Summary

Can investment results be attributed to skill or luck? Genuine skill is more likely to persist, while luck is random and fleeting. Thus, one measure of skill is the consistency of a fund’s performance relative to its peers or benchmark. The Persistence Scorecard measures that consistency and shows that, regardless of asset class or style focus, active management outperformance is often short-lived.

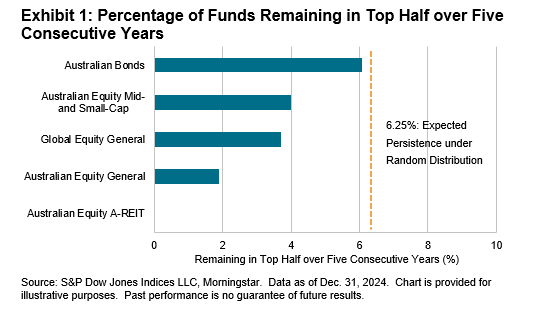

Out of 218 funds across five fund categories that ranked in the top quartile for the 12-month period ending December 2020, only one Australian bond fund maintained its position in the top quartile over the following four consecutive years (see Report 2). Furthermore, even when considering a broader range by shifting from the top quartile to the top half, the percentage of funds remaining in the top half over five consecutive years was lower than would be expected if the performance were completely random (see Exhibit 1).

Report Highlights

The year 2024 revealed contrasting outcomes for Australian active managers, with long-term persistence of outperformance proving elusive. While bond managers demonstrated notable persistence over a three-year period relative to peers and benchmarks, five-year data did not support the existence of genuine skill among them.

- Of above-median funds in 2022, 19% maintained that status in each of the following two years, whereas a random distribution would suggest a 25% repeat rate (see Report 1a).

- Among a total of 195 top-quartile equity funds from 2022, just three funds (2%) remained in the top quartile for each of the next two years, compared to an expected 6.25% under random distribution. In contrast, 38% of top-quartile bond funds sustained their status over the same period (see Report 1a).

- Top-quartile funds from the three-year period of 2019-2021 were more likely to drop to the bottom quartile or be merged or liquidated than to remain in the top quartile in the subsequent three years in three equity categories (see Exhibit 2 and Report 3). Conversely, over a quarter of bond funds retained their top-quartile status over two consecutive three-year periods. However, when extending the analysis to five-year periods, only 8% of bond funds remained in the top quartile over two consecutive five-year periods (see Report 5).

- Persistence of outperformance against benchmarks was generally scarce. For instance, 127 out of a total 307 Australian Equity General funds outperformed the S&P/ASX 200 in 2022, but only one of those 127 winners continued to outperform in 2023 and 2024. Australian Bonds funds stood out as an exception, as active bond managers achieved majority outperformance in both 2023 and 2024 (see Report 1b).