Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jan, 2023

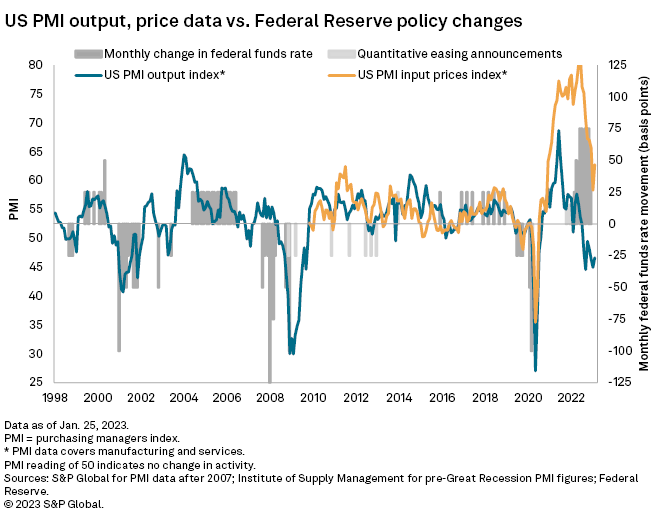

The U.S. economy started 2023 on a disappointingly soft note, with business activity contracting sharply again in January, according to the latest survey data from S&P Global. While moderating compared to December 2022, output is declining at one of the steepest rates since the Great Recession, reflecting falling activity across manufacturing and services.

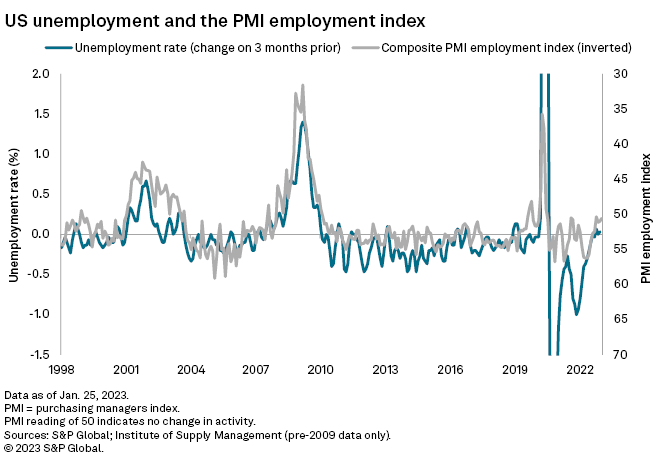

Jobs growth has also cooled, with a far weaker increase in payroll numbers in January than throughout much of 2022, reflecting a hesitancy to expand capacity in the face of uncertain trading conditions in the months ahead. Although the survey showed a moderation in the rate of order book losses and an encouraging upturn in business sentiment, the overall level of confidence remains subdued by historical standards. Companies cited concerns over the ongoing impact of high prices and rising interest rates, as well as lingering worries over supply and labor shortages.

The survey indicated a downturn in economic activity and an acceleration of input cost inflation into the new year. That is linked in part to upward wage pressures, which could encourage a further aggressive tightening of Federal Reserve policy despite rising recession risks.

US recession risks persist

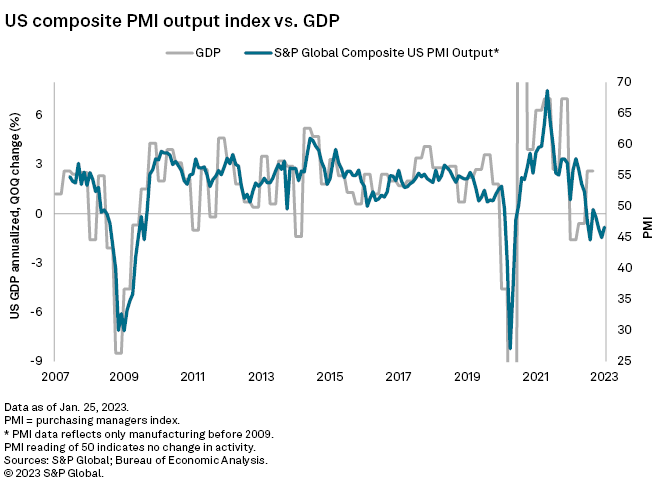

The headline Purchasing Managers' Index, or PMI, output index covering both manufacturing and services rose in January. It was an improvement compared to December 2022's reading, which was the second lowest since the Great Recession, excluding early COVID-19 pandemic lockdown months. The index registered 46.6 from 45.0 at the end of 2022. The sub-50 reading means the contraction in activity was solid overall, albeit the slowest since October 2022.

Other early economic indicators, including those compiled by the Federal Reserve banks of Philadelphia and New York, have also been flashing red warning lights on the health of the economy. This points to a subdued start to the year and, like the PMI, commensurate with falling GDP.

