Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 01, 2022

By Rajiv Biswas

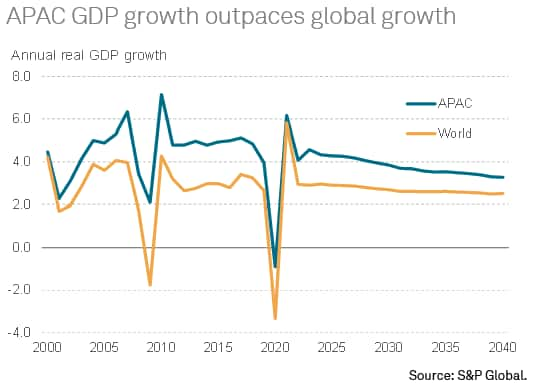

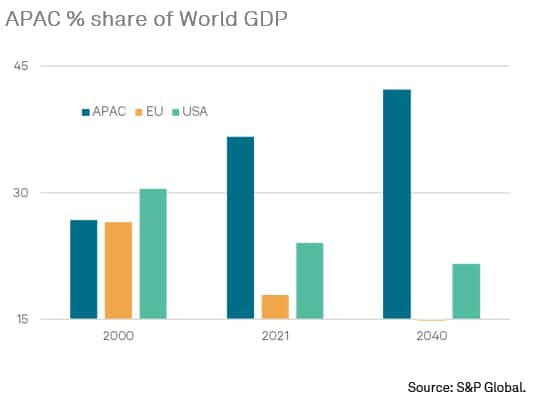

Over the past two decades, the Asia-Pacific (APAC) region has played an increasingly important role in the world economy. The weight of APAC in global GDP has risen from around 27% in 2000 to around 37% by 2021. This has resulted in a substantial rebalancing of the global economy from West to East, driven heavily by the rapid increase in the size of China's economy.

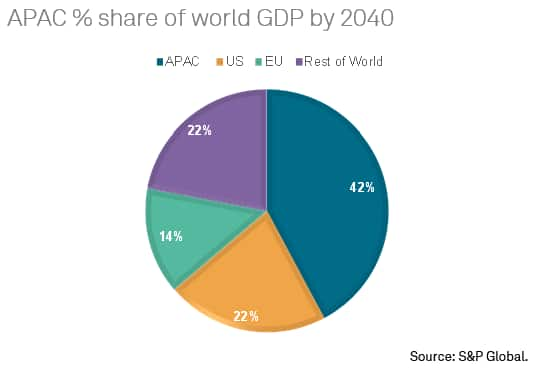

By 2040, the economic weight of the APAC region is forecast to rise further to around 42% of world GDP, driven mainly by the further economic expansion of China, India and the ten Southeast Asian countries comprising ASEAN. The rising economic weight of APAC has far-reaching economic implications, notably due to the growing economic importance of APAC consumer markets as drivers of world demand growth.

The total GDP of the APAC region has risen from 9 trillion in 2000 to 35 trillion by 2021, with APAC now accounting for around 37% of world GDP. Since 2000, the weight of APAC in world GDP has increased by 10 percentage points, which is a relatively rapid upwards shift in the share of the APAC region in the global economic pie.

In contrast, the weight of the European Union (EU) has declined significantly, from 26.5% of world GDP in 2000 to 17.9% in 2021, with the UK "Brexit" from the EU having accelerated the relative decline in the overall weight of the EU. Even if UK GDP is added to the EU total, the share of EU plus UK in world GDP in 2021 is 21.3%, which is still significantly lower than in 2000. The weight of the US in world GDP has also declined from 30.5% in 2000 to 24.1% by 2021, albeit still significantly larger than China.

The rapid growth of China's economy over the past two decades has been a major driving factor for the increasing economic weight of APAC in the world economy. China's weight in world GDP has risen from 3.6% in 2000 to 18.6% by 2021, measured in nominal USD terms. During the same period, Japan's relative economic weight in the world economy has declined from 14.8% in 2000 to 5.2% in 2021, as the impact of demographic ageing and rising government debt levels have acted as a structural drag on the pace of Japan's economic growth over the past two decades. Consequently, there has been a very significant economic rebalancing within the APAC region, with the growth in the size of China's economy outweighing the declining relative weight of Japan's economy.

