Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Sep 11, 2023

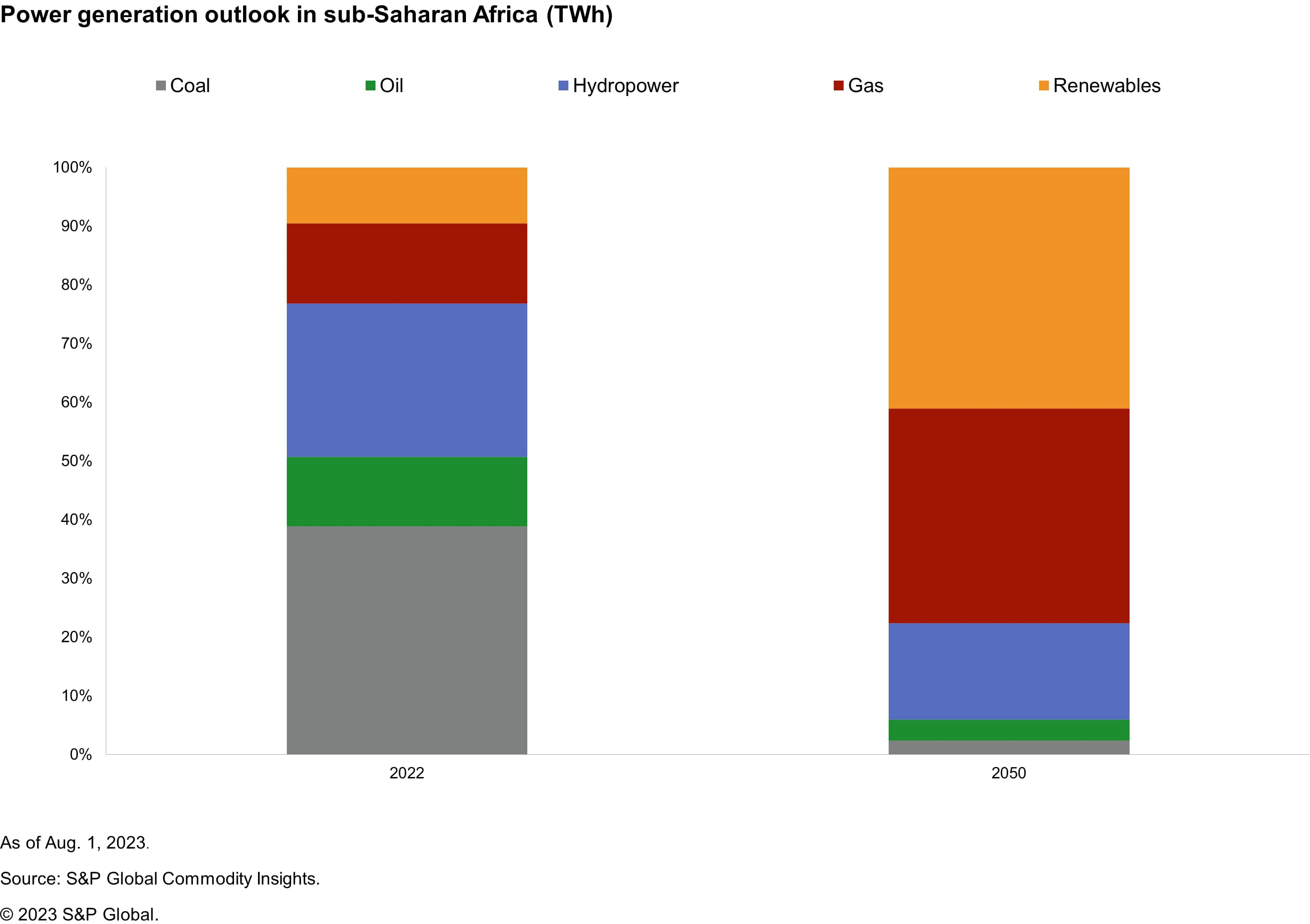

The role of coal in the energy mix in sub-Saharan Africa is changing. Although coal is currently the leading fuel for power generation in the region, its share is projected to decline, with about 9 GW of coal power retirements by 2030 out of the 42 GW installed today and no new projects to be added.

