Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Feb, 2017 | 10:00

By Eric Turner

Highlights

While company-specific factors drove losses at both LendingClub and On Deck Capital in 2016 and both companies considered the year a rebuilding period, larger structural issues in digital lenders' business models make it difficult for them to turn a profit.

While company-specific factors drove losses at both LendingClub Corp. and On Deck Capital Inc. in 2016 and both companies considered the year a rebuilding period, larger structural issues in digital lenders' business models make it difficult for them to turn a profit.

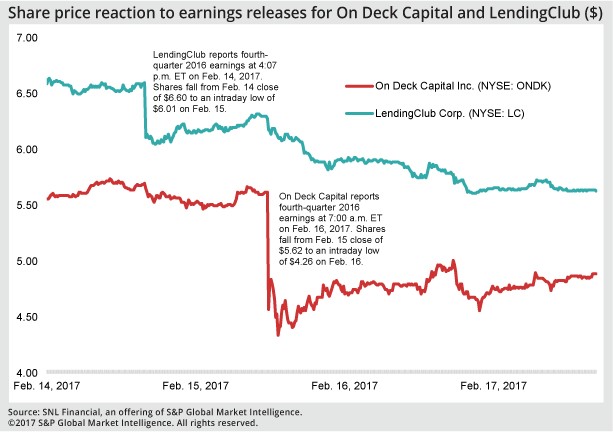

LendingClub and On Deck reported fourth-quarter and full-year 2016 earnings during the week of February 13. Despite continued quarter-over-quarter growth in originations, both companies reported widening losses that caused shares to sink even lower.

Widening losses at both companies to end the year

Both LendingClub and On Deck swung to net losses on an adjusted basis in 2016 and posted much steeper GAAP net losses compared to those in 2015.

LendingClub reported a full-year 2016 adjusted net loss of $37.9 million, or 10 cents per share, compared to 2015 adjusted net income of $56.8 million, or 14 cents per share. The S&P Capital IQ consensus normalized estimate for 2016 called for a loss of 11 cents per share. On a GAAP basis, the loss per share widened to 38 cents from 1 cent year-over-year.

On Deck's 2016 adjusted net loss was $67.0 million, or 95 cents per share, missing the normalized consensus estimate by 27 cents. In 2015, adjusted net income was $10.3 million, or 14 cents per share. The GAAP net loss per share expanded to $1.17 from 2 cents year-over-year.

For the fourth quarter of 2016, LendingClub posted an adjusted net loss of $8.1 million, or 2 cents per share. On Deck's fourth-quarter adjusted net loss was $31.4 million, or 44 cents per share.

While losses have been common for these companies, 2015 looked like a promising year. On a GAAP basis, LendingClub was profitable during the third and fourth quarters, while On Deck was profitable in the second and third quarters. While O nDeck slipped back into continued losses in the fourth quarter of 2015, LendingClub reported GAAP net income of $4.1 million, or 1 cent per share, for the first quarter of 2016. These profitable periods were related to an increase in originations at LendingClub to historic levels and a period of high profitability for loans sold through the On Deck Marketplace.

Loan originations remain costly for digital lenders

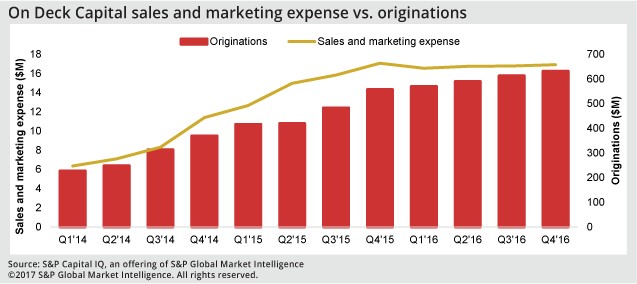

Customer acquisition costs may be the largest headwind in the digital lending industry. Digital lenders rely heavily on marketing in order to acquire new customers. While banks have an existing customer base to which they can market loan products, digital lenders have only customers that have previously taken a loan from them. Marketing relies heavily on direct mailing and email promotion to attract new customers.

On Deck took steps to reduce costs across the board during 2016 and saw sales and marketing costs stabilize during the year. The company is increasingly looking to build longer term relationships with small businesses in order to create low-cost repeat customers.

LendingClub spent a large part of 2016 looking to stabilize its business following the disclosure of improper loan sales to a large institutional investor. This, along with the CEO's undisclosed interest in a third-party fund in which LendingClub was considering an investment, led to the resignation of founder and CEO Renaud Laplanche. These issues, along with some overall concern around the credit quality of underlying borrowers, led some large institutional and bank investors to exit the LendingClub loan market.