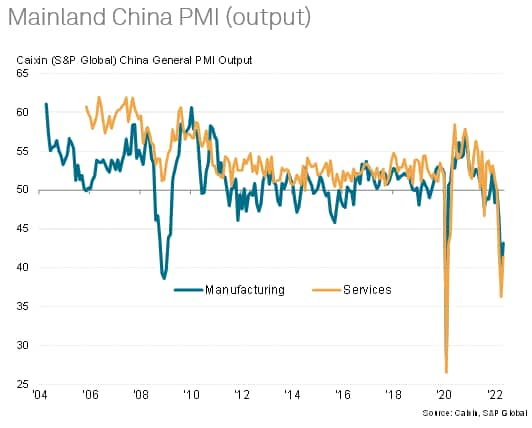

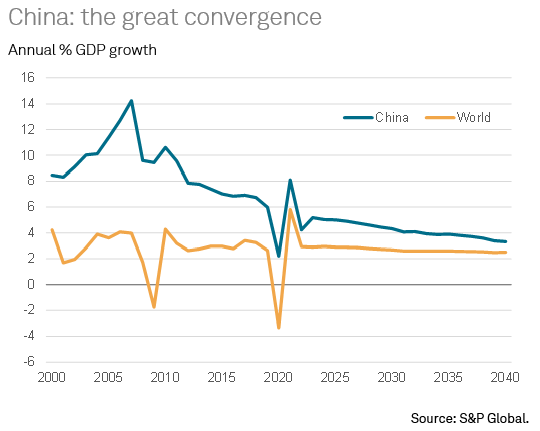

However, the pace of China's economic growth has also slowed significantly since 2010, as ageing demographics and the declining marginal productivity of capital have contributed to a gradual moderation in the pace of growth. The COVID-19 pandemic has also created tremendous disruptions to the pattern of economic growth during 2020-2022.

As China's ageing demographics increasingly impact on the nation's long-term potential growth rate, the outperformance of Chinese economic growth relative to world growth is expected to gradually narrow over the next decade and beyond. Whereas China's GDP growth rate significantly exceeded world GDP growth over the period from 2000-2021, this gap is forecast to narrow significantly over the next two decades.

This will result in a levelling out of China's share of world GDP, at around 20.6% of world GDP by 2040 based on latest long-term growth forecasts, which is only slightly higher than its share of world GDP in 2021.

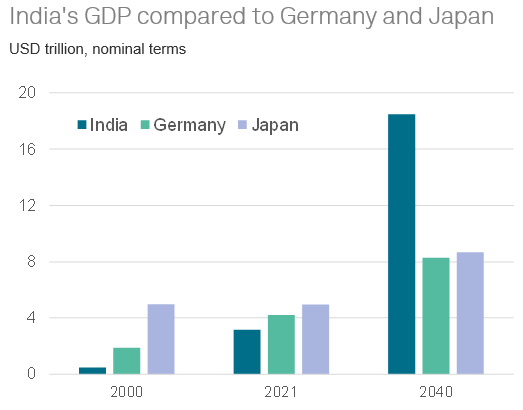

In 2021, India's GDP marginally exceeded UK GDP, making India the world's fifth largest economy. Unlike China, India has a relatively youthful demographic profile, which will help to underpin India's long-term growth rate over the next two decades.

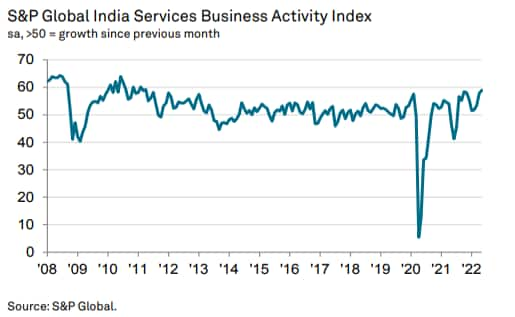

Although India's relatively rapid pace of economic growth in the past decade was heavily disrupted due to the COVID-19 pandemic in 2020-21, rapid growth is expected to resume over the medium-term outlook. Latest S&P Global PMI survey data for India indicate that a strong economic rebound has been underway during the first half of 2022.

Service sector growth continued to strengthen in May 2022, with companies reporting the quickest increase in business activity since April 2011. The upturn was supported by a substantial pick-up in new business growth as demand continued to recover following the reopening of the economy after COVID-19 lockdowns.

Over the past two decades, the size of India's economy has risen from 1% of world GDP in 2000 to 3.3% by 2021 and is projected to rise further to 7.4% by 2040. By 2040, India's GDP is projected to overtake both Germany and Japan, which would place India as the world's third largest economy after the US and China.

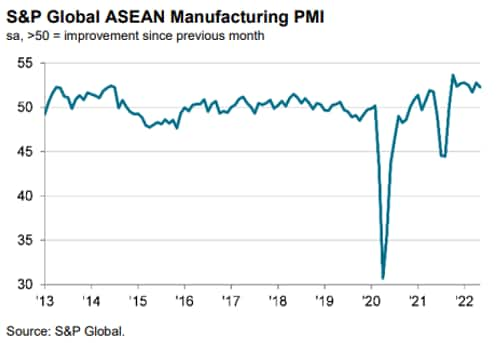

The ASEAN region comprising 10 nations of Southeast Asia had a combined GDP of USD 3.3 trillion in 2021, amounting to 3.4% of world GDP.

Improving domestic demand in ASEAN has helped to support the rebound in economic growth momentum during the first half of 2022, despite the global headwinds from the Russia-Ukraine war, rising inflation and China's economic slowdown. Over the long-term, despite the protracted negative economic shocks caused by the COVID-19 pandemic, the ASEAN region is expected to continue to be one of the fastest growing regions of the world economy. This rapid pace of growth will be driven by both exports and domestic demand.

