Summary

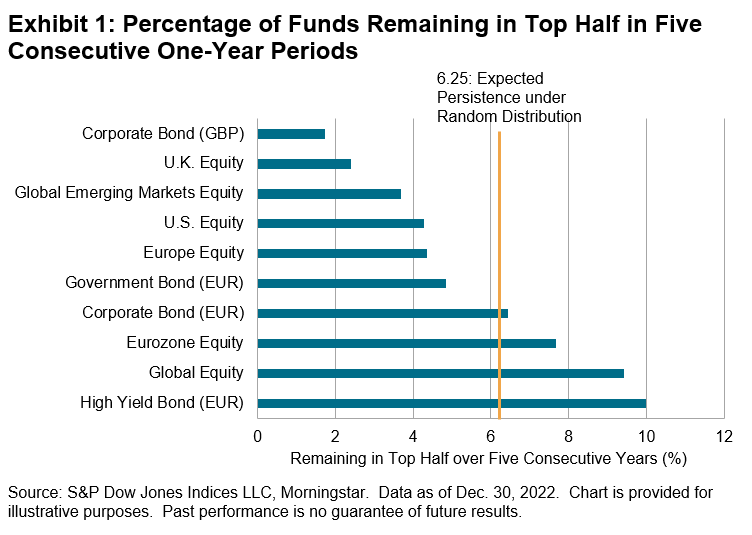

Strong theoretical arguments and extensive empirical data support the expectation that most active managers should underperform most of the time. But most active managers are not all active managers, and most of the time is not all of the time. When we observe active management success, how can we tell whether it is the product of genuine skill or merely the result of good luck? One answer is that results produced by genuine skill are likely to persist, while those due to luck are likely to prove ephemeral.

The Persistence Scorecard is designed to address this question. Our report for year-end 2022 finds little evidence of persistent active management success, despite considering a variety of metrics and lookback periods. Exhibit 1 illustrates the general point, using 10 years of return data for U.S. equity managers.

Following Report 6, we consider the above-median managers in each fund category for the first five years, and then ask what fraction of the initial set of top managers repeated their above-median performance in the second five years. If performance were completely random, we would expect 50% of the winners in the first five years also to win in the second five years; if substantially more than 50% of the winners repeated in the second interval, that might be evidence of consistent skill. Results, however, fell well short of this mark.

Sign up to receive updates via email

Sign Up

Report Highlights

Results of the U.S. Persistence Year-End 2022 Scorecard are broadly consonant with those of prior years, despite 2022’s relatively benign environment for active U.S. managers. A declining market, the underperformance of mega-cap stocks, record sectoral spreads and above-average dispersion all militated in favor of active management, and yet 51% of large-cap U.S. equity funds lagged the S&P 500®. That most active managers underperformed in what might have been a favorable milieu helps explain why consistent value added, while much desired, is seldom observed.

− Only 5% of the above-median large-cap active equity funds in calendar year 2020 remained above median in each of the two succeeding years. (If outperformance were purely random, we would expect a 25% repeat rate.) We see similar results for other fund categories (see Report 1).

− Of 2020’s top quartile large-cap funds, none continued in the top quartile for the next two years (versus 6.25% random expectation). These results were echoed in other fund categories (see Report 1).

− Consistent value added was just as elusive as consistently good peer group rankings. Outperformance by active managers in 2020 did not predict outperformance in the two subsequent years (see Report 1b).

− Results for active fixed income managers were somewhat better than for their equity counterparts, although still typically below the level suggested by chance (see Report 7).

− We continue to find evidence of persistence at the unfavorable end of the distribution. For example, 28% of all fourth quartile U.S. equity funds (based on 2012-2017 performance) were merged or liquidated within the next five years. The comparable figure for top quartile funds was only 10%. Results for active fixed income funds were similar (see Reports 5 and 11).