Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 11, 2023

By Anja Heimann

The rapid tightening of financing conditions and continued feed-through of higher interest rates to consumers, plus an increase in inflation to levels last observed half a century ago, are weighing on the housing market.

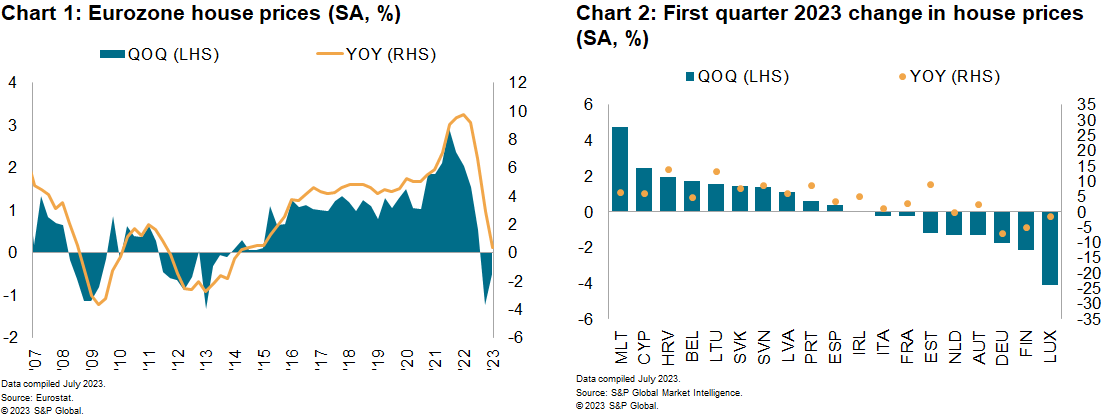

Eurozone house prices declined for the second consecutive quarter in the first quarter of 2023. Amid a weak credit outlook, S&P Global Market Intelligence expects a further deterioration in real esate price momentum in the coming quarters. This trend will be partially counterbalanced by a supportive labor market, accelerating wage growth, and a structural housing supply shortage.

German-speaking economies lead the housing price decline

The quarterly downturn in housing markets was widespread, with prices contracting in eight eurozone economies on a seasonally adjusted basis. Compared with the fourth quarter of 2022, Luxembourg registered the largest fall in house prices — down 4.1% quarter over quarter — followed by Finland and Germany. Meanwhile, small island nations Malta — up 4.8% quarter over quarter — and Cyprus recorded the strongest quarterly price upticks.

Since their third-quarter 2022 peak, house prices in the eurozone have now fallen by 1.7%. German-speaking economies have led the downturn, with German house prices down 8.0% from their peak, followed by Luxembourg. Other members that have recorded sizable peak-to-trough declines include Finland (down 5.3%) and the Netherlands (down 2.9%). House prices in France and Italy have so far only stagnated.

The outlook for housing credit is gloomy

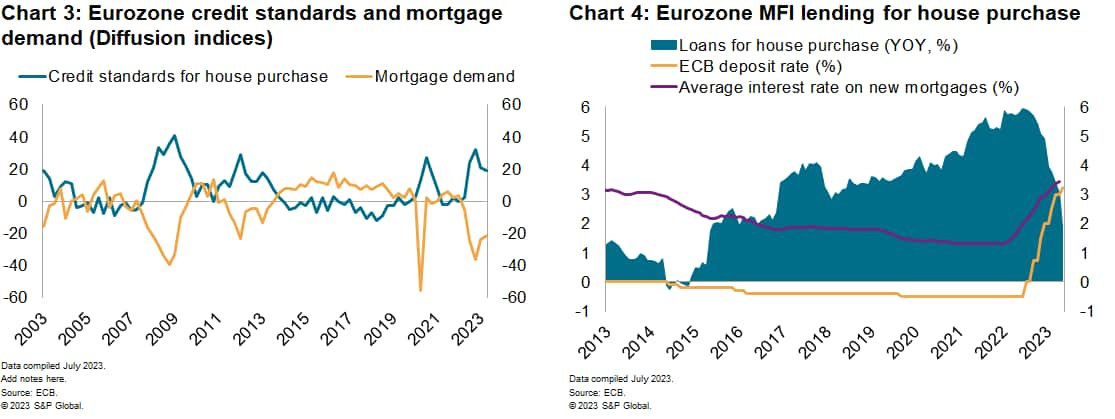

The latest lending survey from the European Central Bank showed a moderate easing in credit standards for loans for house purchases in the first two quarters of 2023, which went together with a small recovery in the forward-looking mortgage demand series.

Still, credit standards remain tighter than their pre-pandemic average and mortgage demand depressed.

This is reflected in mortgage growth data from microfinance institutions (MFIs). New loan growth cooled to 1.9% year over year in May as the average interest rate on a new mortgage climbed from 1.6% to 3.4% during the same period.

Variable-rate mortgages are becoming increasingly popular among new borrowers, suggesting that consumers expect an improvement in financing conditions and lower rates in the near term. This is also partly the consequence of increased interest rate uncertainty.

We believe that further pain is to come for borrowers. We forecast an ECB deposit facility rate peak of 3.75% after one final 25-basis-point hike in July, although we acknowledge that there is a material risk of rates increasing further at the September meeting. Rate cuts are projected to begin in June 2024.

Supply constraints to counterbalance downward pressure on house prices

A shortage of housing has been a common feature across eurozone economies for years and this has been exacerbated since the onset of the pandemic by restrictions on activity, as well as supply chain disruption, material price inflation and labor shortages. This structural factor will help cushion the adjustment of house prices to the higher interest rate environment.

Real estate developers maintain a cautious approach amid weak growth prospects in the eurozone and higher borrowing costs. Building permits for residential dwellings have corrected downwards from the post-pandemic house price and construction exuberance and declined to below their pre-pandemic average (2015-19) in the first quarter of 2023.

The construction Purchasing Managers' Index also points to further downsides. The headline rate declined deeper into contraction territory in May (reading of 44.6) and the new orders component stood at a depressed 40.6.

Outlook

We view a peak-to-trough decline in eurozone nominal house prices around the 10% mark as likely over the next two years. The still-solid labor market in the eurozone and an acceleration of wage growth pose upside risks to this forecast, particularly as the latter tempers affordability concerns.

The speed and intensity of the correction among eurozone member states depends on imbalances that have accumulated in the last decade in each country's housing market, as well as the different average interest rate fixation periods. Those countries where prices rose more sharply in excess of household income, and where house price growth was accompanied by strong debt growth, are the most vulnerable to corrections, as highlighted in a strategic report last year.

The housing market downturn and tighter credit conditions weigh down on the eurozone growth outlook. In our June forecast, we projected fairly lackluster GDP growth of 0.7% in 2023, and we are likely to revise down our current estimate of 2024 growth in the upcoming July interim forecast round.

Learn more about our economics data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.