Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 06, 2026

Global trade downturn eases at the start of 2026

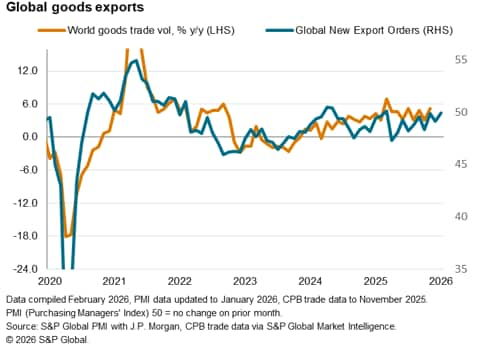

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a near-stabilisation of global trade at the start of 2026. The seasonally adjusted Global PMI New Export Orders Index, sponsored by J.P.Morgan and compiled by S&P Global, rose to 49.7 in January, up from 49.3 in December. Despite indicating a second monthly deterioration in global trade, the pace of decline was only marginal.

Manufacturing trade near-stabilises while the exchange of services falls further

The seasonally adjusted PMI New Export Orders Index for the manufacturing sector rose above the equivalent index for services for the first time in seven months, albeit remaining in contraction territory. That said, posting just below the 50.0 no-change mark, the latest reading for the manufacturing sector indicated only a fractional reduction in export demand for goods. The latest downturn was also among the least pronounced in the current ten-month sequence of contraction, thereby pointing to a near stabilisation of goods trade in the PMI context at the start of 2026.

The softening of the goods trade decline unfolded against a backdrop of improving manufacturing conditions in January. Global goods production rose at the joint-sharpest pace since June 2024, driven by the fastest increase in new orders in nearly a year. The acceleration in goods output growth offered encouraging signs at the start of the new year and suggested that the resilience seen for much of 2025 may have carried through into the first quarter of the new year. That said, it remains uncertain if the latest pickup in goods demand and production may be attributed to further front-loading of goods orders as geopolitical tensions were ratcheted up in the beginning of the year. Business sentiment among manufacturers remained subdued by historical standards in January and was little changed compared to the end of last year.

Notably, a worrying trend of rising price pressures may also act as a deterrent for the manufacturing recovery in the coming months. Goods producers lifted their selling prices at the quickest pace in nearly three years amid intensifying input cost inflation, which was in turn caused by both higher US tariffs and rising metal prices as geopolitical uncertainties heightened.

Services exports meanwhile remained in contraction for the second month in a row in January. Although marginal, the rate at which services trade fell was the sharpest since last June.

The steepening of the services trade decline contrasted with stronger growth in overall new business into the sector at the start of the year. That said, the downturn in services new export business was particularly noticeable in the US, which reported the strongest reduction since November 2022, as external demand for services was dampened by geopolitical uncertainties. Excluding the US, global services new export business in fact rose at the quickest rate in almost a year.

Detailed sector PMI revealed a mix of sectors in the lead for export growth at the start of the year. The best performers were the Media, Beverage & Food and Healthcare Services sectors. On the other hand, Real Estate and Forestry & Paper Products remained the worst performers, followed by Chemicals.

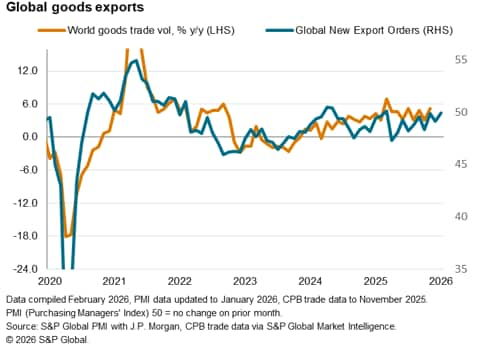

Emerging market new export business growth renews while developed economies remain in downturn

After stalling at the end of last year, emerging markets saw a renewed rise in new export orders at the start of the first quarter. The expansion in new export business was broad-based, albeit marginal, across sectors. Goods exports rose fractionally in January after falling in December, driven by gains in India while mainland China also saw a renewed rise in goods demand from abroad. Meanwhile emerging market services firms witnessed stronger inflows of new export business compared to manufacturing, but the rate of growth had softened for the second month in a row.

