Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Apr, 2022

Gas utility stocks performed better than the broader market for a second straight quarter as a blockbuster buyout fortified a strong backdrop for the sector.

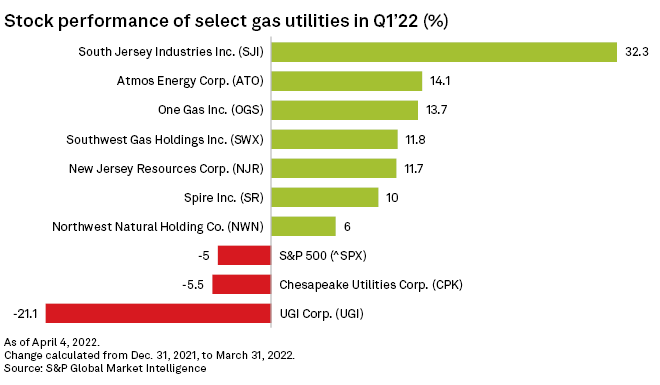

An index of nine gas utility stocks selected by S&P Global Market Intelligence rose 6.2% during the first quarter. Meanwhile, the S&P 500 was down 5%, rocked by geopolitical tension over the war in Ukraine and continuing concerns about rising interest rates. The group also outperformed the S&P 500 Utilities sector.

Shares of local gas distribution companies got a boost in the middle of the quarter after a private infrastructure investment fund announced it would purchase South Jersey Industries Inc. for $8.1 billion.

According to analysts, the deal's lofty valuation reinforced the idea that gas utility assets will remain useful throughout the energy transition. The recent string of gas utility purchases by private investment funds marks a shift from a period of sector M&A that ended several years ago, when strategic acquisitions among utilities drove deal-making, Hennessy Funds Chief Investment Officer Ryan Kelley said.

"It's great to see the interested parties being private equity. That's a different kind of acquisition," Kelley said in an interview. "They're looking at long-term solid growth and good returns, cash flow for many, many years."

Utilities were already poised for outperformance after trailing the market throughout much of the pandemic, Kelley said. With LDC stocks undervalued, the outperformance finally got underway at the end of 2021 as tightening monetary policy became the market's chief concern. Uncertainty over inflation's impact on the economy exacerbated market fears, Kelley said.

"I think that there's also been, in the last month and a half or more, a big move into stability," Kelley said. "And if there's one thing that utilities have going for them, it's predictability."

Fund flow data from Nasdaq IR Intelligence showed capital flowing back into utility stocks, which have been underowned by investors for some time.

Among small- and mid-cap utility stocks, which include many pure-play LDC operators, selling and shorting pressure has eased, Nasdaq IR Intelligence senior analyst Massud Ghaussy said. Index funds have also increased their market share at the expense of active funds, which benefits companies with strong yield and growing dividends, Ghaussy said in an interview.

Southwest Gas Holdings Inc. initially saw muted gains after the South Jersey Industries deal amid its proxy battle with activist investor Carl Icahn. But Southwest Gas pulled ahead of peers after it announced a spinoff of its energy infrastructure service business and after Icahn increased his tender offer for the company.

Meanwhile, Northwest Natural Holding Co. was trailing only South Jersey Industries' share price gain following the deal announcement, but the Northwest Natural stock pulled back sharply after the company announced an equity issuance. Atmos Energy Corp., One Gas Inc., New Jersey Resources Corp. and Spire Inc. all topped Northwest Natural's quarterly gains after the pullback.

Only Chesapeake Utilities Corp. and UGI Corp., two diversified LDC operators that led the sector in 2021, ended the quarter with losses.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.