Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 05, 2023

By Matt Chessum

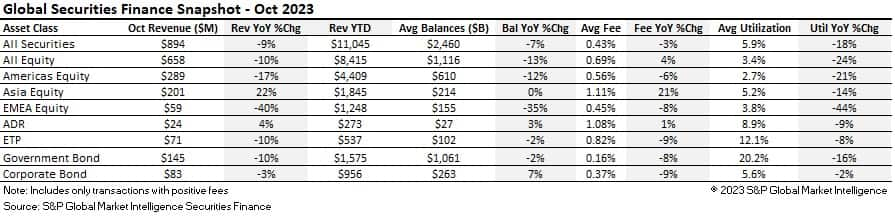

Securities lending activity generated $894M in revenues during the month of October. This is the second time this year that revenues have fallen under the $1B mark. The October figure represents the lowest amount of any month of the year so far and the lowest monthly revenue total since February 2022. Revenues across all asset classes, apart from APAC equities and ADRs, declined YoY. In the equity markets, Americas equities, which have been the main driver of revenues within the securities lending markets for many months, declined 17% YoY, whilst EMEA equities continued their slump with YoY revenue declines of 40%. Balances across equities also declined when compared YoY. Average fees across all equities did increase 4% YoY but this is due to the impressive 21% increase seen across APAC equities. Average fees fell across all other regions.

In the fixed income markets, both revenues and average fees continued to fall. Now that there is more certainty regarding future interest rate moves, pressure on fees is declining and demand is starting to soften. Balances did increase across corporate bonds over the month however, as default rates continue to rise, and companies start to react to the impact of increased financing rates.

October is always a difficult month for equity markets and this year was no exception. Equity markets across the Americas finished the month lower with the S&P 500 suffering its worst October performance for over 5 years. The Dow Jones declined 1.05%, the S&P 500 declined 1.78%, the NASDAQ declined 2.12% and the TSX60 in Canada declined just over 2.8%. A clear lack of conviction continued to dominate performance over the period and profit taking took hold. During the month, corporate earnings for the Q3 period continued to be announced, reportedly beating analyst's expectations across the S&P500 by an average of 3% (this is considered a relatively low level of outperformance). The Fed held interest rates at current levels and economic data showed that inflation was starting to take its toll on US consumer spending and that a slowdown in global demand was starting to hit sectors such as manufacturing.

Across the securities lending markets, Americas equities generated $289M in revenues which represents a decline of 17% YoY but an increase of 4.5% MoM (September revenues $276.2M). Average fees followed the same trend, increasing over the month from 54bps during September to 56bps during October, but declining by 6% YoY (October 2022 average fee 59bps). Daily volume weighted average fees increased steadily over the month. Fees started October at 58bps and finished the month at 62bps. Balances also declined over the month by 3% which was roughly in line with equity market valuations. Utilization was unchanged when compared with September but declined by 21% when compared YoY.

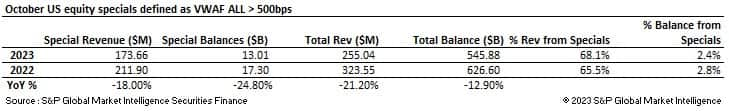

Specials activity across US equities increased over the month with revenues of $173.6M being generated. The percentage of the total revenues generated by specials activity increased over the month, rising from 63.5% during September to 68.1% during October. Specials balances followed the same upwards trend climbing from 2.2% of all balances in September to 2.4% during October. YTD specials revenues for Americas equities stood at $3.138B at the end of the month, 16% higher than at the same point during 2022.

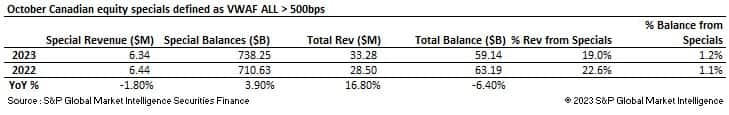

Specials activity across Canada decreased slightly over the month with specials revenues of $6.3M. The percentage of revenues generated by specials remained low at just 19%. Specials activity represented 3.9% of all on loan balances and YTD specials revenues across Canadian equities stood at $86.6M, 16% higher YoY.

