Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jul, 2016 | 10:30

By Tom Manzella

Highlights

Gold-focused producers significantly outperformed their mining peers in second-quarter market cap rankings, benefiting from improved gold prices and global economic uncertainty.

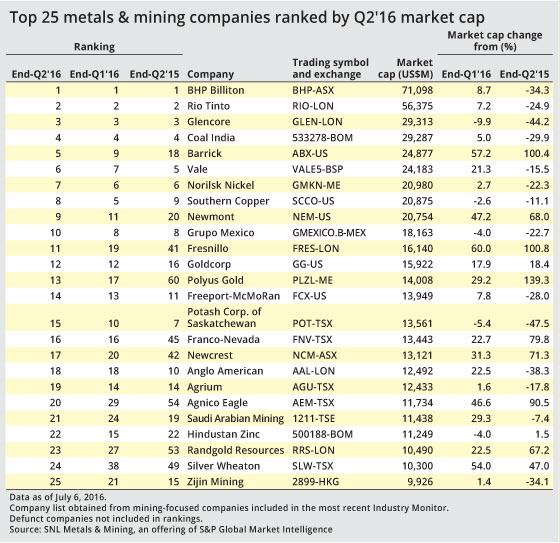

The first half of 2016 was filled with surprises, including a comeback by commodity prices in the first quarter and a gradual improvement of the mining sector in general. Market caps for the top 25 mining companies reflect this shift, with figures as of the June quarter-end improving by an aggregate 13% on a quarterly basis. However, the aggregate market caps were down 14% year over year.

The year-over-year decline in aggregate market cap is heavily skewed by BHP Billiton Group, which remains the largest mining company in this analysis. However, the company's market value declined 34% in the past year, partly due to continuing fallout from the November 2015 tailings dam disaster at its Samarco joint venture with Vale SA.

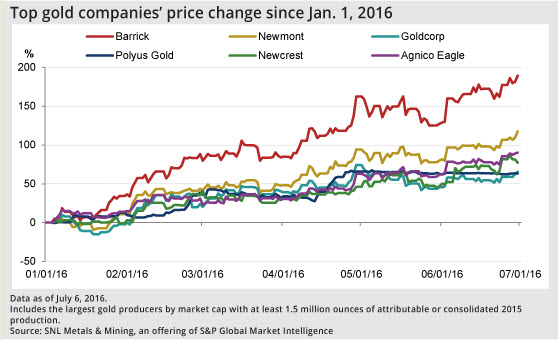

The most notable shifts in the rankings can be attributed to gold-focused companies, which have benefited greatly from rising gold prices, declining mining costs and, most recently, global economic uncertainty as a result of the U.K.'s Brexit vote in June. The Brexit caused major banks to raise their gold price targets, and the yellow metal quickly rallied to a two-year high of US$1,323.62 per ounce on June 27.

U.S.-listed Barrick Gold Corp., Newmont Mining Corp. and Goldcorp Inc. have seentheir share prices rise by 189%, 117% and 65%, respectively, since Jan. 1, accompanied by substantial 13-, 11- and 4-point rises in the rankings compared with the June quarter-end a year ago.

Barrick, ranking fifth in the June quarter, received a high-profile investment in May when billionaire George Soros acquired a 1.7% stake in the company. Soros felt that China's slowing economy could result in higher gold prices and an improved performance by Barrick.

Non-U.S.-listed major gold producers Fresnillo Plc, PJSC Polyus Gold, Newcrest Mining Ltd. and Agnico Eagle Mines Ltd. also rose in the market cap rankings, to the 11th, 13th, 17th and 20th positions, respectively. At this time a year ago, all four companies placed well outside the top 25. Share-price increases were consistent for these companies as well, ranging from 63% to 132% since the beginning of the year.

Polyus Gold, which saw the largest year-over-year improvement in market cap at 139%, holds the impressive title of being the world's lowest-cost gold producer. The company has benefited from the devalued Russian ruble, although inflation in the country could pose a threat to Polyus' steady implementation of cost-cutting measures.

Rankings shifts for non-gold companies were mixed, as most either remained steady or shifted only slightly. Heavyweights Rio Tinto and Glencore Plc maintained their positions in the rankings, while Vale and PJSC MMC Norilsk Nickel slipped by one position each, compared with the June 2015 quarter.

Anglo American Plc, the diversified mining giant that made headlines last December when it announced 85,000 job cuts, saw its market cap decline 38% year over year and rise 23% quarter over quarter.

Glencore remained the third-largest company despite a 44% year-over-year drop in market cap. The company's stock performed well in the first half of 2016, rising 69% since Jan. 1. Coal India Ltd. is just behind Glencore in fourth place, with a market cap of US$29.29 billion as of June 30.

Another major company, Potash Corp. of Saskatchewan Inc., slipped in the rankings by eight positions from last year due to a 48% reduction in market cap. The company slashed its full-year earnings forecast after its first-quarter net earnings fell to US$75 million from US$370 million a year previously. Weak demand for potash in the first quarter played a major role in lowering prices, which led to production cuts and lowered expectations for potash sales this year.