Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Aug, 2017 | 16:15

Highlights

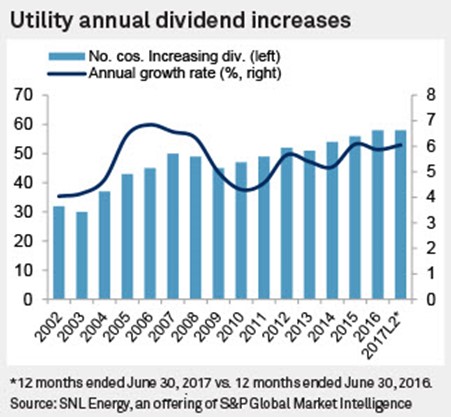

The average dividend growth rate for the 12 months ended June 30, 2017 by the 58 RRA-covered utilities that increased their dividends — now including the nine publicly traded water utilities — was 6.0

The following post was written by research groups within our energy offering, including Regulatory Research Associates, or RRA. For further information on the full reports, please request a call.

The number of utilities increasing dividends has generally trended higher since 2003, when 30 utilities raised dividends. The pace and regularity of growth has been considerably more stable in recent years, compared with the early-to-late 2000s, when companies were recovering from a turbulent period, during which dividend reductions, and subsequent large increases, were not uncommon. Steady profit growth amid overall financial strength throughout the industry have been the driving forces behind the improved results in this study.

ONE Gas Inc., the largest natural gas distributor in Oklahoma and Kansas, increased its dividend by the largest percentage in the 12 months ended June 30, to $1.54 per share from $1.30 per share for the 12 months ended June 30, 2016. Management has provided guidance that forecasts 8%-10% annual dividend hikes between 2016 and 2021, with a target dividend payout ratio of 55%-65%.

Edison International was also among the top dividend-raising companies over the past twelve months, with a 14% increase to $2.05 per share, as it aims to increase its payout ratio above the low end of its target range of 45% to 55%.

Dividend increase averages in this report were calculated by summing the nominal dividends paid by all companies in our index and then computing the total's percentage change.

Already a client? See the full report for additional details.