Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

As the global private equity industry took tentative steps toward recovery in 2024, Japan raced ahead.

The value of private equity investment in Japan jumped nearly 41% over the prior-year total in 2024, far outpacing the 25% year-over-year gain in global private equity deal value, according to S&P Global Market Intelligence data. Fundraising for Japan-focused private equity funds held steady year over year at $8 billion in 2024, even as global fundraising totals declined for a third consecutive year.

Japan's business community is opening up to private equity, and the industry likes what it sees: a steady pipeline of carve-out and take-private deals from an undervalued public market; clear value creation opportunities at low-margin businesses; and a widespread succession crisis playing out across the many family-owned businesses in Japan's middle market, now a ready source of acquisition targets.

Tailwinds to private equity dealmaking in Japan include low interest rates and global investors' pivot away from China. All in all, Japan is positioned to see record private equity activity in 2025.

Read more about increasing private equity investment in Japan.

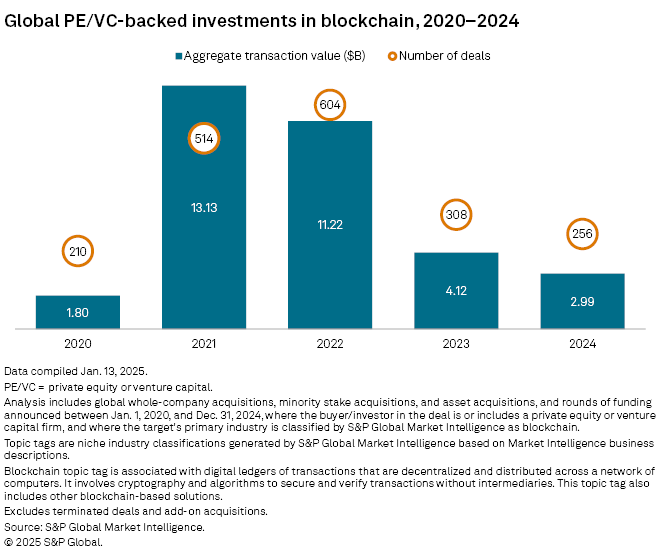

CHART OF THE WEEK: Private equity investment in blockchain continues to slide

⮞ The aggregate global value of private equity and venture capital investment in blockchain technology declined for the third year in a row in 2024, falling 27% year over year to $2.99 billion, according to Market Intelligence data.

⮞ Private equity investments in cryptocurrency, which relies on blockchain, also declined in 2024, falling 25% from the prior-year total to $1.57 billion in 2024.

⮞ While potential applications for blockchain appear to be expanding, it is having a hard time competing for investors' attention amid the excitement building around AI.

TOP DEALS AND FUNDRAISING

– Funds managed by Apollo Global Management Inc. affiliates completed the acquisition of engineered products maker Barnes Group Inc. for about $3.6 billion in an all-cash transaction.

– Thoma Bravo LP is making a majority investment in the merger of government process management software company Opexus and data compliance company Casepoint LLC. Gemspring Capital LLC will continue to own a minority stake in the combined company.

– KKR & Co. Inc. is investing an additional $250 million in medical and dental supplies distributor Henry Schein Inc. As part of the investment, KKR secured two independent director seats on the company's board.

– Bain Capital LP's private equity arm offered to acquire the remaining shares it does not own in surgical facility operator Surgery Partners Inc. for $25.75 per share in cash. Bain and its affiliates already hold about 39% of Surgery Partners' common stock.

– Blue Sage Capital LP raised $618 million at the final close of Blue Sage Capital Fund IV LP. The vehicle seeks to invest in lower-middle-market environmental solutions, niche manufacturing and specialty services companies in North America.

– Petra Capital Partners LLC raised $270 million for its Petra Growth Fund V. The vehicle will invest in healthcare, business and technology-based services companies.

MIDDLE-MARKET HIGHLIGHTS

– OEP Capital Advisors LP, doing business as One Equity Partners, sold aftermarket service and parts provider The WW Williams Co. LLC in a deal with private equity buyer Brightstar Capital Partners LP.

– ICV Partners LLC purchased a significant ownership interest in asbestos abatement service provider Environmental Remedies.

– Monomoy Capital Management LP, doing business as Monomoy Capital Partners, sold Astro Shapes LLC, a custom aluminum extrusion maker. Wynnchurch Capital LP was the buyer.

FOCUS ON: SYSTEMS SOFTWARE

– Legal workflow automation company Maya Financial Inc., doing business as Paxton AI, raised $22 million in a series A funding round led by Unusual Ventures.

– Israel-based cybersecurity company Clutch Security Inc. raised $20 million in a series A funding round led by Signalfire LLC.

– South Korean early payment service provider Allra Fintech Corp. secured about $9 million in a series B funding round. Altara Ventures and Do Ventures participated in the round.

______________________________________________

Read our private equity data dispatch summing up 2024 activity.

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter