Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2021

By Tom Jacobs and Husain Rupawala

Progressive Corp.'s reaction to the start of the COVID-19 pandemic in the U.S. led to it recording the highest number of approved rate decreases among the top four personal auto insurers in 2020, according to an S&P Global Market Intelligence analysis.

Regulators signed off on 195 rate cuts for Progressive and its subsidiaries last year. Allstate Corp. had 120 rate reductions, State Farm Mutual Automobile Insurance Co. had 30 and Berkshire Hathaway Inc.'s GEICO Corp. had 25.

Overall, those insurers received approvals for a combined 370 rate reductions across 46 states and the District of Columbia in 2020. There were 184 rate increases by those companies, while 785 filings had effectively zero impact on premiums.

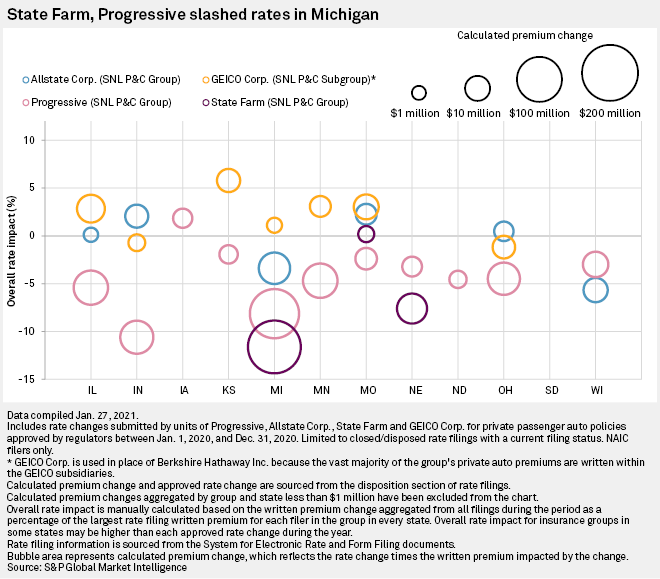

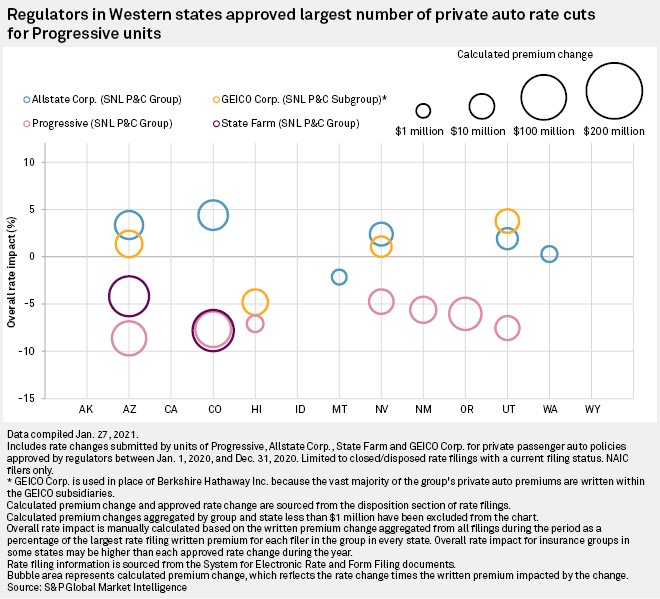

The above charts contain analysis limited to private passenger-auto rates approved in 2020 for the four largest private auto insurers and their subsidiaries. The graphic contains calculated rate impact by percentage in every U.S. state and the District of Columbia, with the exception of Florida because it has its own rate-filing process.

Progressive cuts rates, gains share

Rates fell in 34 states for Progressive, the most among the four companies in this analysis. Allstate saw rates drop in 25 states; rated declined in nine states for State Farm and three for GEICO, which also sought notable rate increases in 18 states.

CEO Tricia Griffith during Progressive's third-quarter 2020 earnings call said the company has added 2.4 million policies compared to the prior September, and felt like it was well positioned coming into the pandemic. The company issued credits to its customers in response to the drop in miles driven by policyholders, which Griffith said enhanced retention.

"We've really enjoyed gaining share across the board, and we want to continue that, so what we're doing now is what we call taking small bites to the apple in terms of rate decreases," she said. "If we see conversions going down or we're less competitive and we get a lot of intel from other companies and our agents, we will take rates down slightly."

The steepest decreases in terms of changes in written premiums for Progressive were in Michigan and Texas. The insurers' rates decreased by 8.1% in Michigan, resulting in an estimated $146.1 million drop in premiums, while rates in Texas fell 5.9% for a $104.6 million decrease.

Michigan regulators approved even larger decreases for State Farm, which saw written premiums fall by $196.3 million.

A few modest increases

State Farm was granted approval on three rate filings in Rhode Island that could potentially boost private auto premiums by $11.8 million with a calculated rate impact of 38.2%. Subsidiary HiRoad Assurance Co. is the likely beneficiary of those changes as it continues its expansion.

GEICO raised rates in 16 states, with the largest occurring in New York. Regulators approved a 4.44% hike there, which translates to an increase in written premiums of $202.3 million, the largest increase in 2020.

While GEICO filed for rate changes in 30 states, there was no impact on its private auto premiums in 11 of them. The company has 17 rate filings in Texas, Maryland, Georgia and Nevada awaiting approval from regulators.