As the company focused on getting institutional investors back onto the platform, something it had accomplished by the end of the fourth quarter, origination growth became a secondary concern. Sales and marketing spend fell along with quarterly originations throughout the second and third quarters of 2016. While sales and marketing spend accelerated in the fourth quarter, originations grew only 1% quarter-over-quarter. This higher spend, for nearly flat originations, was largely related to a tightening of credit standards, requiring the firm to seek out more customers while denying lower quality loans that would have been approved in earlier quarters.

The above chart illustrates just how closely sales and marketing spend correspond to origination growth. LendingClub also illustrates a conundrum that lenders will continue to face in the future. If lenders wish to pursue higher quality borrowers, sales and marketing spend will start to grow faster than overall originations as it takes more time and money to find the right type of borrower.

Underwriting models are still being refined

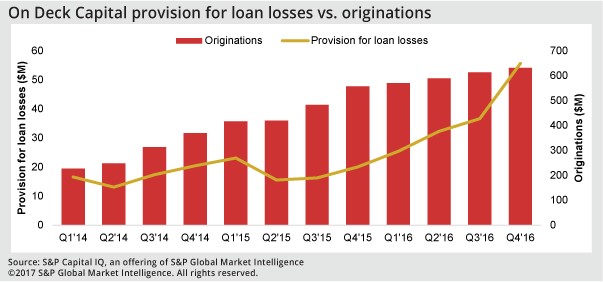

On Deck reported a 52.2% sequential increase in loan loss provisions for the fourth quarter of 2016. This was related to an increase in the provision rate to 7.4% for the full year, inclusive of a jump to 10.2% in the fourth quarter, relative to the company's forecast range of 5.5% to 6.5%. The provision rate measures probable loan losses for new originations in a given period and is calculated as the provision for loan losses divided by new originations held for investment. Loans that are sold through the marketplace are not included in the calculation of provision rate. Management expects the ongoing provision rate to be 7%. Loss rates on longer maturity loans came in higher than management had expected, leading to recalibration of loss assumptions. Management noted on the earnings call that despite this increase, these loans remained an attractive and profitable segment of its business.

Although overall loss provisions will generally increase alongside growing originations, the pronounced jump in the fourth quarter of 2016 is important to note. While digital lenders work diligently to refine their underwriting models, almost all of these lenders have been operating for fewer than 10 years, leaving them with a less-than-perfect view of future loan performance. Only Prosper Marketplace Inc. has seen a full 10 years of operations, while LendingClub started offering loans in the third quarter of 2007. On Deck started in the second quarter of 2008, and industry giant SoFi has only been offering loans since the fourth quarter of 2011. These lenders have operated in a period of economic growth and have yet to see how loans perform in periods of recession or high unemployment. Lenders could also find themselves particularly sensitive to rising interest rates in some cases.

As new products come to market and loans season, loss assumptions could deviate from previously assumed levels, leading lenders to increase loss assumptions and hike rates, as LendingClub did in 2016. In order to show stable earnings, lenders are better off using conservative loss assumptions in order to avoid surprises like we saw with On Deck.

On Deck has been shifting its business away from a marketplace model toward holding loans on balance sheet or selling them through securitizations. In prior years, On Deck had offered 15% to 25% of its term loans through the OnDeck Marketplace, a number that management expects to be in the 5% to 15% range in 2017. The company noted that the premiums received for loans through the marketplace became less attractive in 2016 and that collecting more interest income from loans held on the balance sheet will reduce future earnings volatility.

A tough year could give way to a stronger future

2016 was a tough year for most digital lenders. Long-time lenders like Prosper Marketplace and CAN Capital saw management shakeups, layoffs and questions around the sustainability of their business. Overall, the digital lending model remains compelling, and originations have continued to grow for many lenders. But originations are only one part of the puzzle, and cost management has become an important part of creating a sustainable business.

While profitability has been elusive for LendingClub and On Deck, both companies have recognized the need to control costs while growing loans in a responsible manner. LendingClub management forecasts sequential revenue growth from the second quarter of 2017 through the end of the year. The company is also continuing to roll out its new auto loan product, which is now offered in 26 states. On Deck expects to see positive EBITDA on an adjusted basis for fiscal year 2017, with improvements coming after the first quarter. On Deck expects to be profitable on a GAAP basis in 2018.

In order to achieve these goals, these lenders will need to focus on maximizing marketing spend, increasing their brand profile with the general public and creating a stable borrower base while continuing to refine underwriting models.