Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Apr, 2022

By Heike Doerr

Introduction

Across the investor-owned water utility universe tracked by Regulatory Research Associates, total capital expenditures are expected to increase 7.3% in 2022, continuing a long-term trend of accelerating investments.

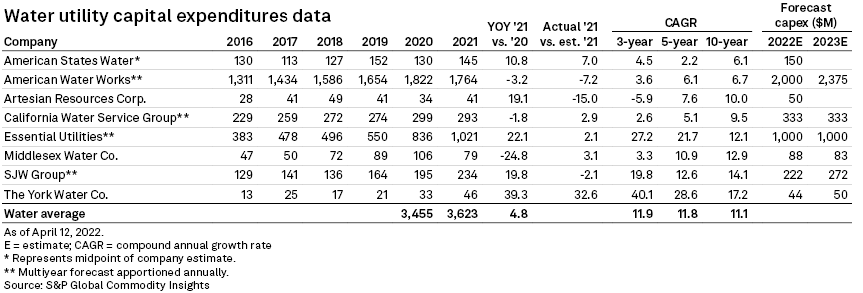

* Total capital expenditures for RRA-monitored water utilities have grown at a 10-year compound annual growth rate of 11.1% and are expected to increase 7.3% in 2022 to over $3.9 billion. In 2021, capital expenditure growth averaged just 4.8%.

* American Water Works Co. Inc., which represents approximately half of the segment's expected 2022 capex at $2 billion in spending, expects to spend $11.5 billion to $12 billion for infrastructure improvements in its regulated businesses over five years.

* The water utility sector has been accelerating its capital spending budgets for decades. The group continues to outpace electric and multi-utilities on a capital expenditure to depreciation and amortization basis and its spending rate is similar to the gas utility level, which began to accelerate in the last decade.

After banner capex growth in 2020, fueled by Essential Utilities' acquisition of People's Natural Gas and SJW Group's inclusion of Connecticut Water's capex spending, capex was more modest in 2021, growing just 4.9%.

The largest multistate water utilities, American Water and Essential Utilities Inc., have the flexibility to adjust their capital budgets to absorb larger projects by scaling back on replacement capital projects in those years.

The three California-based water utilities, American States Water Co., California Water Service Group and SJW Group have greater capex visibility than most of their peers, as their investment programs are approved in rate cases, which are forward-looking and span three years.

The smallest utilities, in contrast, Artesian Resources Corp., Middlesex Water Co. and The York Water Co. see greater swings in their capex budgets, associated with the timing of individual projects and provide little in the way of capex forecasts, though that has improved somewhat in recent years.

American Water Works Co. expects to spend $2 billion, representing approximately half of the segment's expected 2022 capex. In November 2021, the company increased its five-year capital expenditure forecast and now expects to spend $11.5 billion to $12 billion for infrastructure improvements in its regulated businesses. The company expects to invest between $28 billion to $32 billion over the next 10 years.

Notable below, individual company growth forecasts span a wide range, as large multiyear projects from smaller companies can meaningfully swing the capital spending outlook from year to year.

Aquarion Co., the water utility subsidiary of Eversource Energy, comprises just 5% of the company's total capex budget, however, the investment is expected to increase from $110 million in 2019 to $206 million in 2026. Eversource continues to expand its presence in the water sector since the acquisition of Aquarion in December 2017. Most recently, on March 7, the company announced the acquisition of The Torrington Water Co. in a stock-for-stock transaction valued at around $80 million. Acquisitions such as this one are likely to further drive the company's capex budget for the sector higher.

Capex ratio analysis

When utility capital expenditures outpace depreciation, the general implication is that the utility is growing its rate base. In the past three years, the group has posted capex/depreciation ratios in a range of 2.16x to 5.24x. The smaller water utilities are prone to larger swings in their capex budgets, as large projects can have a meaningful impact for a few years. Excluding the three smallest stocks, the water utility CapEx/D&A ratio has averaged 3.02x to 3.12x over the past five years.

This is well above the ratio of electric and multi- utilities, which have ranged on average between 2.1x and 2.4x over the same time period. The average capex ratio for gas utilities has grown, somewhat unevenly, since 2010, reaching a high of 3.6x in 2019. The noteworthy climb in the ratio is a result of the adoption of accelerated infrastructure replacement programs, similar to the distribution system improvement charge that water utilities utilize across 22 jurisdictions.

The water utility sector has been accelerating its capital spending budgets for decades. No water utility has had a capital expenditure to depreciation and amortization, or capex/D&A ratio below 1.0x dating back to 2000. Over the past 10 years, the lowest capex/D&A ratio across the group was 1.58x for American States Water in 2012. During that year, the company decreased its capex spending due to uncertainty surrounding the company's pending water and electric general rate cases, both of which were delayed. The largest capex/D&A during the same time period was 5.24x for York Water last year.

Comparing capital expenditures to operating cash flow, or capex/OCF, can provide a window into how companies may fund their investments. As a company's capex/OCF ratio rises above 1.0, the implication is that the company is increasingly likely to require new external financing. However, operating cash flow can be meaningfully impacted by a variety of factors, including prepayments and other one-time events, and therefore should not be considered by itself as an indicator of the need for external funding.

For water utilities, the capex/OCF ratio has fluctuated for similar reasons as the capex /D&A ratio, driven by spending changes by the smaller utilities. Over the past five years, the capex/OCF ratio for water utilities has been in a band of 0.78x to 1.27x.

York Water, which posted the second-highest capex/OCF ratio in 2021, recently completed a follow-on equity offering, which raised $40.0 million and is intended to be used to finance general corporate purposes, including its capital investment program, repayment of outstanding debt and potential acquisitions.

Broader utility capex also accelerating

Projected 2022 capital expenditures for the 47 energy utilities, included in the RRA publicly traded U.S.-based universe, currently exceeds $154.2 billion, well above the $131.8 billion of actual investment spent in 2021 by the same companies. Much of the increased outlays are driven by federal support for infrastructure investment that was approved by Congress and signed into law late in 2021.

Multiple drivers are expected to impel elevated spending over the next several years. Pent-up demand to replace and modernize aging infrastructure, renewable portfolio standards of multiple states — that include large expansions in low-carbon energy generation capacity — continue to ramp up. Also, federal infrastructure investment plans that are intended to steer conversion of the nation's power generation network to zero-carbon sources by 2035 will come to fruition.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.