Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Aug, 2023

By Zain Tariq and Nathan Stovall

Community banks will struggle to grow earnings over the next few years, prompting more institutions to pursue M&A activity to bolster returns.

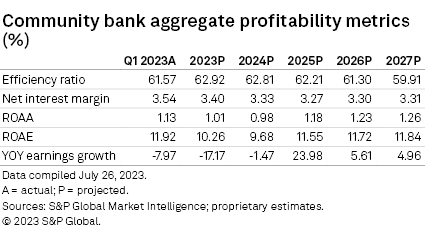

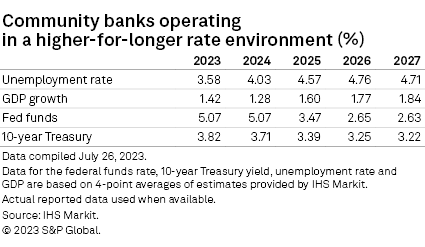

Community bank earnings will fall this year as institutions face liquidity pressures and build reserves for a slip in credit quality. Results are unlikely to recover in 2024 as funding costs and credit costs remain elevated amid a higher for longer interest rate environment. The hits to earnings and returns will be manageable for the vast majority of institutions but could change the strategic outlook for many as boards and management teams contemplate stagnant earnings over the next few years.

Title fight for deposits

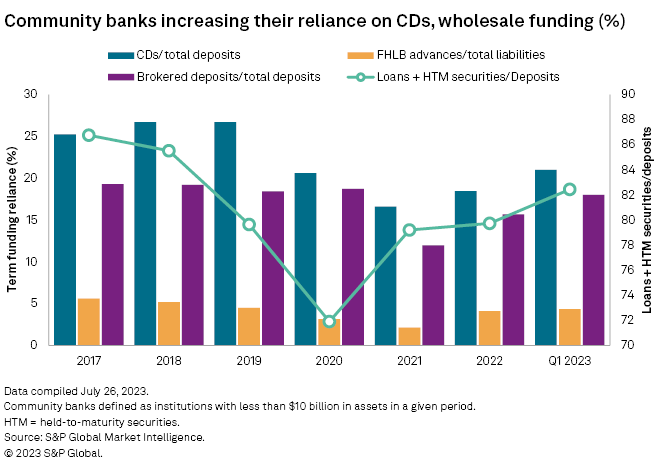

Swift interest rate increases and a liquidity crunch at a few institutions have significantly ramped up competition for deposits. Funding needs differ from one bank to the next, but the competitive landscape has changed, with many institutions responding to the fight for deposits by bolstering liquidity with higher-cost funding sources such as brokered deposits, borrowings from the Federal Home Loan Banks and certificates of deposits.

For some institutions, those actions came out of an abundance of caution, but the efforts also woke up depositors to the significantly higher rates available in the marketplace. Publicly traded banks grew CDs by nearly 18% quarter over quarter in the second quarter, while deposits were roughly flat from the prior period. Community banks were already more reliant on CDs for funding, but we expect the group to report strong growth in the product as well. In fact, more than 600 banks, 95% of which were community banks, were marketing one-year CDs with rates above 4% as of July 28, a 70% increase from the end of March.

If community banks grow CDs by 9% in the second quarter from the prior quarter — close to half the pace of the publicly traded bank group — and deposits held flat with the linked quarter, the products would rise to 22.8% of deposits from 20.9% at the end of the first quarter and 18.5% at year-end 2022.

The strong growth in CDs will continue the trend of interest-bearing deposits becoming larger portions of banks' funding bases. Non-interest-bearing deposits fell to 26.1% of total deposits in the first quarter from 27.5% in the fourth quarter, and we expect that concentration to drop to 23.0% by year-end 2023.

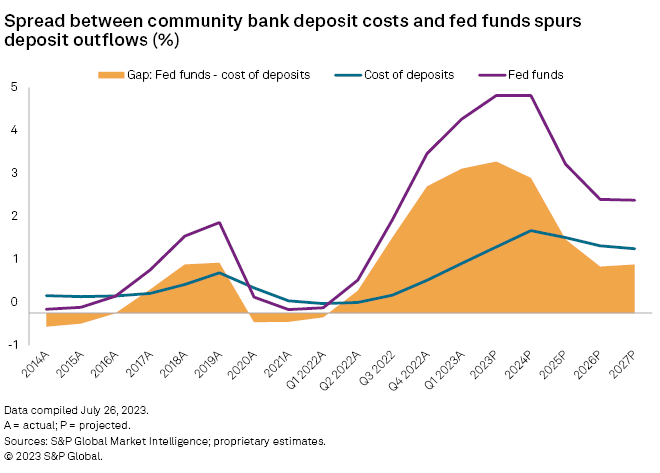

The shifts in deposits will cause funding costs to rise significantly in 2023, serving as a headwind to banks' net interest margins.

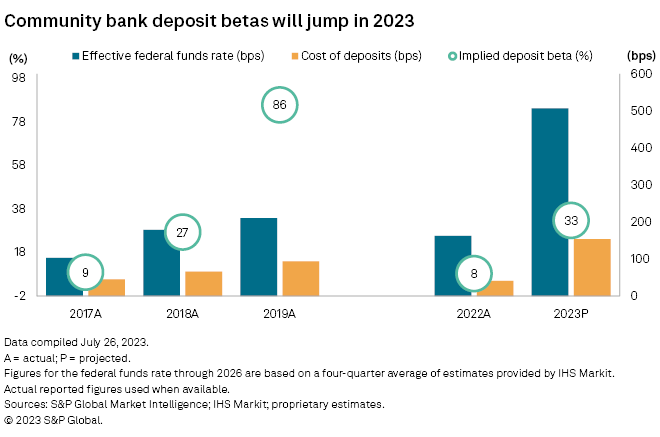

In the first quarter, community banks recorded a deposit beta on all deposits, including non-interest-bearing funds, of 49.0% when compared to the prior quarter. That is up from 22.6% in the fourth quarter and 11.9% in the third quarter.