Higher frequency official data, such as industrial production and retail sales, have also started to corroborate the PMI survey signals of the economy hitting a soft patch, with both manufacturing output and retail sales falling into decline at the end of 2022.

Sectors show broad-based downturn

Goods producers and service providers recorded similar rates of decline in the flash January PMI survey, pointing to a further broad-based weakening of the economy. The downturn remained historically strong in each sector, though both reported that output decline has eased slightly, linked to weaker rates of loss of new orders in both cases.

Inflation gauges tick higher

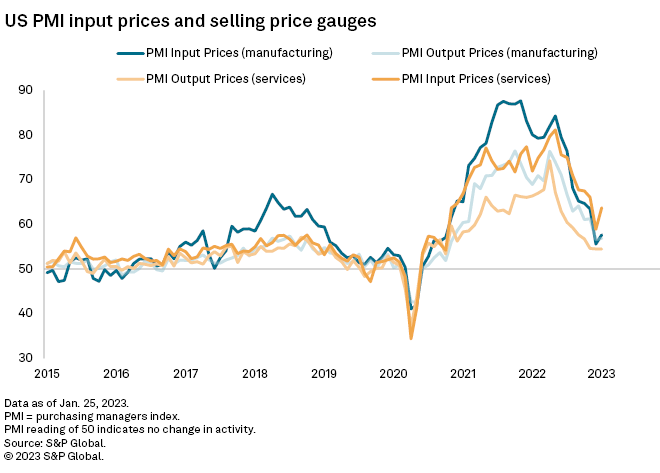

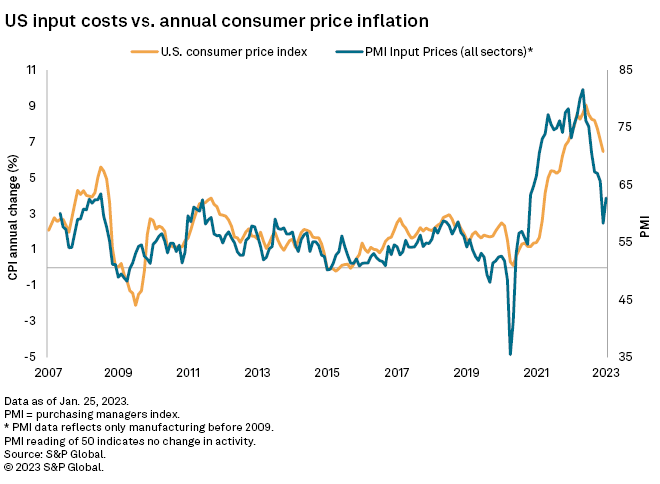

Despite demand continuing to fall in January, the survey shows signs of inflation pressures picking up again. January's data indicated a faster increase in cost burdens at private sector firms, bringing to an end a seven-month sequence of moderating input price rises. Companies reported persistent upward pressure on costs from increases in vendor prices and higher wage costs, though those were well below the average rise over the past two years.

Selling-price inflation also ticked higher in manufacturing during January and held steady in services. Companies also reported the need to pass historically elevated costs on to clients where possible, though efforts to remain competitive and offer concessions to customers dampened price hikes.

It is too early to tell if January's upturn in the price gauges is the start of an upward trend or if a higher-than-normal number of companies are setting new list prices at the start of the year. Even with the latest upturn, however, the survey gauges are consistent with consumer price inflation cooling further from its current rate of 6.5%.

Cooling inflation reflects falling demand — as measured by the sustained decline recorded by the PMI new orders index at 47.9 in January — and alleviation of pandemic-related supply chain stress. Average supplier delivery delays rose only marginally in January and are broadly unchanged over the past three months, marking a major change to the widespread supply delays that plagued the U.S. and global economies at this time in 2022.

Labor market remains tight

The survey responses indicate that a key impetus to cost growth is now coming from staff costs via rising wages and salaries. The service sector input cost index, which includes wages, and employment indexes will be important inflation barometers to watch in the months ahead.

Importantly, even with the downturn in orders and output during the month, employment continued to rise marginally in January as many firms sought to fill longstanding vacancies that were left empty due to widespread staffing availability issues. That the PMI survey has shown a marked cooling in jobs growth in recent months is of course noteworthy, and a sign of economic stress, but so is the fact that even the reduced rate of jobs growth is not consistent with any material rise in unemployment.

Fed policy impact assessment

The economy continues to face recession risk, and inflation pressures are signs of remaining stubbornly elevated, thanks in part to the tight labor market.

While output is falling, the rate-setting Federal Open Market Committee is focused on rising costs. Rising PMI cost gauges suggest the committee will consider that there is more work to do to tame price pressures after the aggressive rate push throughout 2022.

Purchasing Managers' Index data is compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and subindices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data is used by financial and corporate professionals to better understand where economies and markets are headed and to uncover opportunities.

Data and insights for this article were compiled by Chris Williamson, chief business economist for S&P Global Market Intelligence.