Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2026

Financial services growth restrains global economy in January

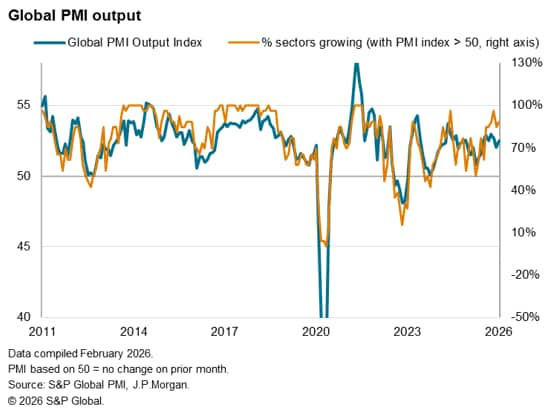

The global economic upturn failed to fully regain earlier momentum in January, having slowed in December, due largely to a cooling in demand growth for financial services around the turn of the year, according to global PMI data. More positively, improved manufacturing growth has slipped over to drive a faster upturn among industrial service providers. The global upturn, while lacking strength, consequently remained encouragingly broad-based by recent standards.

Global business growth off recent highs

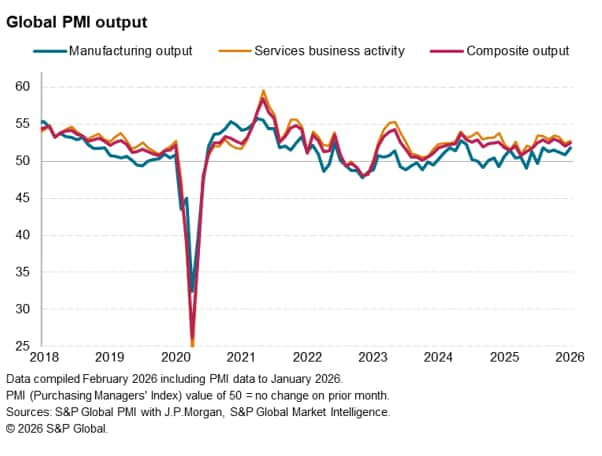

January saw an uptick to global economic growth, according to the worldwide PMI surveys produced by S&P Global in association with ISM and IFPSM for J.P.Morgan. However, the rate of expansion remained the second-weakest recorded since last July, the reduced pace of expansion largely due to a service sector slowdown over the turn of the year.

While manufacturing output growth kicked higher globally in January, rising to the joint-highest since June 2024, service sector growth edged up only slightly from December's six-month low, failing to regain prior momentum.

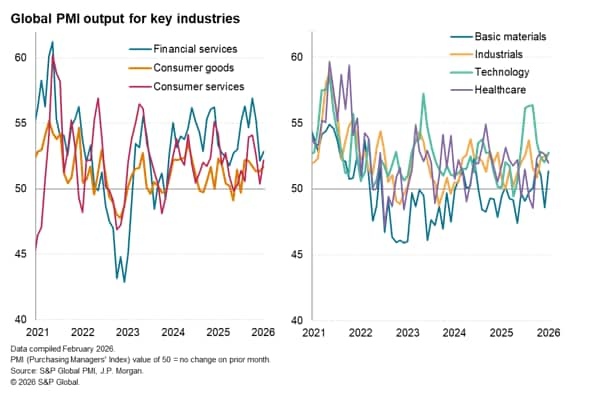

Financial services report cooler demand growth

Digging deeper, a key element of the service sector slowdown around the turn of the year has been weaker growth of financial services activity. Over December and January, the PMI output index of the global financial services sector averaged just 52.5 against 55.2 during the prior six months. New orders growth for financial services has likewise slowed over this period. Compared to the situation seen prior to November, demand has cooled markedly for banking services globally but also for insurance and other financial services (such as investment and pension funds), while real estate has seen a renewed drop in demand over both December and January.

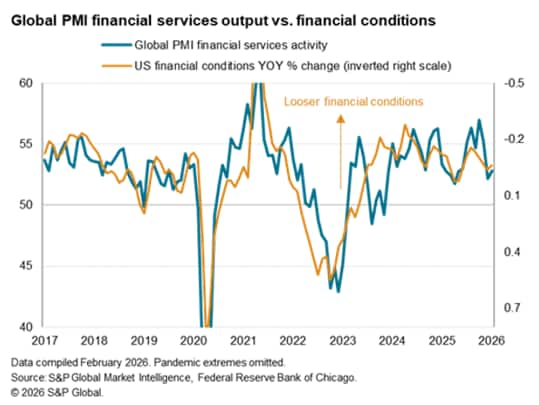

The slowdown in financial services activity growth in part reflects a similar moderation in the extent to which financial conditions have been loosening over the past two months, as depicted for example by the Chicago Fed's financial conditions index.

However, it is not just growth of financial services that has slowed over the turn of the year. Growth of technology and consumer services in particular remain well off the highs seen over the second half of last year, acting as further dampeners on global service sector activity.

Manufacturing spillovers

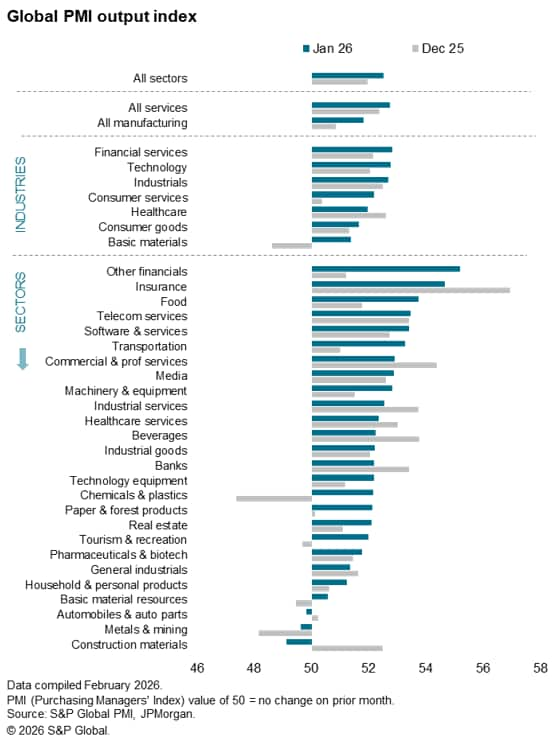

More encouragingly, growth of industrial services output has picked up heading into 2026, with January seeing the sharpest rise in new orders for this sector since April 2023. This suggests that some of the recent improved performance of the manufacturing sector is spilling over to related services providers.

Broad-based upturn

January's improvement in manufacturing performance was by no means broad-based, with construction materials, metals & mining and autos & parts all reporting reduced production volumes at the start of the year. But with only three sectors in decline globally across both manufacturing and services, the number of sectors reporting an expansion of global output in January remains one of the highest recorded since the pandemic and suggests that, although not impressive in terms of strength, the global upturn at least remains encouragingly broad-based.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-growth-restrains-global-economy-in-january-Feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-growth-restrains-global-economy-in-january-Feb26.html&text=Financial+services+growth+restrains+global+economy+in+January+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-growth-restrains-global-economy-in-january-Feb26.html","enabled":true},{"name":"email","url":"?subject=Financial services growth restrains global economy in January | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-growth-restrains-global-economy-in-january-Feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Financial+services+growth+restrains+global+economy+in+January+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-growth-restrains-global-economy-in-january-Feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}