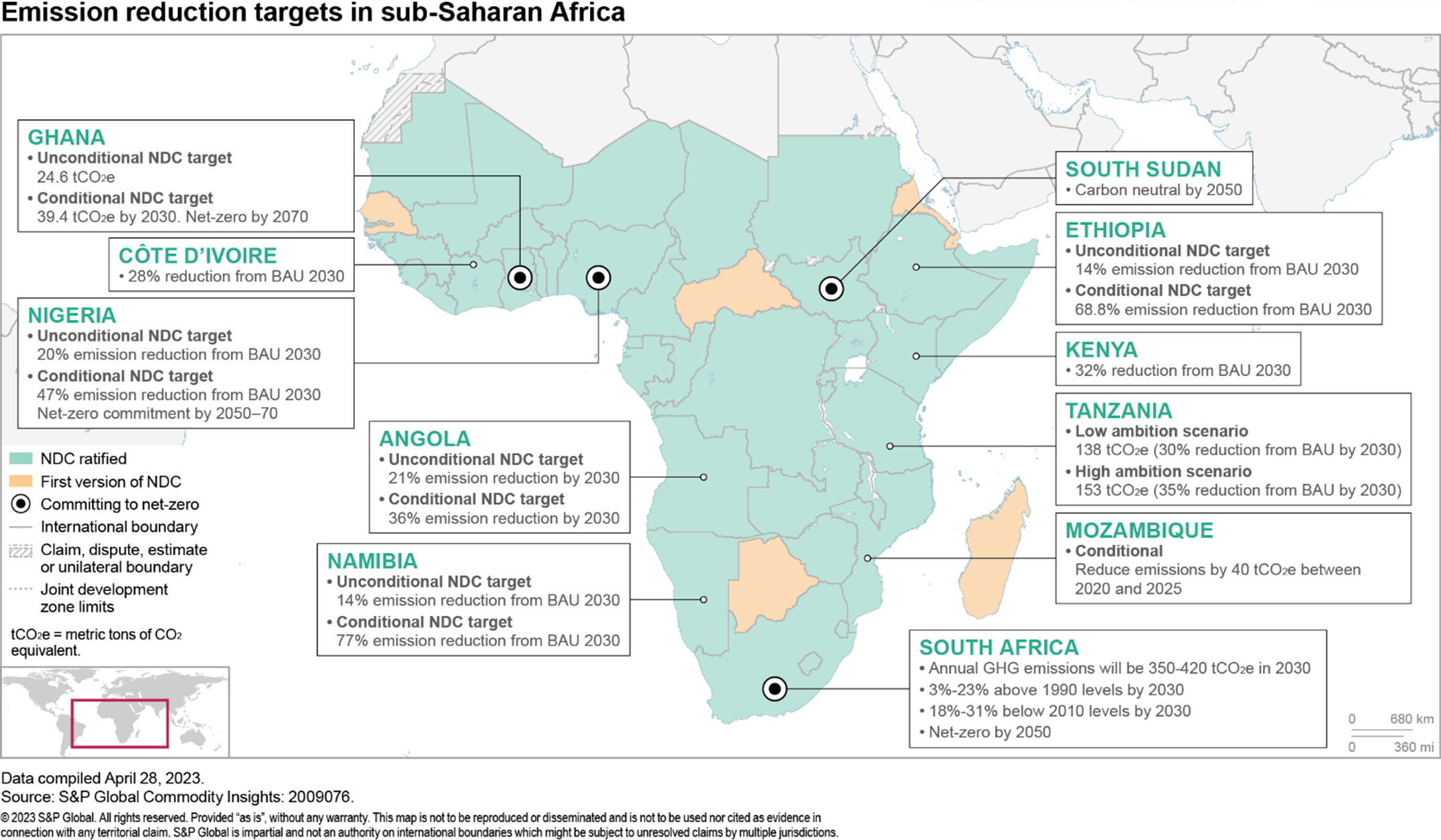

Emissions reduction commitments and self-imposed financial restrictions for new coal plants by global financial institutions are the prime factors for the displacement of coal in the power generation outlook. The supply gap left behind by retiring coal units will open opportunities for cleaner alternatives such as gas and renewables.

The exit of coal from the range of future power generation sources is certainly raising concerns across the region, both in countries with a high reliance on coal-fired generation (namely South Africa) and in those markets that have seen in the past a solution in large coal plants with access to relatively cheaper fuel resources. On the other hand, this switch offers an opportunity for investment in new technologies that could solve the issue of low electricity access while respecting the long-term objectives of reduced carbon emissions. Although this transition may take longer than expected owing to the size of capital investments required along with the challenges in developing the grid infrastructure, sub-Saharan African governments are increasingly accepting that it will be inevitable.

The availability of coal resources in some sub-Saharan African markets favored the choice to invest in coal plants in the past to meet the power supply deficit, while replacing the retiring thermal units. Many countries were aiming to develop coal power projects across the region with the help of international financing. However, projects in the pipeline are struggling to achieve financial closure as they face financial and policy uncertainty following the global trend toward emission reductions to meet the goals of the Paris Agreement on climate change in the 21st Conference of the Parties (COP21).

Besides, the financial landscape for new coal-fired power plants has significantly changed globally; an increasing number of lenders announced a moratorium on funding new projects. However, the withdrawal of China from international coal power investment has been particularly impactful for Africa. The absence of Chinese investments in the new coal power development will leave the project pipeline with no prospective international investors. Other leading international lenders such as the World Bank and the African Development Bank have been staying clear of coal power financing in the region for almost a decade. Hence, obtaining finance for new coal power plants will be extremely rare regardless of their status.

Currently, about 44 GW of projects are in operation in the region, predominantly in South Africa. Beyond South Africa, Zimbabwe follows with an installed coal power capacity of 1.4 GW, with the operating history dating back at least seven decades. South Africa and Zimbabwe account for about 95% of the total in the region. Most of the remaining operating plants are in Senegal and Botswana, and these are relatively new plants with an average power plant age of less than 10 years.

The region has a total of 15 GW of projects in the pipeline, with 2 GW of projects under construction, 6 GW of projects in the planning stage and 7 GW of projects with questionable status. The latter is likely to be scrapped mostly owing to a lack of international investors, which had committed to providing most of the financial support required to implement these projects.

Learn more about our Global Power and Renewables research.

Vignesh Sundaram, senior analyst at S&P Global Energy, conducts research and consulting for the sub-Saharan Africa power and renewables market.

Posted 11 September 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.