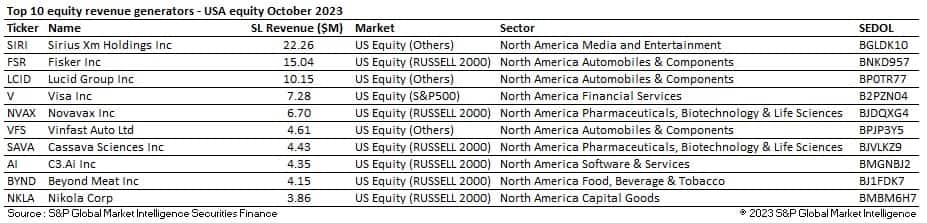

The top 10 equity revenue generators produced $82.8M during the month, 29% of all Americas equity revenues. All the names that appear in the table were reoccurring high value specials that continued to experience strong demand.

Sirius XM Holdings Inc (SIRI) took the top spot over the month. The company is heavily indebted and continually trades at a discount to its net asset value. Short sellers have been borrowing the stock in the belief that a reformulation of Liberty Media's tracking stocks (which owns a majority stake in Sirius XM Holdings Inc) may help to close this gap.

Fisker Inc (FSR) and Lucid Group Inc (LCID) took second and third place in the table as the EV sector remained in focus. The Fed announcement that interested rates would remain on hold but could still be raised by the end of the year caused several high growth EV stocks to fall, increasing their attractiveness to short sellers.

Another popular sector dominating the table, pharmaceuticals, biotech, and life sciences, saw two well known stocks generate a collective $11.13M over the month. Novavax Inc (NVAX), the developer of the COVID vaccine, has seen its share price decline since the end of the pandemic. Its product pipeline reportedly remains relatively thin with a focus on flu and COVID vaccines only, causing short sellers to target the company. Cassava Sciences Inc (SAVA) continues to suffer from a petition that was filed against it, requesting a halt to the trail of the company's new Alzheimer's drug. The company's share price continues to struggle as a result.

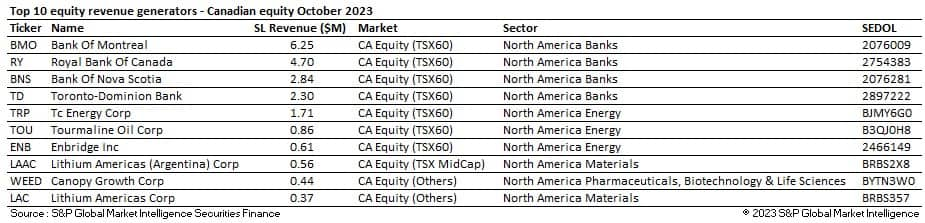

Across Canada, banks and energy companies continued to dominate the highest revenue generator table. Lithium Americas (Argentina) Corp (LAAC) and Lithium Americas Corp (LAC) both appeared in the table following the organizations separation into two independent entities. Both stocks trended lower over the month following the release of an analyst report suggesting that the Lithium market would be moving into a supply surplus during 2024/25. This news triggered to a steep decline in lithium prices across global commodity markets.

The top ten revenue generating stocks collectively produced $20.64M, accounting for 7% of all Americas equity revenues.

Equity markets declined across the APAC region during the month as selling momentum across risk assets spread across the globe. News flow was dominated by further reports that the US was looking to implement additional trade barriers to prevent Chinese companies from accessing advanced semiconductor and chipmaking equipment and the challenges faced by the Bank of Japan amid a weaking currency and recent changes to its yield curve controls. In Hong Kong, a report was released that showed that the Hong Kong stock exchange has been experiencing a slump in trading volumes over the past three years. The exchange blamed sustained high interest rates, global economic fragility, and weak market sentiment, whilst market participants blamed the knock-on effects from global investors retreat from China. Finally, the Philippine stock exchange produced guidelines on short selling transactions that will become effective following regulatory approval, opening the market to securities lending activity.

