Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Nov, 2024

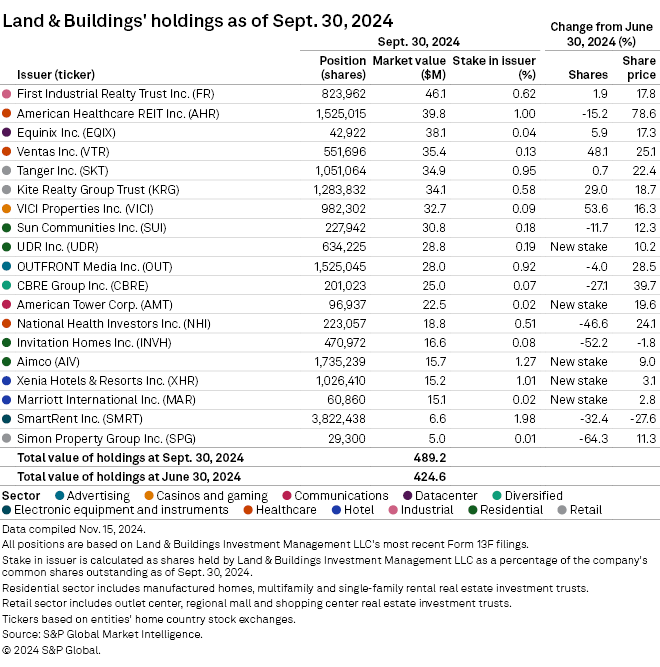

Activist investor Land & Buildings Investment Management LLC grew its share count in casino real estate investment trust VICI Properties Inc. by 53.6% during the third quarter to 982,302 shares owned, a holding valued at $32.7 million as of Sept. 30, according to the investor's most recent Form 13F filing.

The investment firm also upped its stake in Ventas Inc. by 48.1%, growing its value held in the healthcare REIT to $35.4 million as of quarter-end.

Initiations, position increases

Land & Buildings increased its share count in six of its existing positions during the third quarter.

In addition to its stake increase in VICI Properties and Ventas, the activist investor grew its share count in shopping center REIT Kite Realty Group Trust by 29.0%, which was valued at $34.1 million at quarter-end.

Other positions in which Land & Buildings increased its stake included datacenter REIT Equinix Inc., by 5.9%, as well as industrial REIT First Industrial Realty Trust Inc. and outlet center REIT Tanger Inc., by 1.9% and 0.7%, respectively.

– View Land & Buildings' holdings history.

– Set email alerts for future Data Dispatch articles.

– For further institutional investor research, try the Investor Targeting tool.

During the third quarter, Land & Buildings purchased new stakes in five companies.

UDR Inc. marked Land & Buildings' largest new initiation of the quarter, with the firm purchasing 634,225 shares in the multifamily REIT, a position valued at $28.8 million as of Sept. 30.

The firm also purchased 96,937 shares in communications REIT American Tower Corp., valued at $22.5 million at quarter-end.

Other new additions to the firm's portfolio included multifamily REIT Aimco, hotel REIT Xenia Hotels & Resorts Inc. and hotel operating company Marriott International Inc.

Exits, position decreases

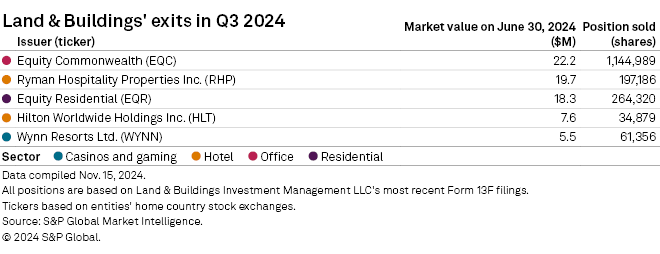

Land & Buildings trimmed its share count in eight of its positions and exited another five.

The firm's largest exit in the quarter was office REIT Equity Commonwealth, a position valued at about $22.2 million in the second quarter.

Land & Buildings also sold out of hotel REIT Ryman Hospitality Properties Inc. The firm held 197,186 shares in Ryman Hospitality the quarter prior, valued at approximately $19.7 million.

The firm's other exits included multifamily REIT Equity Residential, hospitality company Hilton Worldwide Holdings Inc. and casino-oriented Wynn Resorts Ltd.

Among the firm's remaining positions, Land & Buildings sold 64.3% of its stake in regional mall REIT Simon Property Group Inc., bringing it down to the firm's smallest position, valued at $5.0 million.

Land & Buildings also sold more than half of its share count in single-family rental REIT Invitation Homes Inc., a position valued at $16.6 million at quarter-end.

The firm sold 46.6% of its stake in healthcare REIT National Health Investors Inc., as well as 32.4% of its share count in real estate technology company SmartRent Inc.

Other positions in which Land & Buildings trimmed down its share count included real estate services company CBRE Group Inc., healthcare REIT American Healthcare REIT Inc., manufactured home REIT Sun Communities Inc. and advertising REIT OUTFRONT Media Inc.

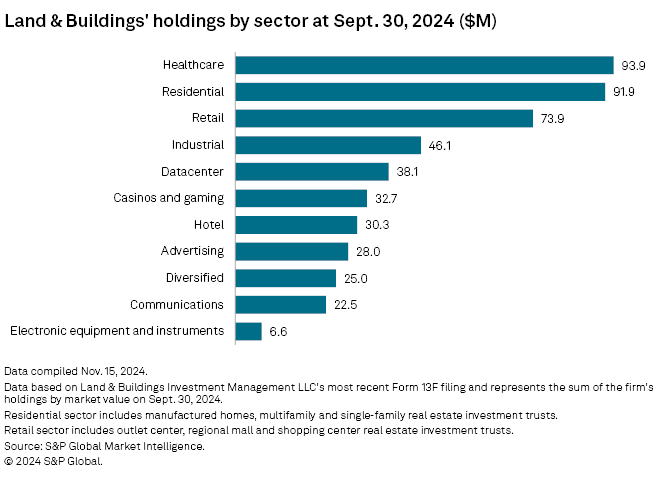

Holdings by sector

By property sector, Land & Buildings held the largest exposure to healthcare REITs at $93.9 million in the aggregate.

The residential sector — which includes manufactured homes, multifamily and single-family REITs — ranked second at $91.9 million in total.

First Industrial Realty remained the firm's largest holding by market value, followed by healthcare-focused American Healthcare REIT and datacenter REIT Equinix.