In contrast, developed markets continued to report lower new export business in January. The rate of decline was the softest in the current downturn that began in June 2022, however, and only slight. This was as a slower reduction in goods new export orders helped to offset a sharper downturn in the service sector.

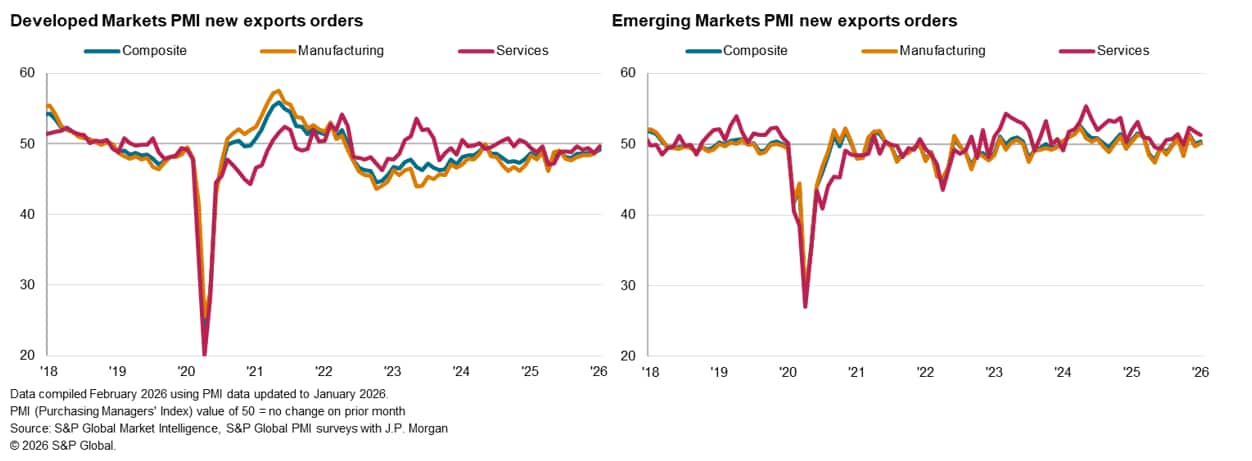

Number of top ten trading economies in expansion more than double in January

The number of top ten trading economies recording higher goods exports rose from just two in December to five at the start of 2026. Japan, the UK and mainland China joined India and South Korea to record higher goods new export orders in January.

Notably, India and South Korea remained in the lead in January with the rates of growth further picking up from December. While the acceleration in growth was marginal for India, the pace at which South Korean manufacturing new export orders rose was the fastest in almost five years, attributed to new product launches.

Meanwhile both Japan and the UK saw their first expansion in new export orders in around four years as foreign demand picked up. Mainland China similarly observed a renewed rise in external demand for goods, though the increase was only slight.

On the other hand, Canada and Brazil continued to record the steepest downturns in goods trade at the start of the fourth quarter, plagued by lingering trade woes with the US. This was followed by the US, itself seeing a more pronounced fall in goods new export orders in January. Finally, the EU and Russia noted marginal reductions in goods trade at the start of the year.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-eases-at-the-start-of-2026-Feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-eases-at-the-start-of-2026-Feb26.html&text=Global+trade+downturn+eases+at+the+start+of+2026+%c2%a0+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-eases-at-the-start-of-2026-Feb26.html","enabled":true},{"name":"email","url":"?subject=Global trade downturn eases at the start of 2026 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-eases-at-the-start-of-2026-Feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+downturn+eases+at+the+start+of+2026+%c2%a0+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-downturn-eases-at-the-start-of-2026-Feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}