Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Jul, 2023

By Jim O'Reilly

Seventeen years after the Federal Energy Regulatory Commission first launched a series of incentives to encourage investment in the US interstate transmission grid, a pair of pending rulemakings that proposed substantial revisions to those incentives and generated more than 160 comment filings from industry stakeholders await a final resolution at the commission.

The original incentives, which critics labeled as "FERC candy" when they were adopted by the commission in 2006, include return on equity (ROE) incentive adders and non-ROE financial incentives, such as 100% recovery of construction work in progress (CWIP) and regulatory asset treatment of deferred costs.

The proposed rule FERC issued in 2020 would revise the scope of ROE incentives available to transmission owners in a renewed effort to encourage new investment in transmission infrastructure, while a proposed modification issued in 2021 would curtail an incentive ROE adder for utilities that are members of a regional transmission organization or independent system operator (RTO/ISO).

➤ FERC's rulemaking to revise the commission's longstanding ROE incentive policies has been pending during a complete turnover of the commission's membership. The initial proposed rulemaking was issued more than three years ago before any of the current commissioners' terms began, and FERC is also on its fourth chairman — two Republicans during the administration of former President Donald Trump, followed by two Democrats after the inauguration of President Joe Biden in January 2021 — since the commission's initial proposal was issued.

➤ FERC's initial incentives proposal, which generated more than 80 comments from industry stakeholders, was followed a year later by a proposed modification that would significantly curtail an ROE adder for membership in an RTO/ISO. The proposed modification prompted more than 85 comments from stakeholders and was issued when three current FERC members were serving on the commission. Two of those three current commissioners were in the majority in issuing the proposed modification.

➤ The proposed modification curtailing the 50-basis-point RTO/ISO adder, if adopted by the commission, could impact approximately 75 utilities identified by Regulatory Research Associates in its transmission coverage universe. The proposed revisions to the commission's incentive policies would essentially leave existing non-ROE incentives unchanged. FERC also recently approved a non-ROE incentive for certain cybersecurity investments in a separate rulemaking.

Introduction

US Congress enacted the Energy Policy Act of 2005 in response to rising energy prices, growing dependence on foreign oil, and concerns over energy security and reliability of the interstate transmission grid prompted in part by a massive blackout in the Northeast in 2003.

The Energy Policy Act required FERC to establish rules "to provide for a return on equity that attracts new investment in transmission" and "encourage use of technologies that increase the transfer capacity of existing transmission facilities." The Energy Policy Act also directed FERC to implement incentive ratemaking for utilities that join an RTO/ISO.

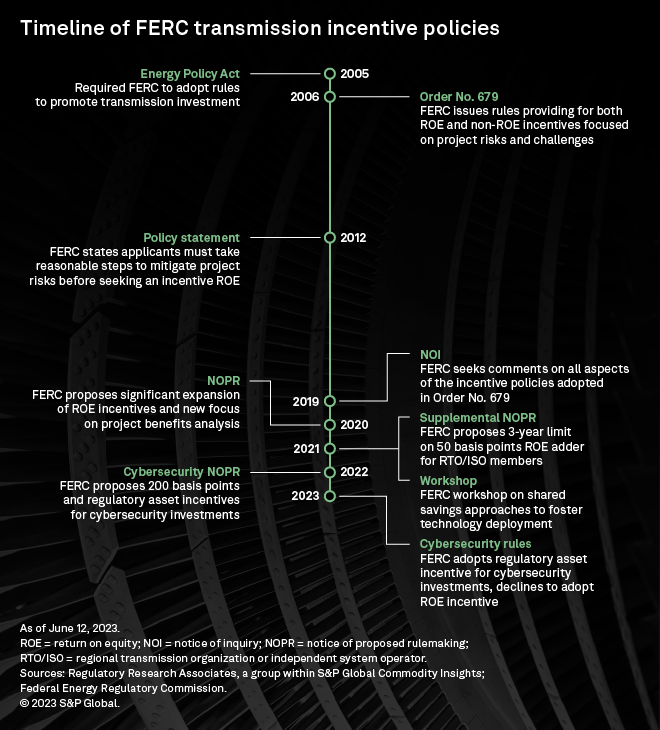

Pursuant to the Energy Policy Act, FERC issued rules in 2006 in Order No. 679 establishing a number of incentive rate treatments for electric utilities, including ROE adders to compensate a utility for the risks and challenges of a transmission project, for forming a transmission-only company (transco), or for companies joining an RTO/ISO (RTO adder).