Over the next two decades, ASEAN's exports will be boosted by strong growth in exports to other fast-growing Asia-Pacific markets, notably China and India. Mainland China and Hong Kong SAR together accounted for 22.6% of ASEAN exports of goods in 2020. Intra-ASEAN trade is also increasingly important, with intra-ASEAN exports accounting for 21% of total ASEAN merchandise exports in 2020.

Domestic demand will also be an increasingly important growth driver, as the rapidly growing consumer markets of populous ASEAN nations, notably Indonesia, Philippines and Vietnam, help to drive consumption spending. Strong investment expenditure will also be an important factor supporting growth, through a combination of rapid growth in public infrastructure spending, strong private investment growth and buoyant foreign direct investment inflows.

Helped by this combination of growth drivers, total ASEAN GDP measured in nominal USD terms is forecast to more than quadruple over the next two decades, increasing from USD 3 trillion in 2020 to USD 13.3 trillion by 2040. This will make the combined GDP of the ASEAN economies much larger than the GDP of Japan or Germany by 2040, highlighting the increasing importance of ASEAN region as one of the world's largest consumer markets. By 2040, ASEAN's share of world GDP is projected to increase to 5.4% of world GDP.

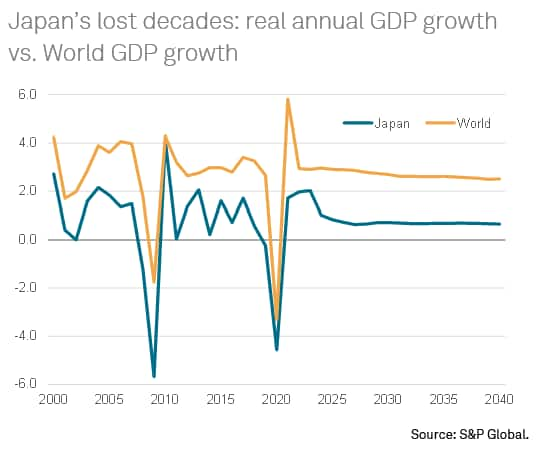

APAC's rising share of world GDP has occurred at a time when Japan's share of world GDP has been falling dramatically. Between 2000 and 2021, Japan's GDP measured in nominal US dollar terms showed no increase. Ageing demographics has been a key factor contributing to this decline, with Japan's population having contracted each year since 2010, with 11 successive years of population declines recorded by 2021. The total decline in Japan's population in the year to October 2021 was 644,000 persons, with the total population at 125.5 million, compared with 128 million in 2010. Furthermore, the demographic profile of Japan's population is also ageing, with the population of working age having fallen to 59.4% by 2021.

According to Japan's National Institute of Population and Social Security Research medium fertility population projection, Japan's population will decline to around 111 million by 2040, down a further 14.5 million persons compared with 2021. Such severe population decline and demographic ageing are having far-reaching consequences for Japan's economy and labour force, with its share of world GDP projected to decline further by 2040.

Japan's very high and rising levels of government debt have also acted as a long-term drag on economic growth, as fiscal consolidation has been a key government economic policy priority.

Japan's declining share of world GDP as measured in US dollar terms has been compounded by exchange rate effects during the past decade, as the Japanese yen has depreciated from 88 per USD in 2010 to 110 by 2021, with an even more severe depreciation to 135 per USD by mid-2022.

The weight of the APAC region in world GDP has risen from 27% in 2000 to 37% by 2021, with a further increase to 42% projected by 2040. This economic shift from West to East has far-reaching implications for multinationals worldwide, as APAC consumer markets become increasingly important drivers of global demand growth.

The shift in economic weight from West to East has reflected the rapid economic ascent of China in the world economy since 2000, as well as the declining economic weight of the EU, which has already fallen from 26.5% of world GDP in 2000 to 17.9% by 2021. Over the next two decades, the share of the EU in world GDP is expected to moderate further, to around 14.2% by 2040. Meanwhile, the role of the US in the world economy is expected to remain broadly stable, with its share of world GDP changing from 24.1% in 2021 to 21.6% in 2040.

The three main growth engines for APAC's economic growth over the next two decades are China, India and ASEAN. The rapid growth in household incomes of Asia's populous emerging markets of China and India will be key drivers for world consumption growth. In addition, consumer markets in populous Southeast Asian nations, notably Indonesia, Philippine and Vietnam, will also grow at a rapid pace.

However, with the APAC region, demographic ageing is having a significant impact on long-term potential economic growth for a number of APAC's largest economies, particularly in Northeast Asia. Japan is suffering the most severe impact from demographic ageing and population decline, which has already significantly reduced Japan's potential long-term growth rate. South Korea is also facing similar demographic challenges due to demographic ageing. Of greatest significance to the global economy is the gradual slowing of China's long-term potential growth rate due to its ageing population and declining marginal productivity of capital.

However, more youthful demographic profiles in other major Asian emerging markets, notably in India, Indonesia, Philippines and Vietnam, will help to mitigate the impact of ageing demographics in Northeast Asia. Consequently, overall APAC economic growth is forecast to continue to outpace global growth over the next two decades, helping to drive APAC's continued economic ascendancy in the world economy.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location