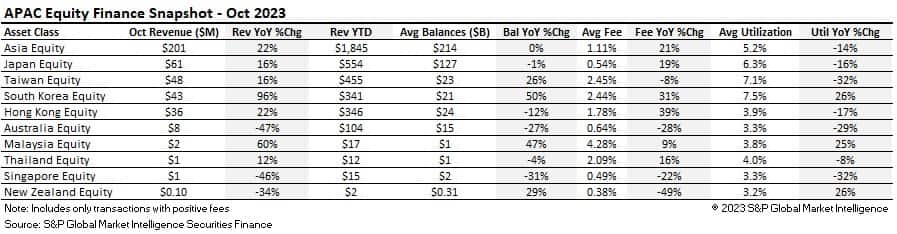

APAC equities continued to shine during the month, generating revenues of $201M and making October the second highest revenue generating month of the year so far (September revenues $225.1M). Revenues across most markets increased by double digits when compared YoY. Australia (-47%), Singapore (-46%) and New Zealand (-34%) were the only markets to see a decline. Strong revenue increases were once again seen across South Korea (+96%), Malaysia (+60%) and Hong Kong (+22%). Average fees across APAC equities increased significantly both MoM (+5%) and YoY (+21%). South Korea once again experienced a remarkable increase in average fees (+31% YoY) as did Hong Kong (+39%). Average fees across the region were the highest seen throughout the year so far. The last time average fees surpassed October's level was during December 2021 (1.12%). Utilization declined over the month dropping to 5.22% from 6.5% during September. This represented a decline of 15% YoY. The decline was caused by a 21% reduction in balances MoM.

South Korea continued to drive APAC equity revenues to multi-month highs. After peaking last month, both revenues and average fees declined MoM but continued to post impressive YoY increases. Balances were 50% higher YoY and utilization increased 26% YoY. Despite the market's revival, news of a forthcoming short selling ban has been circulating in the financial press. When questioned on the likelihood of a ban, the regulator stated that "a complete short selling ban has not been confirmed". The Financial Services Commission is expected to prepare a detailed plan to curb the practise during the week of the 6th November with final plans being drawn up before the 21st November.

In Hong Kong, revenues were driven higher by several specials linked to the property sector. October was the third highest revenue generating month of the year as revenues increased 22% YoY. Average fees declined slightly MoM, following a multi-year high during September (180bps), but remained elevated at 178bps. Despite lendable decreasing significantly over the year (-20% Jan to Oct), it remains 10% higher than during October 2022.

Despite increasingly slightly MoM, revenues in Australia continued to disappoint. Australia has experienced some of the sharpest YoY declines in revenues and average fees of any of the APAC markets throughout 2023. Despite utilization and average fees (64bps during October vs 62bps during September) increasing slightly over the month, YTD revenues generated by Australian equities remain 32% lower YoY.

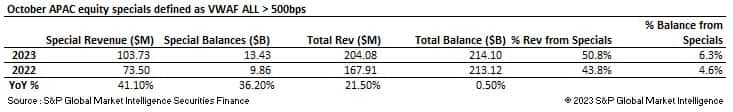

Specials activity generated $103.73M representing a 41% increase YoY and 51% of the total APAC equity revenues for the month. October was the highest specials revenue generating month of the year so far. YTD specials revenues stand 13% higher YoY ($884.4M) and during October accounted for 6% of all balances. Activity remained strong across Hong Kong, Japan, South Korea, and Taiwan.

Ecopro Co Ltd (086520) remained the highest revenue generating stock over the month. YTD this stock has generated over $58M for lenders. The stock remains popular amongst short sellers given its rapid increase in share price. Chinese property stocks continued to be popular borrows. The Hong Kong-listed shares in the Chinese property giant, Country Garden Holdings Co Ltd (2007), fell sharply after it failed to make an international debt payment, and effectively said it expects to default on its offshore debt obligations. Average borrowing fees declined over the month but remained in specials territory. Sunac China Holdings Ltd (1918), another property company, experienced some of the highest fees within the region over the month as utilization hit the 100% mark. Inventory remained concentrated amongst a small number of lenders.

East Buy Holding Ltd (1797), the new name for a stock that has appeared many times in this table previously, Kooleran Holdings Co Ltd, also made a reappearance. This tutoring company, which diversified following a ban on private tuition during weekends and holidays for children under 16 in China, introduced an e-commerce business which accounted for over 86% of the company's latest revenues. Recently, the appeal of East Buy live streaming appears to have faded with declining sales. The share price has reflected this decline, falling over 20% this year, peaking interest from directional investors.

