Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Dec, 2021

By Karin Rives

| In response to growing pressures from investors and the business community, the U.S. Securities and Exchange Commission is expected to soon propose new climate risk disclosure mandates for publicly traded companies. Source: Chip Somodevilla/Getty Images News via Getty Images |

Corporations touting sustainability and net-zero carbon emissions goals could face more stringent reporting requirements in 2022 if and when the U.S. Securities and Exchange Commission makes good on its plan to develop a new climate risk disclosure rule.

But the new year could also bring a growing legal backlash against the SEC's efforts to provide shareholders more consistent and reliable climate information, courtesy of the conservative American Legislative Exchange Council. The influential lobby group in December finalized model legislation for Republican-led states willing to challenge a "forced imposition" of the SEC's environmental, social and governance policies.

The American Legislative Exchange Council resolution got a jump start by 16 Republican attorneys general. They warned the SEC in a joint comment on the planned rule in June that it is "hard to see how it can legally, constitutionally and reasonably assume a leading role when it comes to climate change."

"Bending to the will of activist investors and money managers to compel climate-related disclosures, especially ones that favor 'green' companies or punish 'brown' ones, will lead to failure," Missouri Attorney General Eric Schmitt added in a separate comment. Schmitt cautioned the SEC from moving away from its long-standing practice of filtering out reporting that is not "material" to a company's performance during the past year.

Some legal experts believe that the new SEC mandates will be litigated, potentially delaying implementation for several years.

"I think the materiality standard ... will be one avenue that parties use to fight the climate disclosure rules," said Jose Abarca, an attorney with Armstrong Teasdale who has represented corporate clients in climate-related and government cases. "The argument there is that companies already have to disclose material risks to their business so if climate change poses a material risk to their business, they are already obligated to disclose those risks."

Critics of the SEC rule could also challenge the disclosure mandates under the Administrative Procedure Act, which allows courts to vacate agency rules they find to be arbitrary and capricious, Abarca said in an email.

The growing opposition to the agency's planned rulemaking has surprised proponents who argue that the SEC is merely responding to investor demands. In fact, American Legislative Exchange Council leadership of state legislators specifically said it is dedicated to limited government and free markets, investor advocates noted.

"Red-state politicians who don't support disclosure don't seem to be paying attention to capital market signals," said Heidi Welsh, executive director of the Sustainable Investments Institute, which tracks corporate sustainability trends. "This is odd since they theoretically are champions of the free market and theoretically should honor its demands. [It] seems hopelessly out of touch with what investors, actual capitalists, want and what companies are doing in real life."

Corporations, investors favor rule

According to the SEC rulemaking agenda, the agency was supposed to propose the new climate change disclosure rule before the end of 2021, after failing to meet an initial October deadline. The proposal is now expected to be unveiled during the first quarter of 2022.

Then-acting SEC Chair Allison Herren Lee first ordered a review of corporate climate disclosures in February, just a month after the Biden administration took over. A few weeks later, Lee asked investors and others with a stake in the matter to comment on the review.

Most of the 6,000-plus comments filed as of Dec. 29 appear to favor the idea of requiring companies to use consistent methodologies when reporting greenhouse gas emission reduction goals or other climate-related initiatives. Large corporations, such as Delta Air Lines Inc. and HP Inc., along with investor and environmental groups, have weighed in with specific recommendations on how the new rule should be shaped.

So did the World Economic Forum, commenting on behalf of Bank of America Corp., Dell Technologies Capital Inc. and six other large corporations.

"Reporting standards and guidance are essential for a company's investors as well as to management and the board, and we recognize that the reporting landscape currently has become complex and fragmented," the forum wrote.

Is climate change 'material'?

Shareholders today are demanding more accountability from corporations on issues that others say go beyond a company's core business — such as its diversity hiring practices or long-term environmental impact. The debate over this "materiality" principle in U.S. securities laws has also engaged lawmakers in Congress from both parties.

More than 20 Republican members of Congress commenting on the impending disclosure rule reminded the SEC that it is required by federal law to limit corporate reporting to issues that are relevant to a specific company, rather than imposing "one-size-fits-all, uniform mandates" for an issue as complex as climate change.

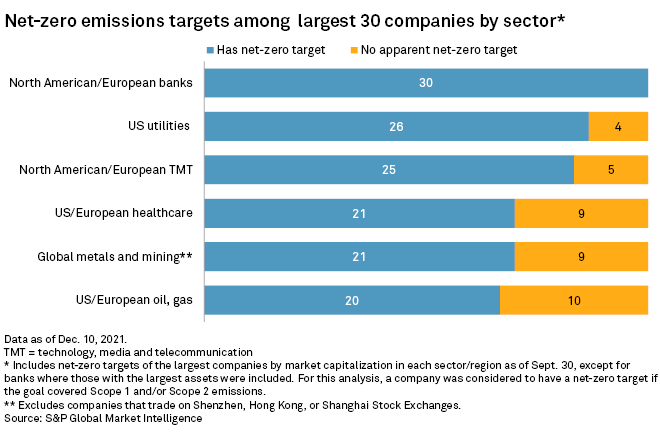

SEC officials counter that investors want to know if publicly traded companies are truly planning for a warming planet, especially as they set net-zero emissions goals for their businesses.

Net-zero pledges "underscore the loud, repeated and sustained calls for decision-useful metrics — metrics calculated using reliable and comparable methodologies that enable investors to decide whether the companies mean what they say," SEC Commissioner Caroline Crenshaw, a Democrat, told a Dec. 14 event organized by the Sierra Club and Center for American Progress. "That is a core purpose of the SEC's disclosure obligations."