FERC also adopted a series of non-ROE incentives for transmission investments that are available to project developers on a case-by-case basis, including full recovery of prudently incurred costs if a project is abandoned or canceled for reasons beyond the developer's control, 100% recovery of CWIP, the use of hypothetical capital structures, accelerated depreciation for rate recovery and regulatory asset treatment for deferred costs.

Order No. 679 required that companies requesting an incentive for a transmission project must show that the project either lowers the cost of delivered power by reducing transmission congestion or ensures reliability. FERC also established a "nexus test" in Order No. 679, which required that a utility requesting transmission incentives must "demonstrate a connection between the total package of incentives sought and the proposed investment, in light of the risks and challenges facing a transmission project seeking incentives."

Reexamining the Order No. 679 incentives

In 2019, prompted in part by "significant developments in how transmission is planned, developed, operated, and maintained" since Order No. 679 was issued in 2006, FERC initiated a broad reexamination of its transmission incentive policies, including incentive ROE adders. In a Notice of Inquiry, FERC sought comments on all aspects of the commission's incentives policies, including how ROE incentive adders interact with base ROEs and non-ROE incentives.

Following stakeholder comments on the Notice of Inquiry, FERC issued a Notice of Proposed Rulemaking (NOPR) in March 2020 that proposed revising the menu of ROE incentive adders available for transmission investments. The NOPR also proposed a sharp departure from the risks and challenges nexus test framework adopted 14 years earlier in Order No. 679, stating instead that the commission would focus its decision "to grant incentives on the benefits to consumers of transmission infrastructure investment identified by Congress: ensuring reliability and reducing the cost of delivered power by reducing transmission congestion." ( FERC proposes dramatic shifts in transmission ROE incentives, new economic test )

FERC noted that in Order No. 679, "the commission stated that it would not require applicants for incentive-based rate treatments to provide benefit-to-cost analyses." The NOPR noted, however, that "shifting from a risks and challenges based paradigm to a benefits-based paradigm, where incentives reward the most beneficial rather than most challenging transmission projects, supports using benefit-to-cost ratios to award economic incentives."

The commission added, "the widespread use of benefit-to-cost ratios for evaluating economic transmission projects in RTO/ISO transmission planning regions demonstrates the reasonableness of employing benefit-to-cost ratios to determine whether transmission projects merit ROE incentives premised upon economic benefits."

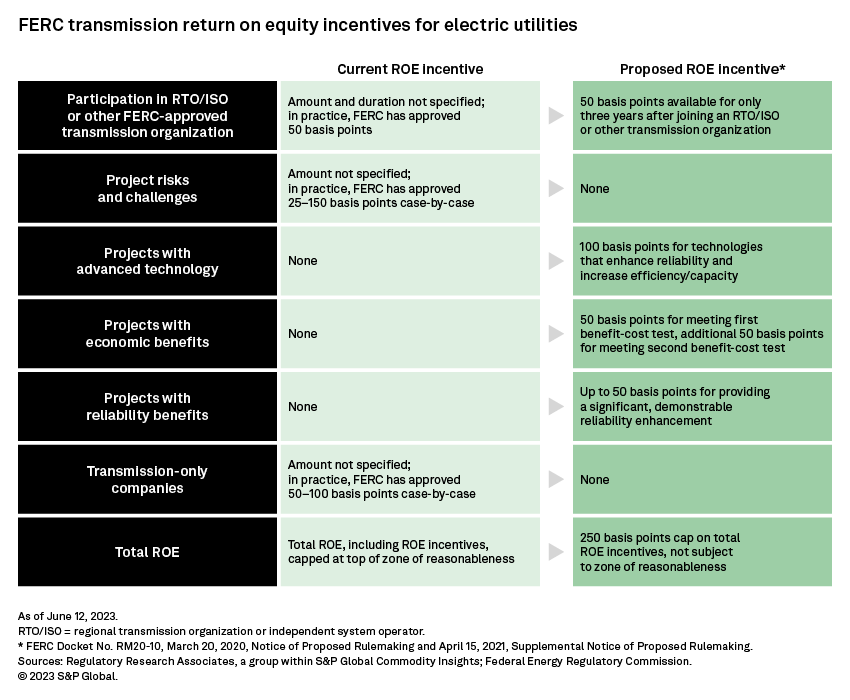

The 2020 NOPR proposed a series of new incentive ROE adders, including the following:

– A 50-basis-point ROE adder for transmission projects that meet a preconstruction benefit-to-cost ratio in the top 25% of projects examined over a sample period and an additional 50-basis-point adder for projects that meet a post-construction benefit-to-cost ratio in the top 10% of projects studied over the same sample period.