Despite a joint venture with Jeep maker Stellantis, Zhejiang Leapmotor Technology Co Ltd (9863), which appeared in the table for the first-time during October, was another popular borrow during the month. The Chinese EV market remains competitive and following Tesla's most recent price cuts, many analysts are expecting a shakeout of those companies that are struggling to compete. Leapmotor is expected to burn through $760 million this year alone which is one reason why short sellers are watching this stock. The EV sector remains a favourite amongst short sellers as it faces an environment of intense competition and elevated interest rates.

Across the Eurozone the main equity indices also moved lower over the month with the Eurostoxx 600 declining 1.99%. European equity markets were impacted by the release of further economic data showing that Eurozone GDP contracted by 0.1% during Q3 and that composite PMIs remained contractionary in both the Eurozone and the UK. Manufacturing numbers that we released also remained subdued.

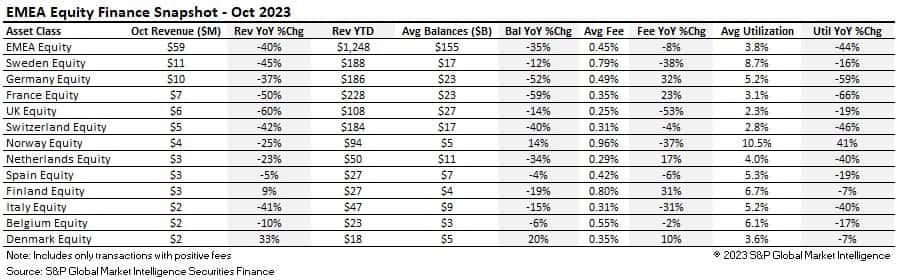

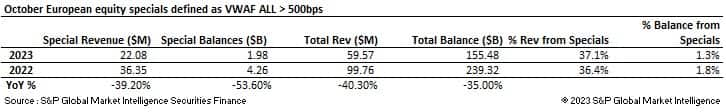

During October, securities lending revenues of $59M were generated by European equities. Revenues declined 40% YoY and 4% MoM, with October over taking September as the worst month for revenues for many years. Average fees remained at a multi-year low of 45bps during the month as balances declined 35% YoY and 6% MoM. Utilization declined to just 3.79% as a result. Most markets experienced heavy double-digit declines in revenues YoY as well as significant decreases in balances.

There were very few, if any, bright sparks to be seen across the EMA equity markets over the month. Sweden overtook Germany to be the highest monthly revenue generating country but suffered a 45% reduction in revenues YoY. Revenues in the UK (-60% YoY) and France (-50%) fell to mid-single digits and revenues across most other countries remained underwhelming. Average fees across both France (+23%) and Germany (+32%) experienced strong YoY gains but the severe decline in balances (France -59% and Germany -52% YoY) offset any potential improvement in returns. Utilization declined significantly across all countries apart from Norway.

Despite the recent poor performance of the region, revenues remain aligned to those generated at the same point during 2022. YTD 2023 $1.25B has been generated vs $1.245B during 2022.

Specials revenues declined over the month both YoY and MoM. October produced the lowest specials revenues of any month of the year so far. $22M was generated which equates to circa 37% of all revenues produced.

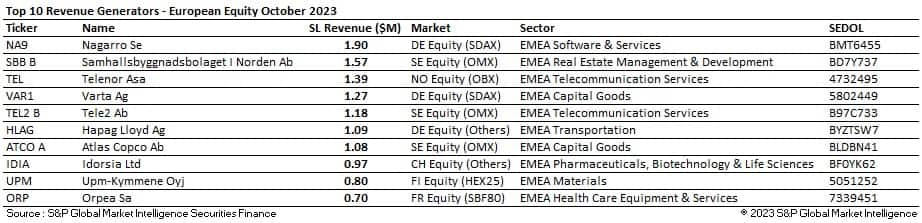

Many of the names that appear in the top revenue generator table have been present for many months. $13.48M was generated by these ten stocks which accounted for 23% of total revenues. Nagarrro SE (NA9) continued to top the table. The continued slow down within the digital engineering sector and the emergence of a short selling report accusing the company of fraud continue to weigh heavy upon the company's share price. Seasonal activity otherwise accounted for an increase in the presence of Nordic companies during the month.

