Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 16, 2023

The Cambo asset signifies the debate on energy security and job creation of the UK economy in the context of decarbonization, climate change, and energy transition. The immediate argument on the asset has led to a debate about whether the field should be granted a license for development or not. The United Kingdom Continental Shelf (UKCS) where the Cambo field is located, is considered a mature basin with six decades of exploration and production and an estimated 21.26 Billion Barrels of Oil Equivalent (Bboe) of remaining recoverable resources to be produced. This is based on a base Brent price of USD 83/bbl according to S&P Global's Vantage product (as of February 2023).

Opposers to the development of the Cambo field are in favor of the rejection of the license for the development, due to environmental concerns whereas proponents argue that it is vital to go ahead with the development for the sake of UK energy security while minimizing carbon leakage aligned with the UK energy transition, decarbonization, and Net Zero emission targets. This article visualizes the potential carbon cost impact in relation to the economic benefits of decarbonization. The exercise reveals that the holistic introduction of carbon cost can better mitigate emissions and maintain economic benefits.

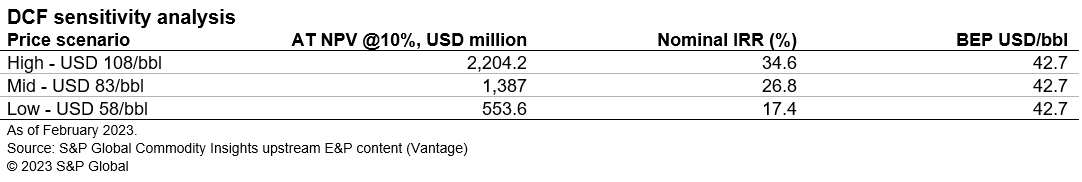

Vantage assessment of the economic viability of the Cambo field is examined using investment metrics such as After-tax Net Present Value (AT NPV) @10% nominal discount rate, Nominal Internal Rate of Return (IRR), and Break-even Oil Price (BEP), considering three Oil Prices Scenarios (Low Case at USD 58/bbl, Base Case at USD 83/bbl and High Case at USD 108/bbl). Fiscal regime assumptions are based on the UK Royalty/Tax fiscal framework.

The asset appears to be economically viable in various price scenarios, as seen by the nominal IRR of 17.4% at a low oil price scenario. The discounted cash flow sensitivity analysis of the Cambo field on a point-forward basis (starting in 2023) highlights that positive AT NPVs are attainable even in the stressed case, demonstrated by the BEP of USD 42.7 /bbl.

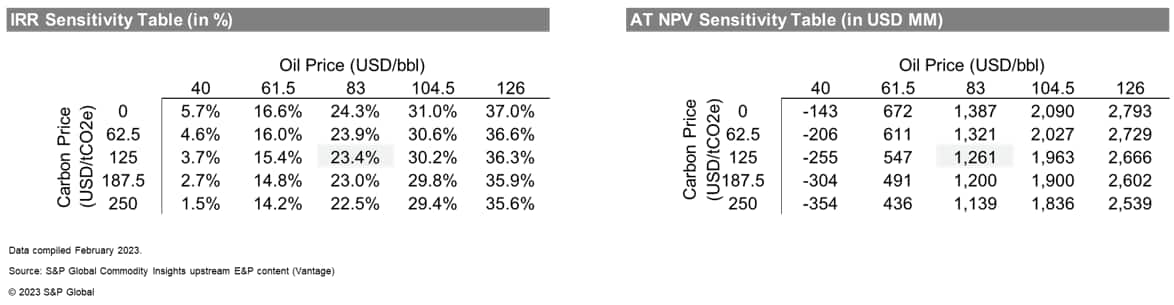

A hypothetical economic model is also considered with carbon emission priced at USD 125/tons of CO2 equivalent (tCO2e); the same price benchmark assumption used by Carbon Disclosure Project to evaluate Shell's emissions. There is currently no legislation in the UK for a carbon tax on upstream emissions. The absolute Scope 1 GHG emissions considered is 3.1 MillionstCO2e over 26 years (2028-2053), as per Vantage Emissions data. This estimate does not consider any mitigation strategies that may be implemented later in the field. As a comparison, Norway licenses new fields for development with a strict carbon emission plan and is planning to increase its carbon emission charges from $58/tCO2e to $250/tCO2e by 2030.

In this post-carbon cost scenario for the Cambo field, under the mid-case Oil price scenario of USD 83/bbl, the AT NPV is not very severely impacted, with a decrease of 9.1% when compared to the pre-carbon cost valuation. Still, under the Carbon-impacted scenario, the nominal IRR drops slightly but is still above the 20% discount rate mark whereas the break-even price has gone up from 42.7 USD/bbl to USD 45.4/bbl but is still far from the 2023 price level.

A summary of the result for the economic viability of the Cambo field with the carbon price impact is shown in the sensitivity table. Considering Vantage's assumptions, positive NPVs are attainable under various carbon and oil price scenarios. Under an extreme scenario of Oil prices of USD 50/bbl and Carbon prices of USD 125 /tCO2e, the nominal IRR drops below 20%.

Even with carbon emission charges applied at various carbon price scenarios, the Cambo field remains commercially viable. However, as shown in the sensitivity table above, market risk, hidden liabilities, and high carbon footprint (from greenhouse gas emissions) could still significantly impact its economic viability.

The Cambo field holds important reserves of hydrocarbons. Even with carbon emission charges applied at various carbon price scenarios, the Cambo field remains commercially viable. However, market risk, hidden liabilities, and high carbon footprint (from greenhouse gas emission) could still have a significant impact on its economic viability which shows that Shell plc's decision to divest the field might be directly linked to an economic factor.

The current energy crisis has demonstrated how important a domestic oil and gas supply is, whilst balancing its obligation to support the energy transition and decarbonization and hit the UK's goals of Net Zero by 2050.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.