal and yes to renewables. That's a governmental decision."

There is cause for optimism, however. The global transition away from fossil fuels and into more renewable sources of energy continues. While some governments are making negative policy statements around the transition, "other regions are seeing opportunities, and they're actively leaning into that from a policy perspective," Vicky Roberts-Mills, global head of energy transition at Axa XL, Axa's reinsurance and large commercial insurance division, said in an interview.

"Policy was always going to be a push or pull in the energy transition. We're not necessarily seeing that slowdown in demand for products and services related to the energy transition," Roberts-Mills said.