ADRs generated revenues of $24.4M over the month, representing an increase of 4% YoY and 17% MoM. Average fees increased significantly during the month, rising from 90bps during September to 108bps during October. Utilization for ADRs has remained constant throughout 2023 with little change being seen MoM, when compared YoY however, as with most other asset classes, a decline can be seen.

Over the month the EV sector continued to dominate the top revenue generator table. Chindata Group Holdings ADR (CD) was a new addition to the table. The company received a non-binding buy out offer earlier in the year at a premium to its most recent price. Investors are therefore looking to borrow the shares to take advantage of the pricing discrepancy. Posco Holdings (PKX) continued to provide value for lenders. The company's share price has rocketed over recent months and some investors still believe that the company may be overvalued.

The Treasury sell-off during the month reportedly exacerbated trading difficulties across some exchange-traded funds as investors grew concerned about the future economic outlook. Investors moved their money to and from fixed-income tracker funds causing spiks in volumes across some of the largest long-dated bond ETFs, creating volatility in the market. As the economic outlook remains uncertain, as reported by S&P Global Market Intelligence, investors also appear to be re-evaluating the value of more expensive actively managed ETFs. It was reported that since the onset of the global pandemic in 2020, asset managers have launched 1,610 actively managed ETFs globally which is 40% greater than the entirety of the previous ten-year period.

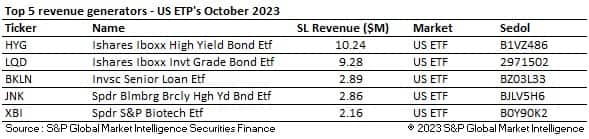

In the securities lending markets exchange traded products generated $71M in revenues (-10% YoY, +34% MoM). October was the highest revenue producing month for the asset class as average fees increased significantly when compared with September (65bps September vs 82bps October). On loan balances also increased over the month whilst lendable declined, leading to an increase in utilization which topped 12% for the first time this year. Americas ETFs was responsible for both the increase in revenues and average fees. Revenues across Americas ETFs increased by 37% MoM whilst average fees increased from 61bps to 79bps.

LQD - iShares Iboxx Investment grade Bond ETF traded increasingly special towards the end of the month pushing revenues for US ETFs higher. Volume weighted average fees topped 2% on several days during the month, increasing monthly revenues. Average balances increased 13% over the month and MoM revenues increased over 450%. As can be seen by the table, high yield and investment grade funds dominated demand across US ETFs. HYG - iShares Iboxx high yield bond ETF experienced its third highest revenue producing month (August $11.8M, March $11.4M). On loan balances increased by 2.9% over the month but average fees increased by 12.1% and revenues increased by 23.1%.

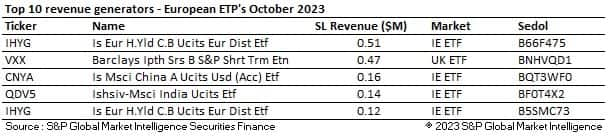

Across Europe a similar picture could be seen with IHYG - iShares European high yield UCITS EUR generating the highest revenues.

Over the month of October government bond returns were negative across several developed countries as investors heeded central banker's warnings that interest rates are likely to stay higher for longer. Bond prices fell as a result and any predicted pivots in interest rate positioning were pushed back to summer 2024.

Across the APAC region, the Reserve Bank of Australia kept rates unchanged whilst retaining a tightening bias as data continues to be monitored to evaluate the economic effects of the 4 percentage points of past hikes. The Bank of Japan loosened its yield curve controls on the 10-year bond and offered to buy circa $4.5B worth of five- and ten-year Japanese government bonds.

In the US, treasury yields remained incredibly volatile with the ten-year yield touching 5% - a level not seen since just before the 2008 financial crisis. Treasury yields across the curve hit levels not seen for many years but started to settle towards the end of the month as signs of a slowing US labour market eased concerns of the need for further rate increases - the topsy turvy world of good news being bad and vice versa remained the order of the day. Some market participants remained concerned that the bond market sell-off and increasingly tight financial conditions continue to be exacerbated by the US Federal Reserve's quantitative tightening program. The additional supply hitting bond markets is driving down prices and adding to pressure on long-term rates. Few remain optimistic that the Fed will dial back the program in response, however. This could help securities lenders heading into Q4 and year end as a liquidity premium is likely to set in.

