Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 23, 2025

By Felipe Peroni and Ignacio Garcia

HIGHLIGHTS

Vietnam shrimp exports up 13.4% to 413,143 mt in 2024

Shrimp output grew 8.4% annually over the last 6 years

Shrimp production in Vietnam has risen by using super-intensive systems and leveraging new feed and pond technologies.

"In Vietnam, a lot of ponds these days are intensive to highly intensive – most of them are lined and use quite a bit of power for aeration and water movement," David Leong, CEO of Shrimp Improvement Systems, a company devoted to producing disease-resistant, fast-growth shrimp broodstock, told Platts May 16.

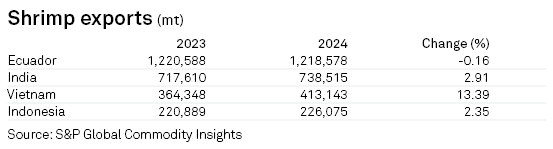

Currently, Vietnam is the third leading shrimp supplier globally, following Ecuador and India. Vietnam's exports totaled 413,143 mt in 2024, up 13.4% on the year, data from S&P Global Energy showed. In the same year, Ecuadorian exports declined by 0.2%, while India increased by 2.9%.

In the first quarter of 2025, Vietnam exported 77,469 mt of shrimp, remaining virtually stable from the same period a year earlier.

Farmers have been implementing real-time water quality monitoring using oxygen, pH, and temperature sensors, combined with automated aeration systems to optimize pond conditions, Leong said. They have also shifted from chemical-based to probiotic-based systems, especially in areas like Da Nang, leading to lower disease outbreaks and reduced production costs.

Regarding the sector's key target of shrimp growth rates, Leong said, "The industry's shifting towards crops under 100 days. We have commercial farmers in Vietnam achieving 50 grams in 90 days or a weekly gain of 3.8 g/week."

Shrimp company Viet-Uc has already obtained a shrimp growth cycle of 70 days from 100 days, VASEP said May 21. To achieve that, it has used improved feed formulations and an electronic chip monitoring system.

Shorter growth cycles also improve survival rates and the feed conversion ratio, the number of grams of feed needed to achieve one gram of body weight. This key indicator influences farming costs and competitiveness.

"One pretty clear thing is that feed conversion rates have come down quite a bit across the board. Whether semi-intensive, intensive, or super-intensive systems, most are hitting under 1.5 [gram of feed per animal weight gain]," Leong said. In the past, such rates could surpass 2 grams.

Vietnam ranks fourth among shrimp exporting countries to the US. In 2024, its imports reached nearly 70,000 mt, an increase of almost 8,000 mt compared to 2023. Although this volume remains less than half of that exported by Indonesia, which holds the third position among exporting countries, Vietnam was the only one to experience growth among the top four shrimp exporters to the US, with an increase of 12.7% compared to 2023.

Platts' daily assessment for peeled, deveined, tail-on shrimp CIF US was $9,480/mt on May 23, up by $221/mt from the previous day. Platts is part of S&P Global Energy.

Products & Solutions

Editor: