Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Nov, 2024

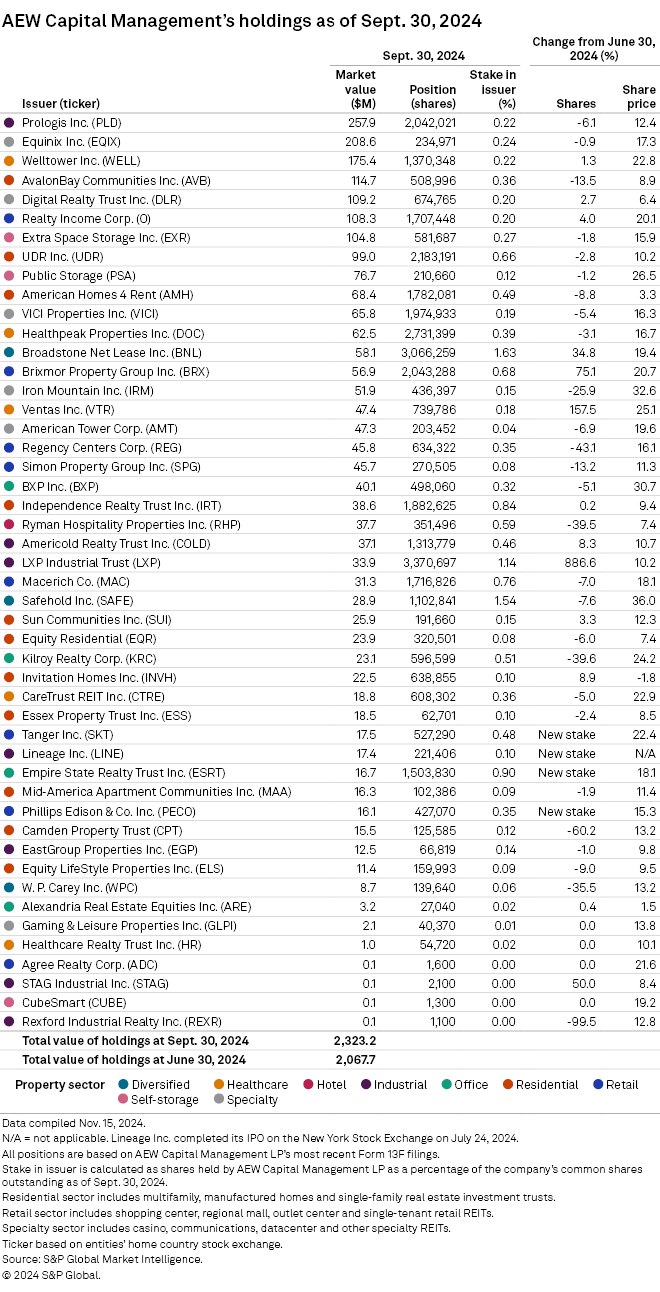

AEW Capital Management LP added four new stakes and bolstered share counts in 13 of its real estate investment trust positions during the third quarter.

The investor's total REIT holdings grew 12.4% sequentially to roughly $2.32 billion in the third quarter, as share prices of almost all of its positions increased, according to AEW's latest Form 13F filing.

New additions

AEW added four new positions to its REIT portfolio in the third quarter. The largest addition was outlet center-focused Tanger Inc., valued at about $17.5 million as of Sept. 30.

Just in the second quarter, the firm sold out of its position in the outlet center REIT, which was the firm's 31st-largest holding as of the first quarter.

The investor also bought 221,406 shares of Lineage Inc., a position valued at $17.4 million at quarter-end. Lineage is a new publicly traded industrial REIT that completed its IPO July 24.

The two other additions to AEW's investment portfolio were office REIT Empire State Realty Trust Inc., valued at $16.7 million, and shopping center-focused Phillips Edison & Co. Inc., worth approximately $16.1 million.

Substantial stake increases in LXP Industrial, Ventas

In addition to the new stakes, AEW also raised share counts in 13 of its existing REIT positions during the third quarter.

The firm upped its stake in industrial-focused LXP Industrial Trust by more than ninefold, valued at $33.9 million. This increase propelled the industrial REIT's ranking to AEW's 24th-largest holding as of Sept. 30.

AEW also more than doubled its stake in healthcare REIT Ventas Inc., which jumped 18 places from the previous quarter's ranking to become AEW's 16th-largest holding as of Sept. 30, valued at $47.4 million.

The firm also increased its share counts in three other REITs by more than 30%: shopping center-focused Brixmor Property Group Inc. at 75.1%, industrial REIT STAG Industrial Inc. at 50% and diversified REIT Broadstone Net Lease Inc. at 34.8%.

– Set email alerts for future Data Dispatch articles.

– For further institutional investor research, try the Investor Targeting tool.

– View AEW Capital Management's holdings history here.

Essential Properties Realty exit; over 10% cutbacks in 9 other REITs

AEW sold out its stake in single tenant REIT Essential Properties Realty Trust Inc. during the third quarter, a position valued at $28.5 million at the end of the second quarter.

In addition to this full exit, the investor also pared share counts in 27 of its REIT holdings, nine of which were down by more than 10%.

AEW substantially sold its shares in industrial REIT Rexford Industrial Realty Inc., keeping only 1,100 shares as of quarter-end, valued at $55,341.

The firm sold 60.2% of its stake in multifamily-focused Camden Property Trust. It slashed more than 30% of its shares in shopping center REIT Regency Centers Corp., office-focused Kilroy Realty Corp., hotel landlord Ryman Hospitality Properties Inc. and diversified REIT W. P. Carey Inc.

Similarly, AEW's stakes in information storage-focused Iron Mountain Inc., multifamily REIT AvalonBay Communities Inc. and regional mall landlord Simon Property Group Inc. were all down more than 10%.

Top holdings

Industrial REIT Prologis Inc. remained the firm's largest holding by market value as of Sept. 30, at $257.9 million.

Datacenter REIT Equinix Inc., valued at $208.6 million, and healthcare-focused Welltower Inc., valued at $175.4 million, were the firm's second- and third-largest holdings as of quarter-end.

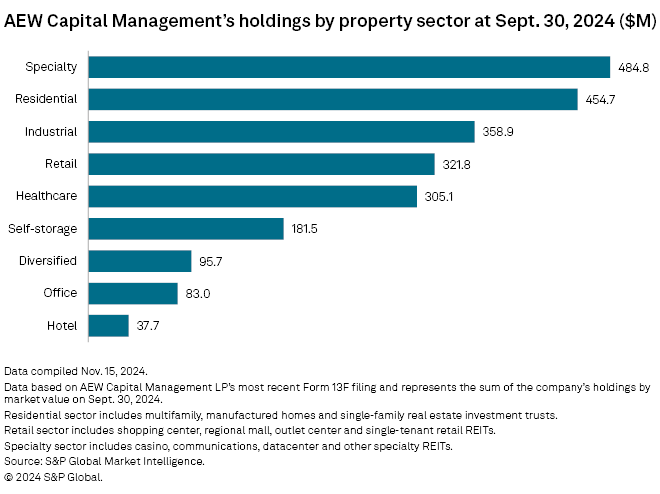

By property sector, AEW held the biggest exposure to the specialty sector — consisting of casino, communications and datacenter REITs — at $484.8 million in the aggregate.

The residential sector, valued at $454.7 million, and industrial sector, valued at $358.9 million, followed.