– Up to a 50-basis-point ROE adder for transmission projects that demonstrate reliability benefits. FERC noted that a transmission project can demonstrate reliability benefits in many ways and cited as one example transmission projects that significantly increase import or export capability between balancing authorities. FERC also noted that it would consider ROE incentive adders for transmission projects that improve grid resilience, including "hardening of transmission assets against adverse weather events, fires, and geomagnetic disturbances."

– A 100-basis-point ROE adder "for transmission technologies that enhance reliability, efficiency and capacity as well as improve the operation of new or existing transmission facilities." FERC declined in the NOPR to list the types of technologies eligible for the technology incentive and proposed a case-by-case determination of eligibility "based on the characteristics of the technology and the benefits that the technology offers."

– An increase in the ROE adder for utilities that are members of an RTO/ISO to 100 basis points from 50 basis points.

The NOPR also proposed to replace the commission's current policy of capping a company's overall ROE, including incentives, at the top of the reasonableness zone with a 250-basis-point cap on total ROE incentives. FERC explained that "our proposal recognizes that base ROE and transmission ROE incentives serve different functions" and that "the different purpose for an incentive ROE adder than for a base ROE provides that ROE incentives may be just and reasonable under different circumstances than base ROEs."

Finally, the 2020 NOPR proposed eliminating the transco ROE adder and sought comment on how the commission should treat transco ROE adders previously granted. FERC noted, "We have not seen evidence of transcos delivering the outcomes that the commission had expected in establishing transco incentives in Order No. 679." The commission further said, "we believe that the transco business model has not enhanced the deployment of transmission infrastructure sufficiently to justify incentives based on this business model beyond those incentives available to all public utilities."

More than 80 stakeholders submitted comments to the commission on the NOPR during summer 2020.

On April 15, 2021, FERC reversed course on the 2020 NOPR's proposal to increase the ROE incentive for members of an RTO/ISO to 100 basis points from 50 basis points. Instead, the commission issued a Supplemental NOPR proposing to maintain the incentive adder at 50 basis points, limit the adder for three years for companies that newly join an RTO/ISO, and eliminate the incentive entirely for companies that have been members of an RTO/ISO for three or more years. ( Transmission-heavy FERC meeting sparks debate on pulling RTO grid incentive )

The utilities that could be impacted by the proposed change to the RTO/ISO adder include members of the California ISO , ISO New England , Midcontinent ISO , New York ISO , PJM Interconnection LLC and Southwest Power Pool .

The Supplemental NOPR did not propose any changes to the other ROE incentives the commission proposed in the March 2020 NOPR.

More than 85 stakeholders submitted comments to the commission on the Supplemental NOPR in summer 2021.

Commission votes and commissioner statements

None of the current commissioners were serving on FERC when the NOPR was approved by a 2-1 vote on March 20, 2020. Former Chairman Neil Chatterjee and former Commissioner Bernard McNamee, both Republicans, were in the majority to approve the NOPR, while former Chairman Richard Glick, a Democrat, dissented in part.

When the Supplemental NOPR was approved by a 3-2 vote on April 15, 2021, three current commissioners were members of FERC at the time: Republicans James Danly and Mark Christie and Democrat Allison Clements. The fourth current commission member, acting Chairman Willie Phillips, is a Democrat who joined the commission in December 2021 and was named acting chairman by President Biden on Jan. 3, 2023.

Christie, Clements and Glick were in the majority to issue the Supplemental NOPR. Danly and Chatterjee strongly dissented from the Supplemental NOPR and issued separate statements. Chatterjee left the commission in August 2021, and Glick left in January 2023. Although Danly's current term expires June 30, 2023, he may remain on the commission until the end of the year if the US Senate does not confirm a nominee for his seat by then.

Christie issued a separate statement to the Supplemental NOPR, noting that he concurred "because [the Supplemental NOPR] moves in the right direction" but stated that "ROE adders needlessly burden consumers with substantial additional costs without demonstrable evidence that they actually incentivize the particular action they are aimed at incentivizing."

Christie added, "I also agree with the Supplemental NOPR's conclusion that the [Federal Power Act (FPA)] does not require an incentive for RTO/ISO participation to take the form of an ROE adder and with its request for commenters to propose alternative, non-ROE incentives that would qualify under [the FPA]." Christie concluded, "because this supplemental NOPR proposes to limit the use of ROE adders for RTO/ISO membership to three years after joining — a welcome first move — I respectfully concur. I look forward, however, to commenters' responses regarding non-ROE incentives."