The global sell off in government bonds also extended to Europe. The German and Italian ten-year yields reached their highest levels since 2011 as investors demanded compensation to hold long dated bonds in a higher for longer environment. Government budget deficits moved to the forefront of investors' minds during the month, following huge levels of debt issuance during the pandemic. Both the European Central Bank and the Bank of England kept benchmark rates on hold, but market participants remain less convinced than their counterparts in the US that the most recent pause translates into an end of further increases. Many believe that it may just be a pause for breath, given the stubborn levels of inflation across the region.

In the securities lending markets government bonds generated $145M in revenues which represents a decline of 10% YoY. Average fees declined to their lowest level since the beginning of the year (16bps) and utilization remained unchanged compared to September. Despite the fall in government bond prices over the month, lendable increased 15% YoY and 2% MoM. Revenues generated by US Treasuries declined by 4% YoY to $77M. Average fees declined to 16bps across the Treasury market whilst utilization increased very slightly to 19.47%.

In Europe short-dated government bonds continued to dominate the highest revenue generator table whilst longer dated bonds started to become more popular amongst borrowers in the US and Canada. The 0% 15 December 23 German government bond continued to be the most expensive borrow across the asset class.

During the month it was reported that approximately €43B of new corporate bond sales took place. This suggests that businesses are willing to accept higher rates and that they see little value in a delay in coming to market. It also suggests that investors are finding the higher rates on these bonds attractive rather than alarming. European companies reportedly issued bonds at the lowest pace since 2014 however as yield volatility and geopolitical concerns weighed on financial markets. Investment grade companies reportedly led the decline.

Bloomberg also reported over the month that Moody's Investors Services had calculated that speculative-grade companies faced a much higher refinancing and default risk because of rising interest rates. High-yield debt worth $1.87 trillion is due to mature between 2024 and 2028, and Moody's expects a peak default rate of 5.6% in January before the rate ebbs lower into August. Despite this, spreads on US investment-grade and high-yield bonds remained below their 20-year averages, regardless of tightening financial conditions and other signs of market stress. Improved credit quality over the last several years along with strong consumer spending were reportedly helping to keep corporate balance sheets strong despite the US Federal Reserve's historic tightening trajectory.

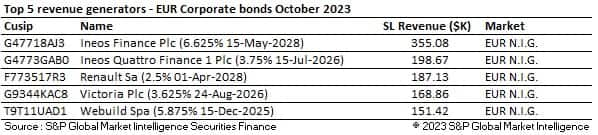

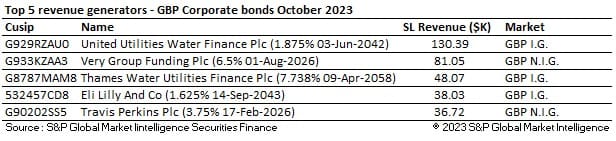

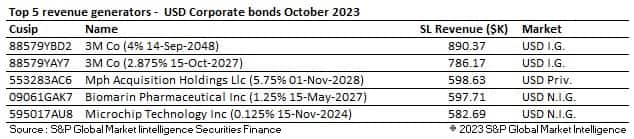

In the securities lending markets corporate bond revenues fell to their lowest monthly level of 2023 so far. The asset class generated $83.2M in revenues which represented a decline of 3% both MoM and YoY. Average fees also experienced a marked drop from 41bps during September to 37bps during October. Utilization increased as balances increased both MoM and YoY.

Non-investment grade bonds dominated the European top revenue generator table whilst across GBP and USD denominated bonds the bond issues remained mixed. Corporate bonds issued by the company 3M continued to generate the highest revenues during the month. The company continues to face two major lawsuits with substantial compensation attached to both. As a single A credit, if a downgrade is issued as a result of either of these, it may have the potential to significantly move the price of the company's bonds.

Over the past month, data from S&P Global Market Intelligence Repo Data Analytics showed that global volumes in both repo and reverse repo markets increased whilst haircuts remained unchanged and average terms decreased.

