Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Aug, 2017 | 08:45

Highlights

Capital expenditure by mining companies slumped, but gold mining projects outpaced the rest of the metals.

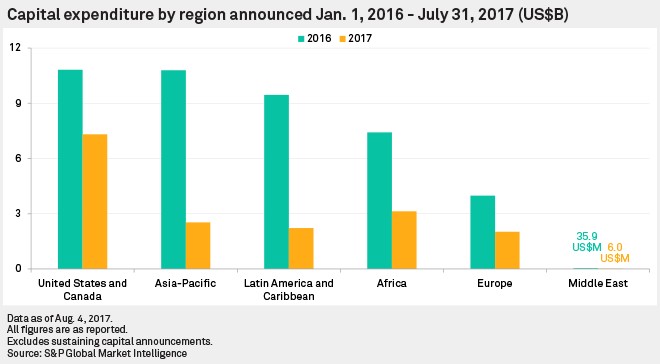

The U.S. and Canada remain the top destinations for announced capital expenditure.

Between the start of 2016 and the end of July 2017, mining companies reported potential capital spending of almost US$60 billion. However, only US$583 million has been spent so far, with the remainder targeted for future spending.

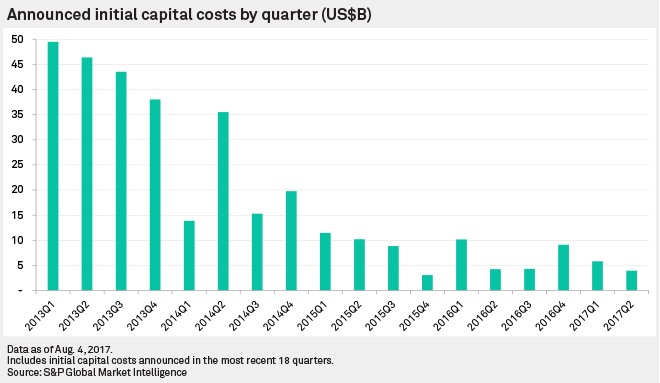

The total CapEx figure was calculated based on 317 capital cost announcements and excludes sustaining expenditure. Capital expenditure announcements with multiple spending scenarios are only included in the aggregations once to avoid double counting, and canceled capital projects are not included. The 19-month total incorporates a sharp decline year-over-year so far in 2017, with the US$17.2 billion announced this year to the end of July being 34% less than the total announced from January to July 2016.

The U.S. and Canada remain the top destinations for announced capital expenditure. This allocation is led by the biggest announced expenditure for 2016, Seabridge Gold Inc.'s US$5.5 billion proposal to support higher production at its KSM gold project in Canada. Atlantic Potash Corp.'s late-stage Millstream potash project in Canada, with an announced capital cost of US$1.8 billion, is the second-largest expenditure announcement in the region.

The number of announced capital projects in the Asia-Pacific region is nearly double the corresponding amount in Latin America. As a result, the total value of potential expenditure in the Asia-Pacific region pulled ahead of Latin America, despite the latter region being the location of numerous high-value individual capital cost announcements. This includes NGex Resources Inc.'s US$3.1 billion estimated plan for its late-stage Constellation copper project in Chile. This capital expenditure would be used to initiate open pit/underground production at the 48-year operation.

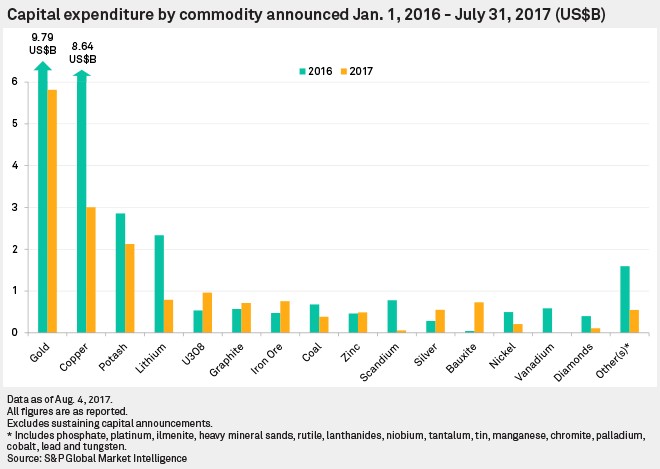

CapEx announcements for the KSM gold project and Constellation copper project from October and January 2016, respectively, are the top two on the list as primary gold and copper projects remain the focus of announced capital expenditure. One of the most notable CapEx announcements is IAMGOLD Corp.'s US$1 billion project to further develop the open pit mine and processing plant associated with its late-stage Cote gold project in Canada.