The pressure should be even greater in the coming quarters as banks seek to preserve their funding in the face of deposit outflows. Community bank deposits declined 1.7% in the first quarter as the spread between the fed funds rate and deposit costs remained historically wide. The community bank group in aggregate could lose more deposits as M&A activity rebounds and smaller banks sell to institutions above the $10-billion-asset threshold, but outflows from community banks are expected to slow as the gap narrows between deposit costs and higher-yielding alternatives in the Treasury and money markets.

As outflows slow and deposit growth returns in 2024, some community banks could prune their bond portfolios, sell securities at a loss and use the cash to pay down higher-cost borrowings or reinvest the cash into higher-yielding assets. However, institutions will need to have the regulatory capital to withstand the hit from such loss-making transactions. As banks gain more clarity about the Federal Reserve's terminal rate and the direction of the economy, securities portfolio restructurings could pick up in the second half of 2023, allowing banks to alleviate one of the headwinds to their margins as deposit costs continue to rise.

We expect second-quarter betas on interest-bearing deposits to rise from 62% in the first quarter and eventually rise above 100% over the next two quarters as banks raise deposit rates and seek to protect their funding by marketing products with higher-cost deposits, such as CDs.

For full year 2023, we project betas on all deposits to reach 33%, up from the 21% year-over-year beta recorded in the first quarter.

Community banks' funding costs will rise at a quicker pace than earning-asset yields and pressure net interest margins. We project the full-year 2023 net interest margin to be 14 basis points lower than the level reported in the first quarter and then fall another 7 basis points in 2024.

Looking ahead

Community bank management teams and their boards could begin to warm up to partnering with another institution as they confront stagnant earnings.

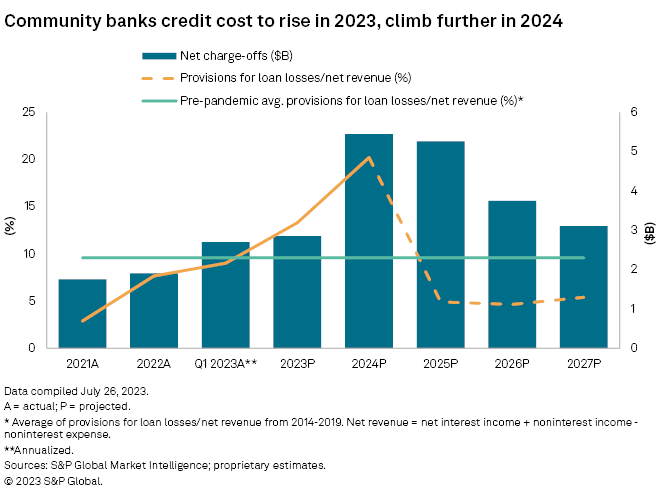

Higher interest rates and community banks' efforts to bolster funding in response to higher rates and the liquidity crunch in the spring have led to increased funding costs and pressure on net interest margins. At the same time, economic uncertainty due to rates remaining higher for longer, the end of COVID-19-era stimulus and post-pandemic changes in consumer behavior will cause community banks to increase reserves for loan losses in 2023 and again further in 2024. Taken together, margin compression and increased credit costs will be a headwind to earnings for the rest of 2023.

The challenges to future earnings growth could lead to a rebound in M&A activity and encourage some institutions to rethink their independence later this year and early in 2024. Bank M&A activity through the first seven months of 2023 remained abysmal as institutions grappled with uncertainty over the economy, interest rates and their own funding bases. Many potential deals would also be hungry for new capital since the required marks that a buyer must take on a seller's balance sheet often leaves the target with little equity. However, the cost savings associated with deals will eventually make M&A an attractive way to mitigate earnings pressure.

Experienced acquirers in the regional bank community like East West Bancorp Inc. and SouthState Corp. said on their recent second-quarter earnings calls that the current environment remains uncertain, but revenue pressures should create deal opportunities over the long term. Prosperity Bancshares Inc., one of the most active acquirers since the financial crisis, said on their second-quarter call they expect M&A activity to "increase significantly." And Pacific Premier Bancorp Inc. said during its respective second-quarter call that pressures on the industry are greater today than ever before and M&A conversations have picked up in the last few weeks.

One potential roadblock to transactions is the looming rise in credit costs. Credit quality has remained clean, but banks are preparing for potential deterioration by tightening lending standards and building reserves for loan losses.

We expect modest loan growth in 2023 as institutions approach new originations with greater caution. The cost of funding new loans will leave community banks with a relatively thin spread against rising funding costs and little cushion to cover for higher charge-off activity that should come in the future. We also expect banks to continue to build reserves as they work to shore up their balance sheets to clear any potential hurdles ahead.

The investment community is particularly worried about loss content in banks' commercial real estate portfolios, which make up larger portions of community banks' loan portfolios. Loss content will be location specific and differ across the subcategories of the asset class, but community banks will feel some pain in their commercial real estate books, particularly as borrowers digest the impact of higher interest rates, less credit availability and lower occupancy since the pandemic.

We expect stiffer financial conditions will cause credit quality to slip in 2023, resulting in notably higher net charge-offs in 2024. However, even with NCO losses in 2024 expected to nearly double from 2022 levels, losses and the reserves required to fund them should prove a modest hit to earnings as opposed to the headwind that would occur during a severe downturn.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.