In addition to his comments about the RTO adder, Christie noted his discomfort with other FERC transmission incentives in public statements. In a recent concurring statement to FERC's March 3 order granting certain non-ROE transmission incentives to The Dayton Power and Light Co. , Christie wrote: "As I noted previously: The commission's incentive policies — particularly the CWIP incentive, which allows recovery of costs before a project has been put into service — run the risk of making consumers 'the bank' for the transmission developer; but, unlike a real bank, which gets to charge interest for the money it loans, under our existing incentives policies the consumer not only effectively 'loans' the money through the formula rates mechanism, but also pays the utility a profit, known as Return on Equity, or 'ROE,' for the privilege of serving as the utility's de facto lender."

Christie continued, "Further, just as the CWIP incentive effectively makes consumers the bank for transmission developers, the abandoned plant incentive effectively makes them the insurer of last resort as well. This incentive allows transmission developers to recover from consumers the costs of investments in projects that fail to materialize and thus do not benefit consumers."

Christie concluded, "Just as consumers receive no interest for the money they effectively loan transmission developers through CWIP, they receive no premiums for the insurance they provide through the abandoned plant incentive if the project is never built. And if the CWIP Incentive is a de facto loan and the abandoned plant incentive is de facto insurance — both provided by consumers — then the RTO participation adder, which increases the transmission owner's ROE above the market cost of equity capital, is an involuntary gift from consumers. There is something really wrong with this picture."

In Danly's dissent to FERC's Supplemental NOPR, he argued that the FPA's statutory text requires the commission to provide incentives "to a utility 'that joins' an RTO. The statute does not limit the incentive solely to encourage utilities 'to join' an RTO; it does not address the issue of whether they 'remain' in the RTO. If Congress intended the RTO adder to only apply as an incentive 'to join' an RTO, it would have said so. It did not. The statute requires incentives to an entity 'that joins' an RTO, full stop, no limitation."

Danly's dissent added, "I support a 100-basis point adder to a utility 'that joins' an RTO. RTOs provide enormous cost benefits to consumers. We should continue to provide strong incentives to utilities to join and to remain in RTOs so that consumers can reap the cost benefits of power markets. That is what the statute requires, and I would strengthen these incentives for any utility 'that joins' an RTO."

Cybersecurity rulemaking

The Infrastructure Investment and Jobs Act of 2021, signed into law Nov. 15, 2021, required FERC to issue a rule that encourages electric utilities to invest in advanced cybersecurity technology and participate in programs such as the US Energy Department's Cybersecurity Risk Information Sharing Program.

As required by the legislation, on Sept. 22, 2022, FERC issued an NOPR including a proposed regulatory framework on how a utility could qualify for incentives for eligible cybersecurity expenditures. Under the commission's proposed framework, eligible cybersecurity expenditures must "(1) materially improve cybersecurity through either an investment in advanced cybersecurity technology or participation in a cybersecurity threat information sharing program; and (2) not already be mandated by Critical Infrastructure Protection Reliability Standards, or local, state, or Federal law."

FERC proposed two options for the type of incentive a utility could receive for an eligible cybersecurity expenditure, an ROE adder of 200 basis points or deferred cost recovery for certain cybersecurity expenditures enabling the utility to defer expenses and include the unamortized portion in rate base. Finally, the commission proposed that any approved incentive(s) would remain in effect for five years from the date on which the cybersecurity investment(s) enters service or expenses are incurred.

Just seven months later, on April 21, FERC issued a final rule in the proceeding that declined to adopt an ROE incentive for cybersecurity investments, while the commission adopted the regulatory asset incentive with minor modifications. ( FERC finalizes new cybersecurity incentives for electric utilities )

In declining to adopt the ROE incentive, FERC concluded that "the cybersecurity regulatory asset incentive satisfies the statutory obligation to benefit consumers by encouraging investments by utilities in advanced cybersecurity technology and participation by utilities in cybersecurity threat information sharing programs. We find that the provision of the cybersecurity regulatory asset incentive alone provides the encouragement that Congress intended without unduly increasing costs on consumers."

With respect to the regulatory asset incentive, FERC modified the NOPR proposal in the final rule to allow, at the request of the utility, the incentive duration to be "up to" five years. The commission said, "this revision provides flexibility to requesting utilities while maintaining ratepayer protections."

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.