Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 06, 2026

Week Ahead Economic Preview: Week of 9 February 2026

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US non-farm payrolls and inflation rescheduled, UK and eurozone GDP

The coming week sees the delayed publication of official US labor market and inflation data, both having the potential to fuel Fed policy expectations. Mainland China likewise provides an inflation update and the UK and Eurozone issue fresh GDP numbers.

The federal government shutdown means the release of the US employment report has been delayed from 6th February to 11th February, and the inflation (CPI) release has been pushed back to the 13th. Payroll growth is expected to have risen from 50k in December to 70k in January and the unemployment rate to have held at 4.4%, while earnings growth looks to have cooled to 3.6% from 3.8%. If borne out, this would likely add to an easing bias among policymakers, though not shift expectations that rates are on hold in the near-term. The update to CPI inflation could be more market moving if there is any material change in the headline or core rates, after they held steady at 2.7% and 2.6% respectively in December. PMI data hint at sustained above-target inflation, but any marked cooling will add renewed fuel to rate cut calls. The FOMC held rates steady at 3.5-3.75% in January after cutting three times late last year, citing the need to wait and assess labor market and inflation trends.

Inflation data are also updated for mainland China and will be eyed in particular for evidence as to whether deflationary pressures are becoming less of a concern. PMI data showed the first rise in business selling prices for 14 months in January, and prior CPI data showed the annual inflation rate hitting a near-three year high of 0.8% in December.

In Europe, the UK comes into added focus after a surprisingly tight decision to hold interest rates steady at the Bank of England's February meeting. The meeting lifted the odds of a rate cut in March. Policymakers are concerned in particular about the labour market's recent weakness, drawing eyes on Monday's upcoming recruitment industry survey. However, monthly GDP for December, plus a full fourth quarter GDP reading, will also give some guidance as to whether the UK economy is picking up momentum, as indicated by the latest PMI numbers. Eurozone GDP is also updated for the fourth quarter, having initially shown a 0.3% rise, in line with the PMI.

Also watch out for Tuesday's Investment Manager Index™ (IMI™), polling fund managers for their views on market trends and drivers at the start of February. January's edition is available here.

Shifting economic trends

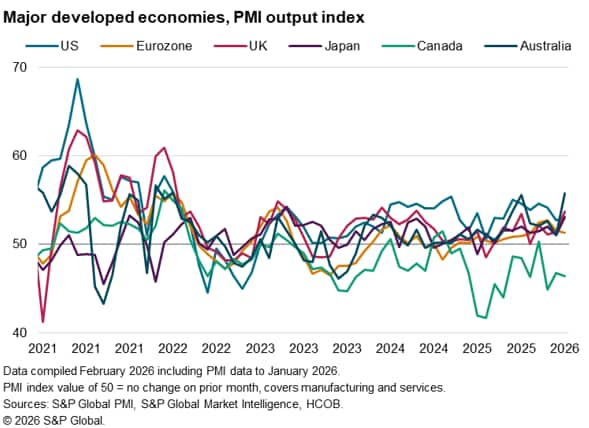

US jobs data and GDP numbers for both the eurozone and UK will give some further guidance on how these major economies are performing. The official data follow PMI numbers which showed the US ceding its lead among the largest developed economies in January. Having stepped lower in December, US business output growth failed to regain much momentum in January amid order book weakness. Meanwhile, growth accelerated in the UK alongside similar upturns in Japan and Australia. Although eurozone growth continued to lag, European companies reported a marked up turn in business confidence about the year ahead, bucking a broader global trend of relatively gloomy outlooks.

Read more about the latest global PMI trends here.

Key diary events

Monday 9 Feb

Americas

- Mexico Inflation (Jan)

- US Consumer Inflation Expectations (Jan)

EMEA

- Norway GDP (Q4)

- Switzerland Consumer Confidence (Jan)

- UK KPMG / REC Report on Jobs (Jan)

APAC

- Japan Current Account (Dec)

- Australia Household Spending (Dec)

- Indonesia Consumer Confidence (Jan)

- Malaysia Industrial Production (Dec)

- Taiwan Trade (Jan)

Tuesday 10 Feb

S&P Global Investment Manager Index* (Feb)

GEP Global Supply Chain Volatility Index* (Jan)

Americas

- Brazil Inflation (Jan)

- US ADP Weekly Employment Change

- US Retail Sales (Dec)

- US Import and Export Prices (Dec)

- US Business Inventories (Nov)

EMEA

- UK BRC Retail Sales Monitor (Jan)

- France Unemployment Rate (Q4)

- Türkiye Industrial Production (Dec)

APAC

- Australia Westpac Consumer Confidence Change (Feb)

- Australia NAB Business Confidence (Jan)

Wednesday 11 Feb

Americas

- Mexico Industrial Production (Dec)

- US Monthly Budget Statement (Jan)

- US employment report, incl. non-farm payrolls (Jan)

EMEA

- Türkiye Retail Sales (Dec)

- Italy Industrial Production (Dec)

APAC

Japan Market Holiday

- South Korea Unemployment Rate (Jan)

- Australia Home Loans (Q4)

- China (Mainland) CPI, PPI (Jan)

- Malaysia Unemployment Rate (Dec)

Thursday 12 Feb

Americas

- US Initial Jobless Claims

- US Existing Home Sales (Jan)

EMEA

- UK RICS House Price Balance (Jan)

- UK GDP (Q4, prelim)

- United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Dec)

APAC

Taiwan Market Holiday

- Japan PPI (Jan)

- Australia Consumer Inflation Expectations (Feb)

- Japan Machine Tool Orders (Jan)

- India Inflation (Jan)

Friday 13 Feb

Americas

- Brazil Retail Sales (Dec)

- US CPI (Jan)

EMEA

- Germany Wholesale Prices (Jan)

- Switzerland Inflation (Jan)

- Spain Inflation (Jan, final)

- Eurozone Trade (Dec)

- Eurozone GDP (Q4, 2nd est.)

APAC

Taiwan Market Holiday

- South Korea Import and Export Prices (Jan)

- China (Mainland) House Price Index (Jan)

- Malaysia GDP (Q4)

- India WPI (Jan)

Saturday 14 Feb

APAC

- China (Mainland) M2, Loan Growth, New Yuan Loans

- China (Mainland) Current Account (Q4, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-february-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-february-2026.html&text=Week+Ahead+Economic+Preview%3a+Week+of+9+February+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-february-2026.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 9 February 2026 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-february-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+9+February+2026+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-february-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}