Repo activity: Volume +4.6%, Weighted Average Haircuts unchanged, Average term decrease of 0.88 days (86.85 days current average).

Reverse repo activity: Volume +1.5%, Weighted Average Haircuts unchanged, Average term decrease of 0.22 days (134.69 days current average).

EMEA

Across the EMEA region, government bond repo volumes increased by 3.7% and reverse repo volumes increased by 7.7% over the month. The largest increases in volumes across repo transactions were seen in Spanish (29%), Irish (25%) and Belgium (23%) government bonds. Across reverse repo, the largest increases in volumes were seen across Spanish (21.24%), Dutch (20.57%) and Irish (12.98%) government bonds. Despite France, Italy and the UK seeing no change in reverse repo volumes, UK repo volumes increased by 9.48% whilst Italian reverse repo volumes increased by 2%.

In the corporate bond market, volumes continued to increase across USD denominated French high yield (35%) reverse repo and EUR denominated French Investment grade repo volumes (55%). French investment grade corporate bonds continued to trade special throughout the month, becoming more expensive by circa 10%. Conversely, whilst Italian high yield bonds remained in special territory during the month, repo transactions became less expensive by circa 64%.

US

US treasuries cheapened over the month with repo rates increasing 4.7% and reverse repo rates increasing by 1.84% whilst volumes declined across both repo (-9.46%) and reverse repo (-4.91%). Canadian government repo volumes also declined over the month.

US long dated bonds became less expensive with the 4.375% 08/15/43, which had been trading very special, becoming cheaper in both repo and reverse repo markets. Bills maturing during 2023 also started moving towards general collateral levels after trading special during September. Maturities during 2024 and 2026 continued to see strong demand with the 2% 05/31/24 and 1.625% 02/15/26 remaining in deep special territory.

Across the corporate bond markets, reverse repo volumes in the USD denominated high yield and investment grade bonds remained steady whilst repo activity declined by 33%. Reverse repo activity experienced no real changes in rates or haircuts over the month whilst repo activity did become slightly less expensive as haircuts remained unchanged.

APAC

Government bond markets experienced an increase in both repo and reverse repo volumes during the month of October.

Japanese government bond repo volumes increased by 15.45% whilst reverse repo volumes increased by 65.46% during the month. Japanese government bonds became less expensive in both markets with repo rates increasing by 46.39% and reverse repo rates increasing by 65.46%. Australian government bonds were the second biggest mover over the period with repo volumes increasing 15.3% and reverse repo volumes increasing by 4.6%.

Across the corporate bond markets, the most notable market moves were seen across USD denominated Chinese high yield corporate bond repo volumes (12.15%) and reverse repo volumes (13.84%) whilst the asst class became cheaper to trade. Hong Kong high yield and investment grade assets remained special with repo volumes increasing by 20.69%.

Revenues continued to decline during the month, but 2023 YTD has seen some exceptional returns generated for securities lending market participants. Despite the softening picture for revenues across EMEA the US, securities lending activity across APAC equities remains robust. Across fixed income assets, the peak of some of the most recent revenues may have now passed, but year to date, these asset classes have been experiencing some of the highest revenues ever generated. It is therefore important to keep these declines within context.

As discussed previously, a lack of conviction is currently dominating financial markets, and this is having a knock-on effect within the securities lending market. Heading into year end, liquidity will be an increasingly important factor across investment strategies, which will be to the benefit of securities lenders.

During 2023, the securities lending market has once again played an important role in risk mitigation, value generation, liquidity, and collateral management across a broad range of market participants. On the 9th November in New York, the securities finance team will be hosting our annual Securities Finance Forum at 1345 Avenue of the Americas, New Yorkbetween 1pm and 7pm, where market experts from both the sell side and the buy side will be discussing the major market events of 2023 and will be sharing their expectations for 2024. We would love to see as many clients and friends attend as a thank you for your continued support, to share our thoughts and ideas with us and to hear your plans for the new year. If you haven't already registered and would like to attend, you can do so by clicking on the following link:

Securities Finance Forum 2023 | S&P Global Market Intelligence (spglobal.com)

If you are unable to make it and would like to discuss any of the above, then please feel free to reach out to your product specialist or S&P Global Market Intelligence representative who would no doubt love to hear from you.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.