Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Mar, 2023

After tumbling in 2022, equity markets are moving higher even as the Federal Reserve seeks to slow economic growth and cool inflation by ratcheting up benchmark interest rates.

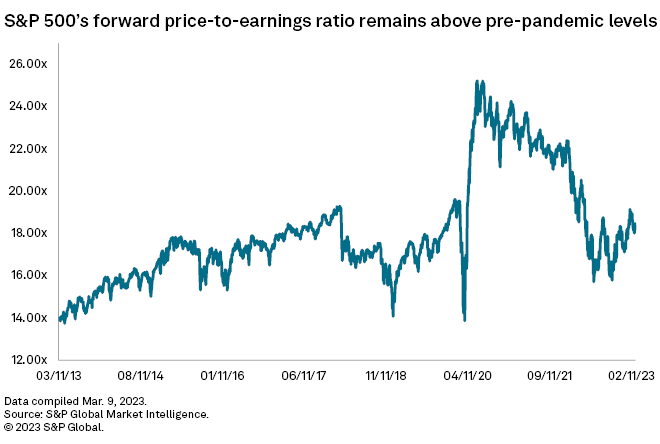

The S&P 500 was trading at 18.21x price-to-forecast earnings March 8, roughly 20% higher than the average for the last decade, according to S&P Global Market Intelligence data. In February, the so-called forward price-to-earnings ratio climbed above 19x for the first time since April 2022, after falling from a record of more than 25x during the summer of 2020.

Low interest rates during the COVID-19 pandemic helped boost valuations, which subsequently plateaued in 2021 and began to fall the following year as the Fed undertook its most aggressive rate hiking pace in decades.

"The combination of record low interest rates and huge amounts of fiscal stimulus made business conditions so attractive that stocks were gaining rapidly, while an uptick in personal savings boosted retail investments into stocks, shares and major indices as well," said Giles Coghlan, chief market analyst with HYCM.

Equity valuations are on the rise again in 2023 despite the Fed teeing up further rate increases.

Stocks reversing into high gear

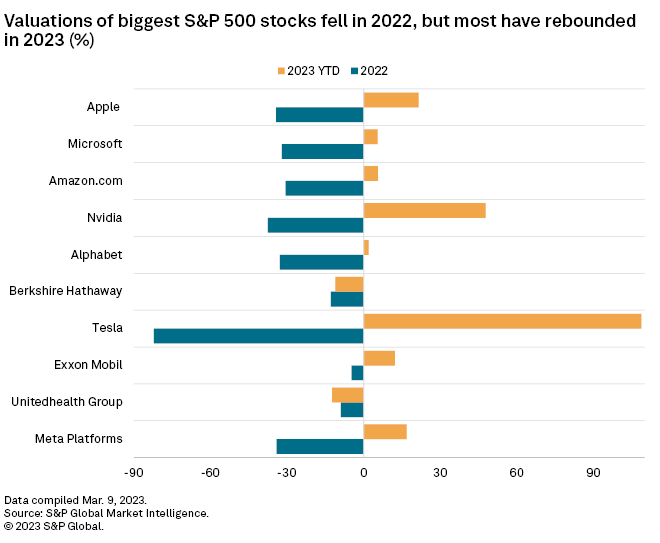

Valuations for the 10 largest S&P 500 stocks are growing this year after declines in 2022.

Tesla Inc.'s forward price-to-earnings ratio has more than doubled thus far in 2023 after falling 82% last year. NVIDIA Corp.'s ratio has climbed nearly 48% this year following an almost 38% drop in 2022.

Equities staying strong despite weaker earnings

Higher interest rates tend to cause stocks to fall as investors place lower values on companies' future earnings. While the Fed has boosted its federal funds rate by 450 basis points since March 2022, financial conditions have only returned to "average" levels, according to Michael O'Rourke, chief market strategist at JonesTrading. With inflation remaining near highs not seen since the early 1980s, these conditions could still be seen as very loose,

"The easy financial conditions allow the S&P 500 to trade at a high multiple despite the fact that earnings have turned lower," O'Rourke said.

As inflation remains stubbornly high even with the Fed continuing to hike rates, it is unclear where stock valuations may be headed, said Jeff Weniger, head of equity strategy at WisdomTree.

Earnings estimates, Weniger said, have been "violently erratic" as forecasters struggle to figure out where prices, the job market and bond yields may be headed.

"Nobody can get a proper grip on what happens next," he said.