Capital plans on primary potash projects are increasing, with the commodity ranked third in announced expenditure. The current year's announced CapEx is almost equal to the entire value for the previous year despite this year's total to date being for only seven months. Planned lithium expenditure ranks fourth for the 19-month period overall, despite slipping to fifth place so far for 2017. This rating is mostly associated with Enirgi Group Corp.'s July 2016 capital expenditure announcement for its Salar del Rincon lithium project in Argentina, amounting to US$720 million, which would be used to extend mine life and develop a lithium carbonate plant operation.

Announced capital spending for primary iron ore and bauxite projects is significantly higher compared with 2016. Iron ore production for Rio Tinto's Hamersley Consolidated in Australia is expected to ramp up due to a capital expenditure program amounting to almost US$340 million. These funds will be allocated to further develop the Silvergrass project, a satellite mine of Hamersley Consolidated. The US$700 million expansion of the Sangaredi bauxite mine, owned by the Government of Guinea and Rio Tinto, is already in the early stages of realization.

NexGen Energy Ltd.'s Rook 1 uranium project in Canada has been allocated almost US$1 billion to begin production and processing in the mine where uranium recovery is expected to be 96%. This makes up the bulk of the uranium-focused capital spending announced for 2017.

Planned CapEx focusing on primary graphite projects is significantly higher so far in 2017. Leading the commodity ranking is Graphite One Resources Inc.'s Graphite Creek project in the U.S. Allocated initial CapEx amounts to almost US$370 million to sustain the project and its associated plant.

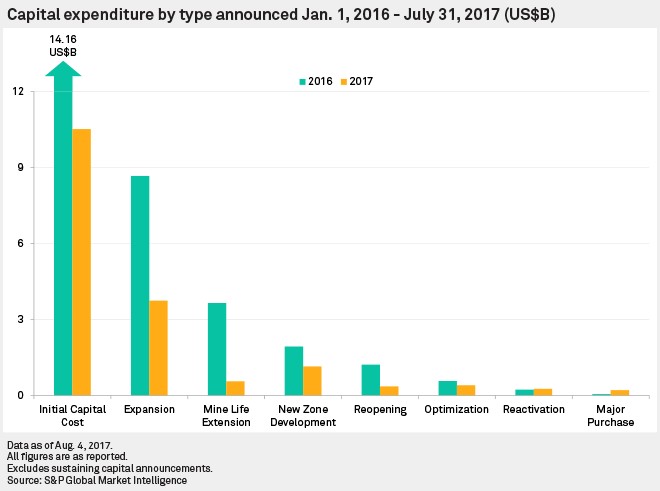

Initial CapEx remains the focus of miners despite a 27% decrease for the first half of 2017 compared with the first half of 2016. Although none of the announced CapEx has been spent as of yet, expenditure on extending mine life has plummeted this year, with only US$560 million allocated as of July-end, compared with US$1.89 billion in the same period in 2016. This sharp downturn is largely attributable to the absence of high-value mine-life extension projects, such as the US$1.4 billion CapEx for the extension of Gold Fields Ltd.'s Damang operation announced in the third quarter of 2016.

While many plans may never get executed in the near future, miners have announced capitals spends amounting to US$11.19 billion over the next five years, with initial capital expenditure accounting for US$4.60 billion and expansion projects US$3.08 billion. On a regional level, US$3.52 billion in plans have been announced in Latin America between 2018 and 2022, US$3.42 billion in the U.S. and Canada, and US$3.11 billion in Africa. In terms of commodities, announced plans for gold spending account for the lion's share globally, US$6.00 billion, over the next five years, with US$1.07 billion allocated to copper.