Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

PODCAST — Jun 16, 2022

Key Observations:

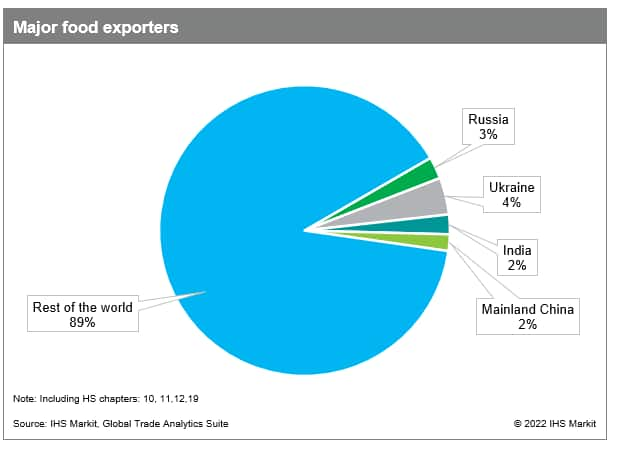

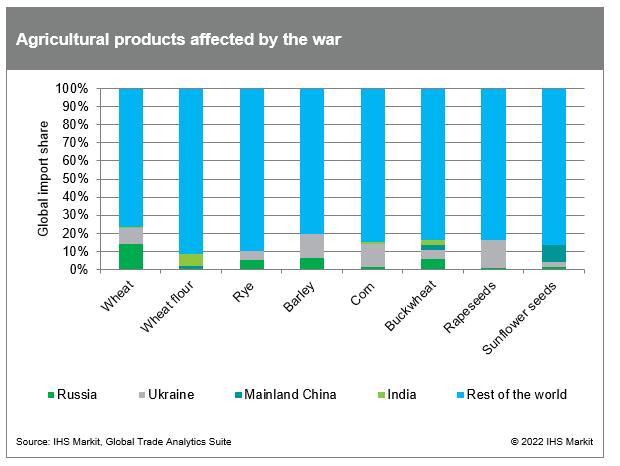

Russia's unexpected invasion of Ukraine continues to send shockwaves through global markets and put increasing inflationary pressure on the entire agricultural industry. One the one hand, food prices are directly affected by disrupted supply from Ukraine and import restrictions for Russian goods in many markets. Russia and Ukraine hold key positions in global food markets, accounting for around 7% of total exports, and together were responsible for around 21% of global wheat exports in 2021.

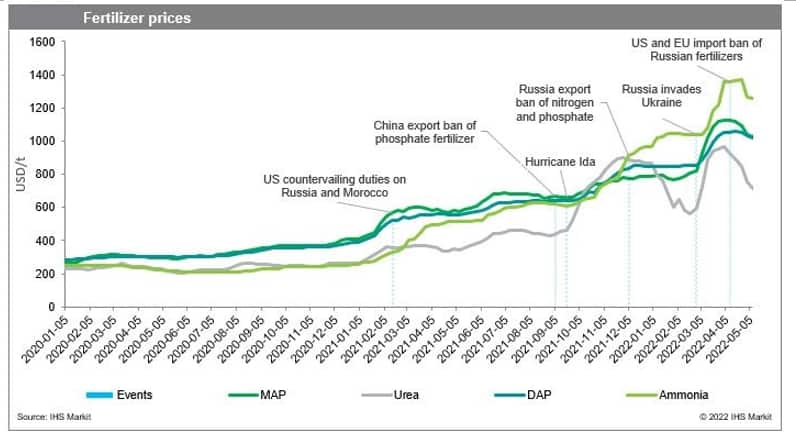

On the other hand, food prices face additional inflationary pressure from rising fertilizer prices. This double burden also relates to the conflict as Russia and Belarus are major exporters of nitrogenous, phosphatic, potassic, and mixed fertilizers. This indirect price effect from fertilizers likely causes more concern than the direct effect of reduced food exports as Russia's and Belarus' share in global markets is larger and scarce availability of fertilizers impedes agricultural production globally.

The response of fertilizer markets to the conflicts has been tremendous. In the first month after the invasion, fertilizer prices increased on average by 40% compared to their pre-conflict levels. While this illustrates the dependency of global markets on Russian supply, it is important to highlight that the conflict only adds to a series of events, which led to a surge in fertilizer prices over the past two years.

As in the above chart, fertilizer prices have experienced an upward trend since the beginning of 2021, which has been fueled by rising input prices (gas for ammonia production), supply chain disruptions (hurricane Ida), and trade policy. The latter is of particular interest as it showcases the high degree of uncertainty already present in fertilizer markets before the conflicts. In early 2021, the United States imposed countervailing duties on excessively subsidized Russian and Moroccan phosphate imports. Over the course of 2021, mainland China and Russia then imposed bans on their own fertilizer exports to ensure sufficient supply in domestic markets, which put additional pressure on global fertilizer markets. Russia's invasion of Ukraine, therefore, only added to an already strained market by increasing fertilizer input costs and inducing key destination markets such as the European Union and the United States to ban any imports of Russian fertilizers.

This column is based on S&P Global Market Intelligence GTAS data. The full version of the article is available for our clients on Connect platform. For more details about GTAS, please visit the product page.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 16 June 2022 by Philipp Ludwig, Data Analytics Apprentice, GTAS Forecasting, Maritime, Trade & Supply Chain, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?