Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Energy Transition, Natural Gas, Emissions

September 03, 2024

By Staff

HIGHLIGHTS

What's happening? Cash prices at SoCal Gas city-gate have regularly been below Henry Hub this summer, an unusual occurrence for a location that is often one of the highest priced in the US. While weak prices in the US have led to some curtailments of production in the Southeast and Northeast, production in Western US basins that supply California has remained robust, especially in the New Mexico side of the Permian Basin. High storage inventories are also weighing on prices. The Aliso Canyon storage facility has increased capacity, pushing SoCal inventories to their highest level since 2015.

What's next? Basis discounts could continue through October. The September and October forward contracts were both priced 4 cents/MMBtu below Henry Hub on Aug. 29, Platts M2MS data showed.

What's happening? Key indexes in the Federal Reserve Bank of Dallas' latest survey of Texas manufacturing, service and retail sectors showed mixed results in August. Two out of three showed month-to-month improvements, but service and retail sectors' numbers were down from August 2023. Power and natural gas average prices plunged from August 2023, as peak power demand weakened amid milder weather.

What's next? The Electric Reliability Council of Texas' Monthly Outlook for Resource Adequacy for September forecast a peak of 77.5 GW, compared with a peak of 84.2 GW in September 2023. S&P Global Energy forecast ERCOT's September load levels to average about 5% lower year on year.

What's happening? China's domestic steel demand has fallen rapidly over the past few months. The apparent domestic steel consumption in July declined 11% month on month and 12% year on year to 73.79 million metric tons, according to Energy calculations. Apparent consumption equates to the crude steel output after subtracting net exports and increased steel inventories, reflecting the amount of steel consumed domestically. The debt-laden property sector remains the culprit behind China's falling steel demand and is still not showing signs of bottoming out. Sluggish domestic consumer spending has also affected the manufacturing of products such as cars and home appliances.

What's next? A lack of adequate policy support to ease China's steel industry woes is expected to keep domestic steel demand subdued for the rest of 2024, with any potential rebound in steel prices in the near future likely to be short-lived. China's steel demand is expected to decline to around 750-800 MMt/y in the next five to 10 years, which means at least 20% of the current steelmaking capacity will have to be cut, in order for the industry to regain its health.

What's happening? Spot European methyl methacrylate prices are declining on subdued demand despite ongoing tight supply. Platts, part of Energy, assessed the DDP Northwest Europe methyl methacrylate spot price at Eur2,800/t Aug. 30, down Eur50 on the day. On Aug. 12, the highest assessed price was seen at Eur3,125/t on substantially tight supply. However, weaker demand coupled with the summer holiday period led to a shift in prices. Meanwhile, supply remained very tight, with multiple players struggling to find material for September, while the focus was on October to December deliveries.

What's next? With Trinseo being back from maintenance early in the week of Sept. 2 and Rohm operating as per usual after some supply limitations in August, prices slightly declined, though remaining elevated compared to historical levels. A significant factor is also increased imports heading into Europe. However, market players suggest that September market conditions will be flat to August.

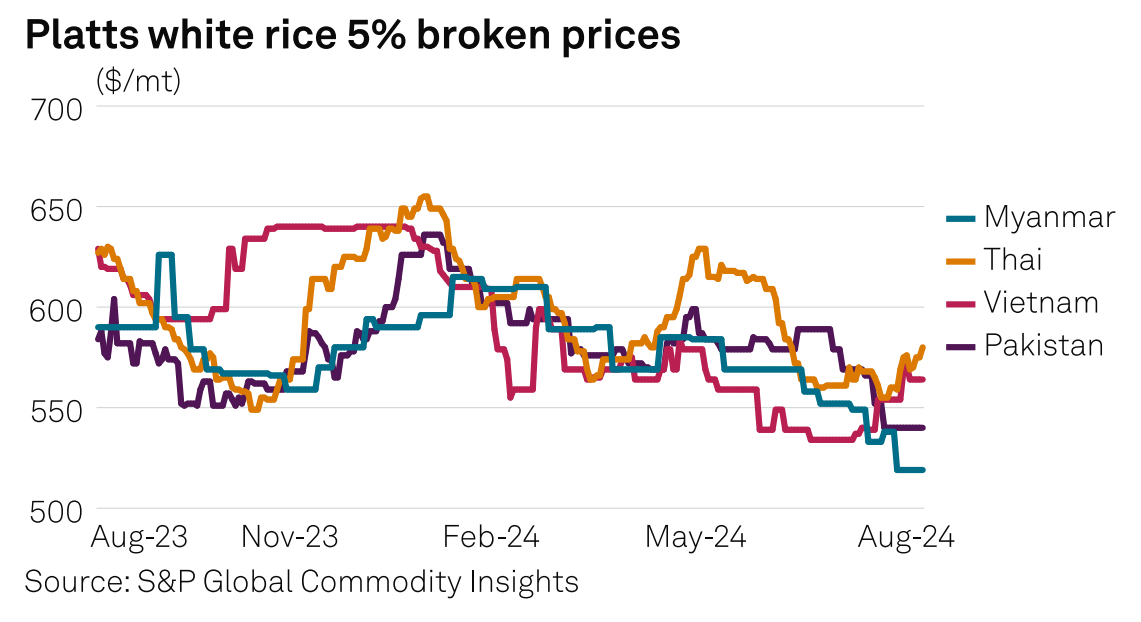

What's happening? Myanmar's rice prices are on a downtrend, with the Platts-assessed Myanmar 5% broken white rice at a one-year low. On Aug. 23, Platts assessed Myanmar 5% broken white rice at $519/t FOB FCL, dropping $71/t on the year and down $30/t on the month. This decline in the country's rice prices is attributed to sluggish demand, high freight costs and the depreciation of Myanmar's kyat against the US dollar.

What's next? The lower price of Myanmar's 5% broken white rice is likely to make it more competitive against the same variety from Thailand, Vietnam and Pakistan.

Reporting and analysis by Kevin Birn, Markham Watson, Jing Zhang, Maria-eleni Tsimeki, Aditya Deval